Why are "blankety blank" tax-hike bills even allowed?

by Keli'i Akina, Ph.D., President / CEO, Grassroot Institute of Hawaii

I think we can all agree that we are living in a period of financial stress.

Local businesses are still recovering from the unprecedented COVID-19 lockdowns; Lahaina is still years away from fully rebuilding after the August 2023 wildfires; housing prices are still out of reach for most people; everyone is worried about the extent to which new tariff wars and federal budget cuts will affect our jobs and cost of living; and persistent inflation continues to eat away at our purchasing power.

Nevertheless, in the waning days of the 2025 Hawaii legislative session, some Hawaii lawmakers seem determined to increase the state’s transient accommodations tax on our largest industry — tourism — as if higher taxes would have no effect on it.

In addition to the TAT-related bills — HB504 and SB1396 — our state legislators also are considering a big tax increase — via HB202 — on all Hawaii businesses through a stealthy redefining of what is considered an adequate reserve fund of the state's unemployment insurance program.

For tourism industry employers, piling a UI tax increase on top of a TAT increase would be a double whammy.

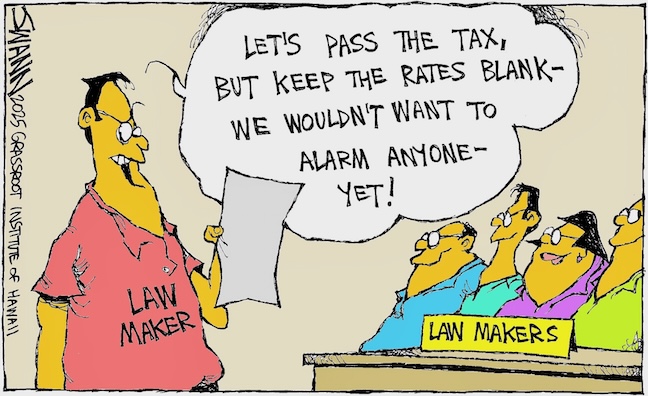

Making these three bills even worse is that none of them specify by how much the taxes would increase. As my friend Tom Yamachika, president of the Tax Foundation of Hawaii, calls them, they are all “blankety blank” bills. Their specific amounts were stripped earlier in the session, and since then, the bills have been gliding through the hearings with public testifiers not even knowing exactly what they were up against.

Why is that even allowed?

At any rate, it is still possible that these three bills can be defeated.

Starting next week, a small group of legislators from both the House and Senate will review all of the bills that have made it through both chambers, hammer out compromises if necessary and present them for final votes.

Maybe those lawmakers will add an amendment that would make a bill meaningless. Maybe they will remove an appropriation. At a minimum, they will have to fill in the blank amounts of the proposed tax bills — or they might decide there are no workable versions to move forward, which would be the end of these particular bills.

Obviously, I am hoping for the latter option. My sincere wish is that this year’s conference committee members will put aside all talk of TAT and unemployment insurance tax hikes and instead focus on policies that will strengthen our economy, not weaken it.

The good news, at least, is that all the other major tax hikes proposed this year have been rejected — and kudos to the many legislators who helped make that happen. But that’s not a free-pass card to let these last few tax-hike proposals go through. Hawaii's economic future is at stake.

It is also important that our lawmakers elevate government transparency and accountability to a higher level. This era of blankety-blank bills needs to end.

E hana kākou! (Let's work together!)