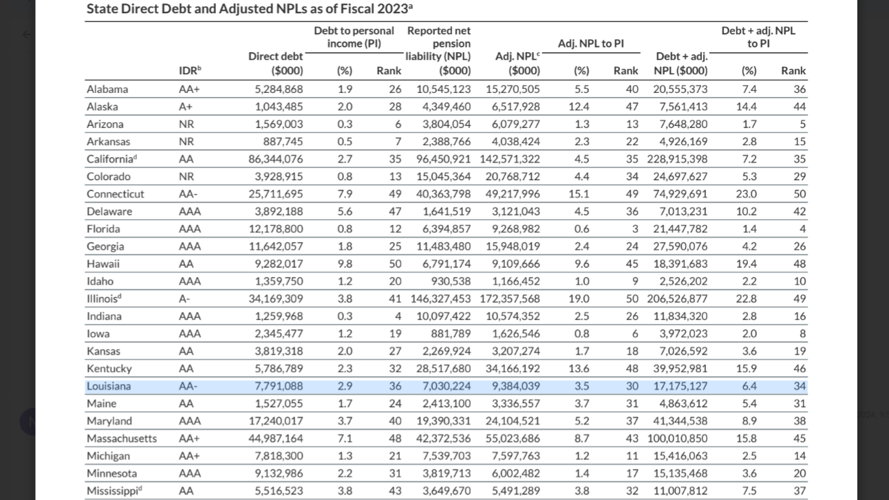

States Ranked by Pension Debt

U.S. Pension Liability Burdens Rebound Even as More States Contribute

News Release from Fitch Ratings, Wed 20 Nov, 2024

Fitch Ratings-New York-20 November 2024: Overall long-term liability burdens rose among U.S. states in fiscal 2023, reflecting a rebound in pension liabilities, even as outstanding direct debt fell, according to Fitch Ratings in its latest annual report.

Coming off of the very strong market rebound following the pandemic, less robust pension asset returns in 2022 resulted in the median ratio of state pension assets to Fitch-adjusted liabilities falling significantly in fiscal 2023, to 66% from 73.5% the previous year based on data from states’ annual comprehensive financial reports (ACFRs, or audits). Pension data in state ACFRs generally lags actual pension system results by one year. The decline in pension asset values did not erase all of the improvement reported in fiscal 2022, with the median ratio in fiscal 2023 still above the 60.2% fiscal 2021 level. “Additionally, stronger market performance reported by pensions in their own fiscal 2023 audits will result in improved ratios and steady or lower pension burdens in upcoming state fiscal 2024 audits,” said Senior Director Doug Offerman.

Despite reporting weaker ratios of assets to liabilities in fiscal 2023, U.S. states continued to improve their pension contribution practices, with 40 states making at least full actuarially determined contributions (ADCs) in fiscal 2023, up from 37 states in fiscal 2022 and 25 in fiscal 2016. Continued improvement in fiscal 2023 reflected favorable state fiscal conditions, with reserve balances at historically high levels, even as the post-pandemic revenue surge began to slow. State liability burdens remained unevenly distributed, with only nine states having burdens above 10% of personal income.

At the state level, there were few material changes to rankings in fiscal 2023. Tennessee’s long-term liability burden metric, which measures direct debt plus Fitch-adjusted net pension liabilities from 2023 state audits to calendar year 2023 personal income, remains the lowest, at just 1% of personal income, followed by Nebraska, South Dakota, Florida and Arizona. The rankings remain unchanged at the opposite end with Connecticut carrying the highest long-term liability burden, at 23% of personal income, and Illinois, Hawaii, New Jersey and Kentucky rounding out the top five.

Fitch’s ‘U.S. States Sector Monitor (2024 State Liability Report)’ and a supplementary data file are available at www.fitchratings.com.

---30---

NJSN: At the other end of the state-by-state rankings were Connecticut, 23%; Illinois, 22.8%; Hawaii, 19.4%; New Jersey, 17%; and Kentucky, 15.9%.

2020: Pension Debt: Hawaii Among 5 Worst > Hawaii Free Press