Territorial Bancorp Urges Shareholders to Vote FOR Hope Bancorp Merger

UPDATE: A-Better-Deal-for-Territorial? Blue-Hill-Asks-Shareholders-to-Reject-Hope

Compelling Combination with Hope Bancorp Creates Substantial Value for All Territorial Shareholders and Significant Benefits for Hawai‘i and Territorial Customers, Employees and Communities

Preliminary Indication of Interest by Outside Investor Group, Blue Hill, is Illusory, Non-Binding and Highly Conditional — Exposing Territorial Shareholders to Significant Uncertainty and Downside Risk

Launches http://www.territorialandhopecombination.com/

News release from Territorial Bancorp Inc., October 07, 2024 08:30 ET|

HONOLULU, Oct. 07, 2024 (GLOBE NEWSWIRE) -- Territorial Bancorp Inc. (NASDAQ: TBNK) (“Territorial” or the “Company”) today announced it is mailing a letter to Territorial shareholders in connection with the Company’s upcoming Special Meeting of Stockholders (the “Special Meeting”) to vote on the proposed merger with Hope Bancorp, Inc. (NASDAQ: HOPE) (“Hope Bancorp”) and related proposals. The Special Meeting is scheduled for November 6, 2024 at 8:30 a.m., Hawai‘i Time. Territorial shareholders of record as of August 14, 2024 are entitled to vote at or before the meeting. Other important information related to the Special Meeting can be found at www.TerritorialandHopeCombination.com.

Highlights from the letter being mailed today include:

Hope Bancorp Merger Provides Territorial Shareholders with Significant Value and Substantial Upside Opportunity. The merger is a 100% tax free, stock-for-stock transaction under which Territorial shareholders will receive 0.8048 shares of Hope Bancorp common stock for each share of Territorial common stock they own. This per share consideration represents an approximate 25% premium to Territorial’s closing stock price just prior to the merger announcement.

Additionally, Territorial shareholders will benefit from the considerable upside value of the stronger combined company as well as $10.5 million of incremental value from annual merger enabled cost savings and synergies, and Hope Bancorp’s dividend, which is more than 1,000% higher than Territorial’s standalone quarterly dividend.

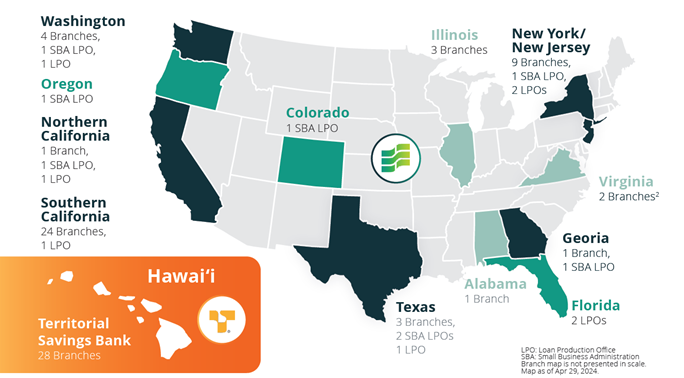

As a Result of Merger, Territorial Shareholders Will be Investors in a Larger, More Diversified Regional Bank with Exciting Growth Opportunities. The combined company will have increased resources and expanded growth investment opportunities as well as a more resilient business that is better able to navigate market cycles.

Merger Preserves Territorial’s Unwavering Commitment to Hawai‘i and Provides Benefits to Customers, Employees and Communities. Local branch and all other operations will continue to be led by local teams with customers able to rely on the same people they know and respect. Employees will continue to receive competitive compensation and benefits with new career opportunities. Hope Bancorp has committed to building on Territorial’s more than 100-year legacy of supporting Territorial’s local communities.

Blue Hill’s Preliminary Indication of Interest is Illusory, Non-Binding and Highly Conditional. Blue Hill does not have committed financing, and its suggested transaction is dependent on numerous conditions, including its ability to overcome significant regulatory hurdles in a regulatory process that Blue Hill has not yet started. Blue Hill is a newly created entity and appears to lack M&A and regulatory experience with transactions of this size and complexity.

Blue Hill Exposes Territorial Shareholders to Significant Risk and Uncertainty. Under Blue Hill’s Preliminary Indication of Interest, Territorial’s Stock Could be Worth Substantially Less Than it Is Today. In addition to significant challenges in gaining regulatory approvals, a leading proxy solicitation firm has stated that it is highly unlikely that Blue Hill can meet its required tender threshold given the composition of Territorial’s shareholder base.

If Blue Hill does not acquire 100% of outstanding Territorial shares, Territorial’s shareholders could be left with an illiquid, stub minority investment in a controlled company. Territorial would face the declining performance and limited growth prospects that it does today as a small, monoline one- to four- family loan focused bank with limited scale.

Blue Hill Is Unlikely to Deliver Its Claimed Benefits to Hawaiʻi. Rather, Blue Hill’s Transaction Could be Detrimental to Hawaiʻi, Jobs and Communities. In press reports and elsewhere, Blue Hill repeatedly emphasizes “local management,” but none of its named principals appear to primarily reside in Hawaiʻi, according to public information. Blue Hill’s registered business address appears to be a residential home in Hudson, New York. There would likely need to be significant job cuts and reduced investments in areas such as technology in order for Blue Hill to reach its stated financial targets after it took control of Territorial.

The Territorial Board of Directors unanimously recommends that shareholders vote FOR the Hope Bancorp merger and related proposals TODAY.

The full text of the letter being mailed to shareholders follows:

* * * * *

Dear Fellow Territorial Bancorp Shareholders,

As previously announced, Territorial Bancorp has entered into a definitive agreement to merge with Hope Bancorp. This transaction delivers significant value to Territorial shareholders and provides you with the opportunity to benefit from the substantial upside opportunities of a larger, more diversified regional bank.

On November 6, 2024, Territorial will hold a Special Meeting of Stockholders (the “Special Meeting”) to vote on this transaction. How you vote will influence the value of your Territorial investment.

The Board unanimously recommends that Territorial shareholders vote FOR the Hope Bancorp merger and related proposals.

Compelling Value for Territorial Shareholders

The merger is structured as a 100% tax free, stock-for-stock transaction under which Territorial shareholders will receive 0.8048 shares of Hope Bancorp common stock for each share of Territorial common stock they own. This per share consideration represents:

- ~ 25% premium1 to Territorial’s closing stock price just prior to the merger announcement

- Strong implied transaction multiples across all relevant metrics, including earnings per share and adjusted tangible book value per share

Opportunity to Participate in Future Growth and Value Creation

The all-stock consideration in the merger will allow Territorial shareholders to participate in the considerable strategic, operating and financial benefits we anticipate unlocking through the combination:

- Larger, more diversified footprint, expanding our opportunities and reducing our risks

Solid financial position and greater access to capital, enabling the combined company to capture its many new growth opportunities and invest in new technology and solutions to continue expanding our portfolio and penetrating our markets

- 1,000%+ increase to Territorial’s standalone dividend, increasing from $0.01 per share to $0.11 per share3

- $10.5 million of incremental value from annual merger enabled cost savings and synergies

- Immediate accretion at close, tapping into Hope Bancorp’s double-digit percentage EPS growth v. Territorial’s losses as a standalone company

- The transaction with Hope Bancorp will vault Territorial into a new class of banking institutions. With a broader footprint and diverse revenue streams, we will become part of a significantly more resilient business better able to navigate market environments to drive growth and shareholder value.

Preserves Territorial’s Unwavering Commitment to Hawai‘i Market

Territorial has been part of the fabric of our local communities across Hawai‘i for more than 100 years, and with this transaction – local leadership, local operations, local relationships, all remain in place.

| Territorial Savings Bank |

Employees |

Customers |

Communities |

- Continuing to operate under Territorial name

|

- Continued strong local workforce

- Retaining all customer-facing branch staff to ensure relationship continuity for customers

- Competitive compensation, benefits

- New career advancement opportunities

|

- Access to expanded array of banking products & services

- Benefits from enhanced technology platforms for improved customer experiences

- Additional choices for customers

- Continued reliance on teams at local branches

|

- Shared cultural values that emphasize volunteerism and active engagement with local communities

- Ongoing commitment to Territorial’s legacy of community support and investment

|

Blue Hill’s Unsolicited Preliminary Indication of Interest is Not in the Best Interest of Territorial Shareholders, Customers, Employees or Communities in Hawaiʻi

After our definitive merger agreement with Hope Bancorp was reached and announced, Blue Hill Advisors LLC (“Blue Hill”) – a recently formed entity with only three disclosed investors – delivered its self-labeled “preliminary indication of interest” to acquire Territorial Bancorp for $12.50 per share in cash through a tender offer, with the potential option for holders of up to 30% of Territorial shares to remain investors in the Company.

In consultation with its legal and financial advisors, the Territorial Board carefully considered the Blue Hill preliminary indication of interest on multiple occasions. The Board unanimously determined to reject the preliminary indication of interest because the Board does not believe that it is a superior proposal, or likely to lead to a superior proposal, as defined by the terms of the Hope Bancorp merger agreement. We firmly believe that our merger with Hope Bancorp remains in the best interest of Territorial shareholders.

Blue Hill’s Non-Binding, Preliminary Indication of Interest is Highly Conditional

- No committed financing to purchase Territorial

- Requires side agreements with undisclosed terms to be negotiated and signed by numerous unidentified investors

- Subject to an undefined due diligence process

- Dependent on overcoming significant hurdles in a regulatory process that Blue Hill has not yet started and would be challenging

Blue Hill’s Cloak of Secrecy and Anonymity Creates Substantial Regulatory Risk and Uncertainty for Territorial Shareholders

We find it difficult to believe that either federal or Hawaiʻi regulators would allow Blue Hill to purchase Territorial based on the following:

- No evidence that Blue Hill, its named principals nor its undisclosed investors have obtained – or even tried to obtain – regulatory approval for a transaction of this size and complexity based on information it has provided to Territorial

- Blue Hill says it will immediately reconstitute the Territorial Board after it gains control of the Company, but has not disclosed the names of its new directors or the individuals who will replace Territorial’s current management

- Blue Hill has not shared any detailed business plan, including specifics on Board, management, strategy, resources, capital planning, policies and procedures if it were to gain control of Territorial – all of which are required in the regulatory process

- Blue Hill was only established in February of 2023

- According to public sources, Blue Hill’s registered business address appears to be a residential home in Hudson, New York

Even if Blue Hill were to gain regulatory approval, its ability to complete a tender offer is highly unlikely. Based on advice from a leading proxy solicitation firm whose principals have overseen hundreds of tender offers over the past 40+ years, it is highly unlikely that Blue Hill could achieve its required 70% tender threshold given the composition of Territorial’s shareholder base. Abandonment of the Hope Bancorp merger and the failure of the Blue Hill transaction to materialize would leave Territorial significantly weakened in the aftermath of two failed deals with significant standalone business risks.

Under Blue Hill’s Preliminary Indication of Interest, Territorial’s Stock – and the Value of Your Investment – Could be Worth Substantially Less Than It Is Today

If Blue Hill is unable to complete a 100% tender, the remaining Territorial shareholders would be left with an illiquid, stub minority investment in a controlled company. Blue Hill’s undisclosed investors – who would control the Company – have provided no assurance that they would serve all shareholders’ interests and have not defined a governance structure that ensures they do.

As a standalone company, Territorial would face the same business and value downside risks that Territorial faces today as a small, monoline one- to four- family loan focused bank with limited scale.

Unlike the Hope Bancorp stock-based transaction, Blue Hill’s cash-based transaction creates immediate tax consequences, which could leave Territorial shareholders with less – in some cases substantially less – than the $12.50 per share consideration.

Blue Hill is Not Positioned to Deliver Its Claimed Benefits to Hawaiʻi. Rather, Blue Hill’s Transaction Could be Detrimental to Hawaiʻi, Jobs and Communities

In press reports and elsewhere, Blue Hill repeatedly emphasizes “local management,” but:

- None of Blue Hill’s named principals appear to primarily reside in Hawaiʻi, according to public information.

- Blue Hill is not based in Hawaiʻi. Blue Hill’s registered business address4 appears to be a residential home in Hudson, New York, which is also for rent5 on apartments.com.

- Blue Hill has provided no assurances as to whether it would reduce employment levels, change employee compensation or benefits, or reduce investments in communities after it gains control of Territorial.

- In order for Blue Hill to reach its targeted 55% efficiency ratio, there would likely need to be significant job cuts and reduced investments in areas such as technology.

Protect Your Territorial Investment and Ensure You Have the Opportunity to Realize the Upside Value Created by the Territorial + Hope Bancorp Combination by Voting FOR the Merger Today

We are on a path to complete our merger with Hope Bancorp by the end of 2024. The Hope Bancorp merger will create a stronger, more diversified regional bank with an expanded footprint and diversified offerings to drive future growth. The merger will provide Territorial shareholders with compelling value and the opportunity to participate in the considerable upside of our combined business, and it will enable Territorial to build on our more than 100-year legacy of supporting our local Hawai‘i communities.

We urge you to consider the concrete and compelling opportunities that the Hope Bancorp merger will create and not be distracted and deceived by Blue Hill’s illusory, non-binding, highly conditional preliminary indication of interest.

The Territorial Board of Directors unanimously recommends that you vote FOR the Hope Bancorp merger and related proposals TODAY. You can vote by internet, telephone or mail.

On behalf of the Territorial Board of Directors and management team, thank you for your continued support of Territorial Bancorp.

Allan S. Kitagawa

Chairman of the Board, President and Chief Executive Officer

BD: Hawaii bank postpones acquisition-vote meeting | Banking Dive

* * * * *

Territorial Bancorp Postpones Special Meeting of Stockholders

Postponement Provides Additional Time for Territorial Board and Management to Engage with Territorial Stockholders Regarding Hope Bancorp Merger

News Release from Territorial Bancorp Inc., October 04, 2024 09:00 ET

HONOLULU, Oct. 04, 2024 (GLOBE NEWSWIRE) -- Territorial Bancorp Inc. (NASDAQ: TBNK) (“Territorial”) announced today that it has postponed the Company’s Special Meeting of Stockholders (the “Special Meeting”) to vote on its proposed merger with Hope Bancorp, Inc. (NASDAQ: HOPE) (“Hope Bancorp”), which was originally scheduled for 8:30 a.m., Hawaii time, on October 10, 2024. The Special Meeting has been rescheduled for November 6, 2024 at 8:30 a.m., Hawaii time. The August 14, 2024 record date for stockholders entitled to vote at the Special Meeting is unchanged.

The Special Meeting has been postponed in order to allow the Territorial Board of Directors and management team to continue discussions with stockholders regarding the pending Hope Bancorp merger.

The Territorial Board continues to unanimously recommend that Territorial stockholders vote “For” the merger with Hope Bancorp and all related proposals.

Additional Information about the Hope Merger and Where to Find It

In connection with the proposed Hope Merger, Hope has filed with the U.S. Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4, containing the Proxy Prospectus, which has been mailed or otherwise delivered to Territorial’s stockholders on or about August 29, 2024, as supplemented September 12, 2024. Hope and Territorial may file additional relevant materials with the SEC. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE PROXY PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR FURNISHED OR WILL BE FILED OR FURNISHED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. You may obtain any of the documents filed with or furnished to the SEC by Hope or Territorial at no cost from the SEC’s website at www.sec.gov.

read … News Release

SA: Territorial Savings Bank takeover vote postponed | Honolulu Star-Advertiser

AB: Territorial in Hawaii postpones merger vote as competing offer lurks | American Banker

* * * * *

Territorial Bancorp Board Reaffirms Its Commitment to Proposed Merger with Hope Bancorp

Again Rejects Blue Hill Proposal as Remaining Highly Uncertain, Inferior to Hope Merger Agreement and Unlikely to Benefit Territorial Shareholders

News Release from Territorial Bancorp Inc., September 30, 2024 09:00 ET

HONOLULU, Sept. 30, 2024 (GLOBE NEWSWIRE) -- Territorial Bancorp Inc. (“Territorial”) again reaffirmed the commitment of its Board of Directors to the proposed merger with Hope Bancorp, Inc. (“Hope”) that was announced on April 29, 2024. The announcement was made in response to additional information provided to Territorial from, and further information released by, Blue Hill Advisors LLC (“Blue Hill”) on September 26, 2024 regarding the Hope merger and the proposal by unidentified investors and Blue Hill (the “Blue Hill Group”).

“While the latest Blue Hill Group information indicates an increase in their offer by 4%, the proposal continues to leave so many unanswered questions, such that the Blue Hill proposal remains highly uncertain and inferior to the Hope merger,” said Allan S. Kitagawa, Chairman, CEO and President of Territorial.

Mr. Kitagawa continued: “The Territorial Board already carefully considered the proposal on two separate occasions, and each time rejected the proposal for a number of reasons. The Territorial Board has now considered the latest information and, for a third time, has rejected what remains a highly speculative proposal. We again urge shareholders to vote “yes” in favor of the proposed merger with Hope Bancorp.”

The Blue Hill Group proposal was again found to be inferior for the following numerous reasons, among others:

The Blue Hill Group continues to rely on potential investments from unnamed investors, supported only by “non-binding indications of interest.” In comparison, Hope has entered into a signed merger agreement with Territorial, and has already invested real money in the regulatory and shareholder approval processes.

The Blue Hill Group proposal continues to provide no evidence to assure the Territorial Board that the unidentified investor group (individually and as a whole) could each secure the required regulatory approvals promptly, if at all.

The Blue Hill Group continues to include the uncertain completion of a tender offer as a requirement for completion of a transaction. In contrast, the proposed transaction with Hope represents a traditional merger with a profitable and experienced financial institution.

The Blue Hill Group proposal continues to be subject to a variety of additional conditions, including due diligence. By contrast, a detailed due diligence review has already been completed and only a minimal number of remaining conditions are needed to complete the Hope merger.

The proxy statement mailed to Territorial shareholders details the process the Territorial Board engaged in before entering into a merger agreement with Hope, including its consideration of other strategic alternatives. In addition, the Territorial Board has continued its diligence in repeatedly rejecting what remains an inferior offer.

Territorial continues to note that the proposed merger with Hope is expected to benefit Territorial’s shareholders, customers, employees and the communities in which Territorial operates.

* * * * *

Additional Information about the Hope Merger and Where to Find It

In connection with the proposed Hope Merger, Hope has filed with the U.S. Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4, containing the Proxy Prospectus, which has been mailed or otherwise delivered to Territorial’s stockholders on or about August 29, 2024, as supplemented September 12, 2024. Hope and Territorial may file additional relevant materials with the SEC. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE PROXY PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR FURNISHED OR WILL BE FILED OR FURNISHED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. You may obtain any of the documents filed with or furnished to the SEC by Hope or Territorial at no cost from the SEC’s website at www.sec.gov.

About Us

Territorial Bancorp Inc., headquartered in Honolulu, Hawaii, is the stock holding company for Territorial Savings Bank. Territorial Savings Bank is a state-chartered savings bank which was originally chartered in 1921 by the Territory of Hawaii. Territorial Savings Bank conducts business from its headquarters in Honolulu, Hawaii, and has 28 branch offices in the state of Hawaii. For additional information, please visit https://www.tsbhawaii.bank.

---30---

SA: Proxy firm advocates investors reject Hope bid for Territorial | Honolulu Star-Advertiser (staradvertiser.com)

BD: Would-be acquirer Blue Hill boosts offer for Hawaii bank | Banking Dive