Hawaiian sees some yield softness in North America

From CAPA Center for Aviation September 10, 2012 (excerpt)

Hawaiian Airlines recently revised its expected 3Q2012 revenue per revenue passenger mile from up 1.5% to down 1.5% to a decrease of 1% to 4%. The carrier attributed the downward revision in its projections to lower than expected yields on certain routes to North America and lower load factors in some of its international markets.

Company CFO Scott Topping during a recent investor presentation noted some “pockets” of capacity increases in certain North American markets. At the same time higher occupancy rates at Hawaiian hotels are influencing fares, resulting in Hawaiian “dropping into the next fare buckets,” Mr Topping explained. “So we are getting good volumes. We’re just trading volumes for fares.” However, he stressed that scenario only applies to a small portion of its North American network.

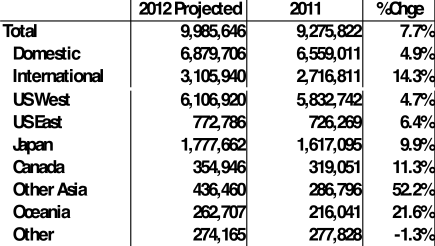

Data compiled by the Hawaii Tourism Authority show that seating capacity from Hawaii to the US west coast should increase nearly 5% for calendar year 2012 and about 6% in the country’s east coast markets. Much of that rise in east coast seating capacity is attributable to Hawaiian’s launch of new service from Honolulu to New York JFK and United’s debut of flights from Washington Dulles to Honolulu in Jun-2012.

Estimated increase in seating capacity to Hawaii by region: full-year 2012

Source: Hawaii Tourism Authority

Hawaiian’s management has repeatedly stated it was pleased with the performance of the new service to New York, with CEO Mark Dunkerley in May-2012 declaring that the route was booked at a higher load factor for the summer time period than any other US mainland route served by the carrier. But United’s response from its Washington Dulles hub likely put pressure on Hawaiian’s fares from New York. Hawaiian also likely offered lower promotional fares to support the launch of its first US east coast market.

See related article: Hawaiian pushes forward with international diversification strategy

Hawaiian is somewhat responsible for the pressure it is seeing on its load factors in certain international markets. Mr Topping cited Hawaiian’s increase of service to Fukuoka in Jul-2012 from four weekly to daily and the airline’s decision in Dec-2011 to operate daily service to Sydney. Hawaiian’s CFO said those types of capacity increases are driving softer load factors in the carrier’s international networks.

Allegiant Air senior vice president of planning Jude Bricker also recently acknowledged to investors that the carrier is moving into a soft seasonal period with respect to flights to Hawaii. The airline made its debut to the Hawaiian islands in Jun-2012 with the launch of flights to Honolulu from Fresno in California and its Las Vegas base. The company is following that debut in Nov-2012 with new services to Honolulu and Maui from Eugene in Oregon, Bellingham in Washington and Stockton and Santa Maria in California. During 1Q2013 Allegiant is further expanding its Hawaii flights with the addition of service from Boise in Idaho, Spokane in Washington and Phoenix in Arizona to Honolulu.

Being new to the market, Mr Bricker explained that Allegiant does not know what to expect as seasonality sets in; however, Allegiant has stated that its operating margin during Jul-2012 in its markets from the US to Honolulu outperformed the company’s overall operating margin.

See related article: Allegiant’s latest round of Hawaii flights reflects its network strategy.

Hawaiian Airlines also plans further long-haul expansion during 4Q2012 even as load factors in its long-haul markets are currently softer than the company would prefer. The carrier is preparing for a Nov-2012 launch of service from Honolulu to its fourth destination in Japan - Sapporo - and Brisbane, which will be its second destination in Australia.

The service expansion by both JetBlue and Hawaiian reflects each carrier’s confidence in their respective long-term strategies. But for the moment each airline, along with Alaska and Southwest, needs to carefully manage the short-term weakness to ensure resources remain robust enough to sustain their overall growth.