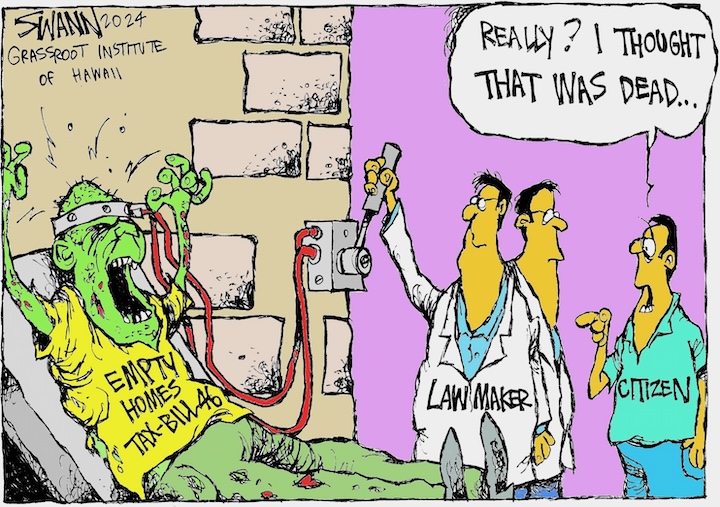

‘Empty homes’ tax fraught with pitfalls and unlikely to work

from Grassroot Institute of Hawaii, October 9, 2024

The following testimony was submitted by the Grassroot Institute of Hawaii for consideration by the Honolulu City Council on Oct. 9, 2024.

_____________

Oct. 9, 2024, 10 a.m.

Honolulu Hale

To: Honolulu City Council

Tommy Waters, Chair

Esther Kiaʻāina, Vice Chair

From: Grassroot Institute of Hawaii

Ted Kefalas, Director of Strategic Campaigns

RE: Bill 46 (2024) — RELATING TO REAL PROPERTY TAXATION

Aloha Chair Waters, Vice-Chair Kiaʻāina and other members of the Council,

The Grassroot Institute of Hawaii opposes Bill 46 (2024), CD1, which would create a so-called empty homes tax supplemental to any other property taxes currently paid by owners of certain properties in Honolulu’s residential zoning districts.

The surcharge would be equal to 1% of the property’s assessed value for the first year the tax is in effect, 2% for the second year and 3% for all tax years thereafter.

The stated goals of Bill 46 (2024) are to increase the supply of homes by encouraging owners to rent or sell vacant homes and raise funds for affordable housing and homelessness.

Grassroot believes that an empty homes tax would be difficult to administer, create substantial paperwork problems for Honolulu residents — to the extent even of comprising an invasion of privacy — and is not the best way to increase the housing supply.

The first problem here is definitional: What is an empty home? The bill states that “a dwelling unit on residential property is an empty home unless it qualifies for any of the following exemptions.”

Basically, Bill 46’s presumption would be that a dwelling on Oahu is empty unless its owner qualifies for an exemption, which would put the burden squarely on property owners to prove their status.

It then lists 15 exemptions, including for homes used as principal residences for more than six months a year; rented for more than six months a year; for sale or recently sold; subject to court proceedings; determined to be a “substandard building”; licensed by the state as a halfway house; and other reasons.

But the number of exemptions can vary, as shown by the variations in other jurisdictions that have been experimenting with such a tax,[1] and also by the fact that when this proposal was introduced in 2022 at Bill 9, it listed only 11 exemptions.[2]

Beyond that, this proposed empty homes tax would leave it to the Honolulu Department of Budget and Fiscal Services to determine whether a property was truly vacant.

The bill currently states that the department would be required to mail a form to all owners of residentially zoned properties on Oahu for the owners to declare whether their homes are empty as defined by the bill.

Further, the bill would empower the department to conduct “audits and investigations to determine the validity of property status declarations made for any residential property,” and could require “owners or occupants of the property to provide information at any time up to three years after the tax year in which the empty homes tax is due.”

Such information would include but not be limited to government-issued personal identification, driver’s license, vehicle registration, utilities records, mailing addresses used for personal bank and credit accounts, tenancy agreements, occupancy agreements, proof of income and general excise taxes paid for rental income, proof of receiving or providing medical care by the owner or tenant that precluded occupancy of the dwelling unit, death certificates, court orders and proceedings, proof of military orders of deployment and possibly many other personal records.

Frankly, we at the Grassroot Institute think most people would consider having to provide such information as a condition of paying property taxes on a home to be an egregious if not unconstitutional invasion of privacy.

Privacy concerns aside, the magnitude of all this required paperwork, investigation and enforcement would be enormous. For fiscal 2025, there are 251,787 parcels in Honolulu’s Residential class and 28,058 in its Residential A class.[3] This doesn’t count short-term rentals or bed and breakfasts that might exist in residential zones.

The department would not have to review each of these properties every year, but it seems reasonable to ask whether it has or could ever have the staff to sort through this magnitude of annual declarations.

There is no mention in the bill of how many new full-time employees the city might have to hire or how much the city might have to spend to implement and enforce this proposed tax.

And consider how this might affect homeowners who for some reason make a so-called “false claim.” The bill proposes a civil penalty of “not less than $250 and not more than $10,000 for each day that the violation continues, upon reasonable notice.”

Bill 46 would provide a grace period for owners who forget to file, but only for the first year of the empty homes tax; all forgetful owners in future years would have to file appeals that could be costly and time-consuming.

In addition, the bill says that anyone who fails to timely pay the empty homes tax would be subject to nonpayment penalties of 1% of the empty homes tax due, payable within the first year of nonpayment; 2% within the second year of nonpayment; and 3% of all accrued empty homes taxes for the third year.

After three years of nonpayment, the city would be allowed to seize the property in question and sell it to raise the money needed to pay the delinquent tax amount.

As for the goal of providing more housing, Grassroot pointed out in its May 2023 policy brief, “The ‘empty homes’ theory of Hawaii’s housing crisis,” that there have been only two robust econometric studies of the effectiveness of empty homes taxes in serving this goal, and they reached contradictory conclusions.[4]

Grassroot’s study did acknowledge such a tax could be useful for generating tax revenue, but it would be almost impossible to quantify how much.

Do we really want to create a headache for the city administration and city property owners in hopes of raising an unknown sum of money — especially when there are easier ways to go about raising revenue?

Moreover, there are effective ways to produce affordable housing. Grassroot discussed some of those ways in its December 2023 report “How to facilitate more homebuilding in Hawaii,” which essentially recommends removing or updating the many state and county regulations that hinder homebuilding.

We encourage the Council to adopt those recommendations before turning to implementing an untested, administratively complicated tax.

Please consider, too, that an implicit empty homes tax already exists as a function of the housing market.

The fact is that anyone who chooses to leave their home empty for more than six months out of the year is already forgoing more than $12,000 in rental income, based on average rents.[5]

This suggests that anyone who leaves their home empty has good reason to do so, and that an empty homes tax surcharge might not motivate them to act otherwise.

All things considered, the Grassroot Institute of Hawaii urges you to reject Bill 46 and instead focus on alternatives that have good track records for meeting the goal of producing more housing.

Thank you for the opportunity to testify.

Ted Kefalas

Director of Strategic Campaigns

Grassroot Institute of Hawaii

[1] Jensen Ahokovi and Mark Coleman, “The empty homes theory of Hawaii’s housing crisis: A tax on empty homes might increase rental occupancies and generate tax revenues, but there is no evidence showing it would increase the state’s housing supply or reduce housing or rental prices,” Grassroot Institute of Hawaii, May 2023, p. 8.

[2] “Bill 9 (2022) — Relating to real property taxation,” Honolulu City Council, Feb. 1, 2022, pp. 3-5.

[3] “Number of Records by Land Use Class for Tax Year 2024-2025,” City and County of Honolulu, July 2024.

[4] Jensen Ahokovi and Mark Coleman, “The ‘empty homes’ theory of Hawaii’s housing crisis,” p. 11.

[5] “What is the average rent in Honolulu, HI?” Apartments.com, accessed Oct. 7, 2024.