|

|

Monday, October 7, 2024 |

|

Financial State of the States--Hawaii Ranks 45th

By Selected News Articles @ 6:32 AM :: 2604 Views :: Hawaii State Government, Hawaii Statistics, Taxes

|

|

from Truth in Accounting, October, 2024

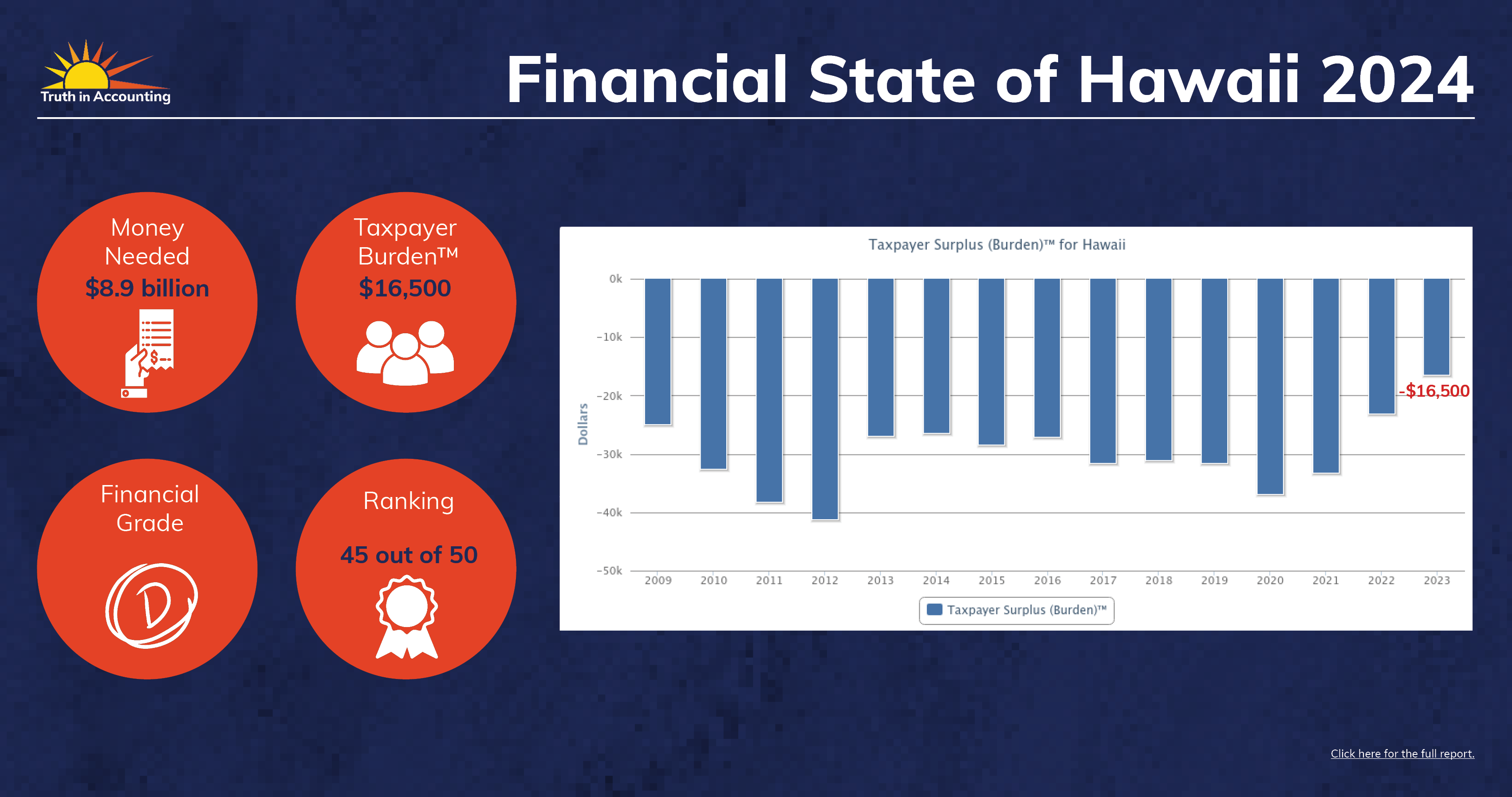

Hawaii, like most other states, improved its financial condition in 2023. This is a positive development, and Truth in Accounting applauds the state’s commitment to improving its fiscal solvency. The state increased its money available to pay bills by $2.5 billion. However, Hawaii still needed $8.9 billion to pay all its bills.

Reported revenues exceeded expenses partly because of increased tourism taxes. On August 8, 2023, a wildfire in Lahaina, Maui, resulted in at least 115 deaths, destroyed over 2,000 homes, and affected 800 businesses and 7,000 employees. The State is assessing the damage but cannot yet estimate the impact. In response, the governor has imposed a 10 percent spending restriction on discretionary general fund expenses for all Executive Branch departments in fiscal year 2024.

However, unfunded pensions and other post-retirement benefits continued to impair Hawaii’s ability to pay its bills. As outlined in the comprehensive 2024 Financial State of the States report, inflation, market volatility, and other economic factors could further impact the state’s financial situation. Based upon the state’s latest audited financial report for the fiscal year 2023, Hawaii had a Taxpayer Burden™ of $16,500, earning it a “D” grade from Truth in Accounting.

Ranking 45 out of 50

- Hawaii had $12.8 billion available to pay $21.7 billion worth of bills.

- The outcome was a $8.9 billion shortfall, which breaks down to a burden of $16,500 per taxpayer.

- Increased tourism taxes helped revenues exceed expenses, and the Maui wildfire’s devastation led to a 10 percent spending restriction for fiscal 2024.

The State’s Bills Exceeded Its Assets

| Total Assets |

$38,575,447,000 |

| Minus: Capital Assets |

($6,622,317,000) |

| Minus: Restricted Assets |

($19,156,890,000) |

| Assets Available to Pay Bills |

$12,796,240,000 |

| Minus: Total Bills* |

$21,717,541,000 |

| Money needed to pay bills |

$8,921,301,000 |

| Each taxpayer’s share of this burden |

$16,500 |

*Breakdown of Total Bills

| Bonds |

$12,755,364,000 |

| Other Liabilities |

$5,081,738,000 |

| Minus: Debt Related to Capital Assets |

($12,487,600,000) |

| Unfunded Pension Benefits |

$9,520,090,000 |

| Unfunded Retiree Health Care Benefits |

$6,847,949,000 |

| Total Bills |

$21,717,541,000 |

Financial Grade D

Bottom line: Hawaii would need $16,500 from each of its taxpayers to pay all of its outstanding bills and received a “D” grade for its finances. According to Truth in Accounting’s grading scale, any government with a Taxpayer Burden between $5,000 and $20,000 is given a “D” grade.

The data included in this report is derived from Hawaii’s 2023 audited Annual Comprehensive Financial Report and retirement plans’ reports. To compare prior years and other states’ and cities’ financial, demographic, and economic information, go to Data-Z.org.

read … Full Report

|

|

|

|

|

|