State Governments Parlay Sports Betting Into Tax Windfall

by Rob Simon, US Census Bureau, December 10, 2025

Sports betting tax revenues have skyrocketed in recent years as more states got in on the action.

The national total of state sales tax revenue from sports betting soared 382%, from $190 million in the third quarter of 2021 (when data collection began) to $917 million in the second quarter of 2025, according to the U.S. Census Bureau’s Quarterly Summary of State and Local Tax Revenue (QTAX).

Sports betting became possible in May 2018 when the U.S. Supreme Court struck down the Professional and Amateur Sports Protection Act. Since then, a majority of states have legalized some form of sports betting; including online, mobile, retail sports betting and pari-mutuels (such as wagers made on horse-racing).

Sports betting is a growing industry, and the tax revenue it generates helps fund public schools, roads, highways, law enforcement and gambling addiction treatment.

Over the past four years, many states have eased restrictions on gambling, contributing to the explosion of sports betting sales tax revenue (Figure 1):

- New York’s online sports betting market went live Jan. 8, 2022. The state applies a 51% tax rate to gross gaming revenue and regularly collects over $200 million in revenue per quarter.

- Ohio’s legal sports betting market went live Jan. 1, 2023, and took in $39 million in the first quarter of that year.

- North Carolina’s sports betting market went live March 11, 2024. The state collected $38 million during the second quarter of 2024.

- Illinois increased its tax rate from a flat 15% on adjusted gaming revenue to a graduated rate between 20% and 40%. This took effect Jan.1, 2025.

- Delaware, Kansas, Maine, Massachusetts, North Carolina and Vermont adopted online sports betting in recent years; Missouri followed suit on Dec. 1, 2025.

The Seasonality of Sports Betting

Sports betting revenue is typically higher in the winter – which includes the fourth quarter of one calendar year and the first quarter of the next – than in the summer.

The fourth quarter of the calendar year includes some of the most popular sporting events:

- Major League Baseball (MLB) playoffs.

- Start of both the National Basketball Association (NBA) and National Hockey League (NHL) seasons.

- Prime portion of the National Football League (NFL) season.

The first quarter of the calendar year sees the remainder of the NBA and NHL regular seasons, as well as the NFL playoffs and Super Bowl. It also includes the March Madness college basketball tournament.

Revenue wanes in the summer months when MLB is often the only major sport in action.

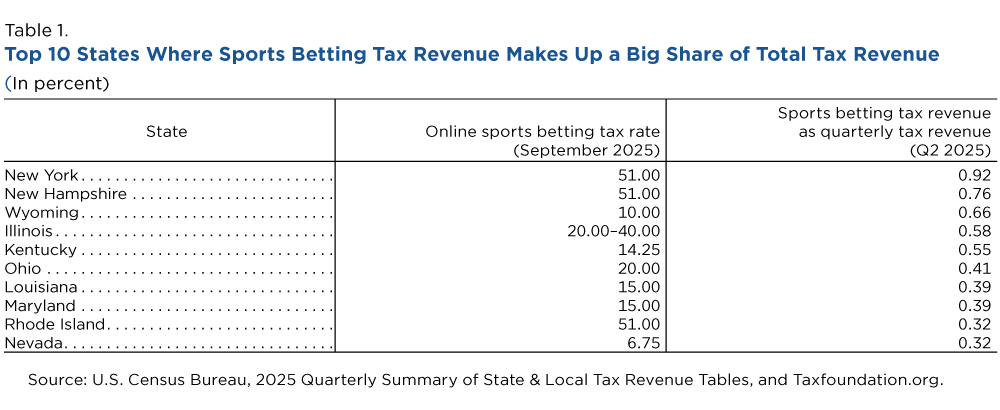

Percentage of State Tax Revenue

States have varying tax rates on sportsbook revenues, ranging from 6.75% (Iowa, Nevada) to 51% (New Hampshire, New York, Rhode Island). Typically, the higher the rate, the larger the portion of a state’s total tax revenue that comes from sports betting (Table 1):

About QTAX

The QTAX survey provides state and local tax revenue data on property taxes, income taxes, license taxes on everything from liquor licenses to hunting and fishing permits, and sales and gross receipts taxes on items like motor fuel, utilities, and tobacco.

Specific details on these taxes can be found in the tax revenue classification manual.

---30---

Rob Simon is a survey statistician at the Census Bureau.