Tesoro’s Kapolei refinery is for sale.

Abercrombie has threatened to oppose any Chevron purchase because he has suddenly become worried about monopoly.

In his State of the State speech, Abercrombie declared that natural gas is an alternative energy source.

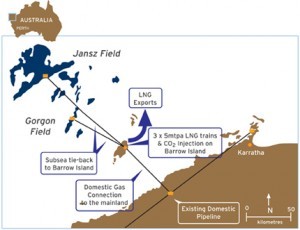

Chevron is developing massive new natural gas fields in Australia.

Tesoro’s Kapolei refinery was originally built by The Gas Company with financial backing from ERS.

And the article below fills in may of the gaps between Chevron, acquisitions, and natural gas….

With Cash in Hand, Chevron Considers Options

From GCaptain.com January 29, 2012

HOUSTON -(Dow Jones)- Chevron Corp. (CVX) is being conservative about spending its abundant cash because it wants to be prepared for the right acquisition opportunity, the company top executive said Friday.

“We are opportunistic when it comes.. .to add to the portfolio, and we want to be in a position of having sufficient resources to be able to take advantage of an opportunity,” Chief Executive John Watson told investors.

At the end 2011, Chevron had $10 billion in cash, excluding debt.

Chevron’s cash priority is to fund its massive capital projects world-wide and its annual dividend payout, Watson said. But the company would favor acquisitions if the right opportunity arrives over sharply increasing its share buybacks, he added.

Watson said that if the company was going to make an acquisition in the U.S., “organizational capability” would be a consideration. Workers’ technical know-how was a key element of Chevron’s $3.2 billion acquisition of U.S. natural gas producer Atlas Energy in 2011. “Certainly, manpower is at a premium,” Watson said. “That is an important part of what we’re looking for.”

Chevron said it expects to spend $1.25 billion share buybacks in the first quarter, unchanged from the fourth-quarter.

The San Ramon, Calif.-based company has been spending significantly less in share repurchases than rivals Exxon Mobil Corp. (XOM) and ConocoPhillips (COP), prompting speculation among some analysts that the company might be amassing cash to make acquisitions.

Chevron said its spending will peak in the next three years as it funds the development of its liquefied-natural-gas projects Gorgon and Wheatstone in Australia. The company confirmed it expects to have a $32.7 billion capital expenditure this year.

In 2011, Chevron’s capital expenditure budget of $29.1 billion was above its guidance of $26 billion because the company bought adjacent acreage to the properties it acquired from Atlas Energy in the Marcellus Shale in the northeastern U.S.

Chevron said Gorgon is on track to start production in late 2014 and that the company plans to asses the final cost of the project–currently with a price tag of $37 billion–later this year when it has a better idea of the impact of labor costs and materials. Watson said that it “remains to be seen” if the company will build a fifth train, or processing unit, for Gorgon….

read … With Cash in Hand, Chevron Considers Options

---30---

Related: Abercrombie to Tesoro: Drop Dead