People are on tight budgets, and the state should be too

from Grassroot Institute of Hawaii, September 12, 2024

The Hawaii Legislature enacted the largest tax cut in the state’s history earlier this year, but with rising expenses for rebuilding Lahaina, lawsuit settlements and COVID-era hazard pay for government union workers, can Hawaii afford to keep the cut?

Grassroot Institute policy researcher Jonathan Helton weighed in on the question during his latest appearance on Johnny Miro’s Sunday morning show on the H. Hawaii Media radio network.

“We’ve looked at the math … and it looks like if the state were to keep its spending levels relatively flat over the next couple of years, then there would be no need to cut services,” Helton said.

Despite the optimistic outlook, Helton stressed the need for fiscal prudence, citing Gov. Josh Green’s proposal to eliminate long-vacant state positions as a promising approach.

With over 4,700 positions currently unfilled, including more than 100 that have been vacant for over four years, Helton suggested, “Let’s take a look at which positions aren’t really needed in order to provide the core government services and let’s simply not appropriate funding for those. … Put the funding to better use elsewhere, and you will have freed up funding while not reducing services.”

Helton also promoted the idea of a volunteer-staffed cost-of-government commission, similar to those at the county level.

“Simply adopting one of these commissions and asking the people who serve on it to look for duplicative spending or places where the state could consolidate — that would be a good first step toward identifying things in the long run to reduce costs,” he said.

Reiterating the importance of preserving the tax cuts, Helton stated: “People are living on tight budgets, and a lot of people are leaving Hawaii because they can’t afford to stay. So when we ask the question, ‘Can the government afford the tax cut?’ I think that we could also ask, ‘Can the people of Hawaii afford the high taxes?’ And the answer to that I think is no.”

He concluded, “If people are going to live on tight budgets, perhaps the government should also look to restrain some of its spending as well.”

TRANSCRIPT

9-8-24 Jonathan Helton with host Johnny Miro of the H. Hawaii Media radio network

Miro: Good Sunday morning to you. I’m Johnny Miro. Once again, it’s time for our public access programming for our five Oahu radio stations with H. Hawaii Media and five Kauai radio stations with H. Hawaii Media available at HawaiiStream.fm and FMLive365.

We’re going to delve into the state budget once again. We can’t lose sight of that very important topic. Is anything going to happen to the budget? Will they keep it as they agreed upon at the state Legislature?

We’ll see if the state of Hawaii, which has passed the largest tax cut — remember, in the history — in the history of the state earlier this year. But you have bills for Lahaina rebuilding, lawsuit settlements, and hazard pay that are mounting up.

Now, can the state afford to keep the tax cut? That’s the big question. Everybody’s kind of amazed that it went through, but can they afford to keep the tax cut? And how will lawmakers adapt to reduced revenues?

Well, Jonathan Helton, policy researcher at the Grassroot Institute of Hawaii, joins me to discuss these questions. Good morning to you, Jonathan.

Helton: Good morning to you, Johnny.

Miro: All right, can you remind listeners about the state’s tax cut and just how it works?

Helton: As you said, the state passed the biggest tax cut in state history this year. We were very excited. Into nuts and bolts, the tax cut does two things, and it’s really pretty simple.

Number one, it will increase the size of the standard deduction. And number two, it expands the tax bracket so that more of your income is taxed at the lower tax rate.

This applies to all taxpayers whether you’re filing head of household, married, single — it helps everybody.

And what the Legislature did do that will make it a little bit more confusing is they decided to phase it in. So the tax cut isn’t going to go into effect all at once. It’s going to go into effect starting in the next tax year, and up until 2031. So it’s a phase-in period of about seven years.

Our take on this is that this is really good for people. So many people have been leaving Hawaii because they can’t afford to stay. And one of the things that the state government has the most direct control over is not the cost of food or even the cost of housing, but they do have direct control over the tax bill. By reducing the income tax, like this bill did, we’re very hopeful that it’s going to help more people be able to afford to stay in Hawaii.

Miro: Yeah, we’re not used to it. So it’s kind of like people still probably can’t realize it, Jonathan. But can you remind us how much this is going to save Hawaii taxpayers?

Helton: So, let me give you an example. If you’re a family of four and you make $100,000 a year, in this next year the cut is going to save you $348, which doesn’t sound like a lot. But by 2031, when the cut is fully phased in, you’re going to be saving 10 times that amount. So you’ll save almost $4,000 off your income tax bill. It will gradually grow over time, and we’re very hopeful that this will help people.

But let me give you some numbers that are a little bit more broad. So in general, for all Hawaii taxpayers, in the upcoming year it will save about $240 million. And in the year after next, it will save about $600 million. And so by the time we get to that 2031 phase-in date, it will be saving taxpayers as a whole more than $1 billion a year. So we’re talking about pretty substantial amounts of saving, both on an individual level and across the board.

And so we put something together that we think will be really helpful for people to understand the tax cut. It’s actually on our website. If you go to grassrootinstitute.org/taxcalculator — and that’s grassrootsinstitute.org/taxcalculator — we have put together a tool that will allow you to put in your tax status and your annual income, and it will tell you how much this is likely to save you over the next several years. So we’re excited about that tool. We hope it will help people really understand how this tax cut is going to affect them and hopefully the entire state.

Miro: We’ll remind them at the end about that. That’s exciting. Going forward, Jonathan, what is the state’s financial picture looking like? Now, how do the revenues compare to planned spending and debts? Those two questions.

Helton: That’s the key question: Can the state afford to keep the tax cut without cutting services?

So our take on it is this: People are having to live on really tight budgets, so we think it’s fair that the state also live on a tight budget.

Now let me give you some statistics kind of at the stage of where we’re at.

So, state debt was about $14 billion as of July of last year, and those numbers are usually lagged about a year. And actually, that debt number has been either going down or flat in recent years, so it sounds like a lot, but it’s not been getting too much worse.

Spending for this year was about $11 billion from the general fund. The spending has picked up during the pandemic and now as we’re sort of after the pandemic. The spending has been at a higher level than it was before. But we’ve looked at the math — factoring in the tax cut, factoring in what the state expects, factoring in expected state spending — and it looks like if the state were to keep its spending levels relatively flat over the next couple of years, then there would be no need to cut services.

Even if spending levels were to grow by perhaps 3% or 4% per year, there would be no need to cut any services, and you could retain the tax cut. So we’re pretty hopeful that you can have both — retain some spending and retain the tax cut.

Now, we can talk about how there might be ways for the state to actually reduce spending that’s either not needed or is in fact wasteful. And I’m sure we’ll talk about that later. But from a big-picture point of view, we don’t think that there’s going to be a major conflict between reducing spending and having the tax cut in play.

Miro: OK. Jonathan Helton, policy researcher at the Grassroot Institute of Hawaii. Next question: I guess the state Council on Revenues met last Thursday. What was their prediction for the state’s revenue collections going forward?

Helton: The State Council on Revenues is an organization that is composed of people who are economists or who work in perhaps the financial sector. And they are appointed to estimate how much the state’s revenue is going to increase over the next several years. That’s their job, and that’s how we’re able to — how we and then also the state budget people‚— are able to build their budget.

So what the Council on Revenues estimated for this current year is that the state will collect about $9.9 billion in general fund taxes. That’s things like income taxes, corporate taxes, GET, transient accommodation taxes — all of those about $9.9 billion.

Now, let’s compare that to what the previous estimate was. The Council put forth an estimate of about $9.96 billion back in May.

Miro: Billion. So —

Helton: There’s a difference of about $60 million. They’re expecting the state to take in roughly $60 million lower than they were back in May. But the current estimate takes into consideration the tax cut.

So yes, the tax cut will reduce state revenues, but it’s not going to reduce state revenues by a ton in the current year. So we’re pretty optimistic about what the state’s revenue picture could be for the next several years.

Miro: OK. Then there was also an article in Civil Beat that came out last week. It discussed some big bills the state’s going to face from lawsuit settlements and hazard pay. How much money are we talking about with that?

Helton: So, the Civil Beat article cited several different amounts of money that the state is going to need to pay. So there was an agreement between the state and several of the unions that the state would need to pay about $450 million in hazard pay to the government union, the government employees union. So that was factored into the 2025 budget that’s already been passed. So that’s been paid for already.

Another big question mark is the funding for Lahaina recovery, and the state put several hundred million dollars towards that in last year’s budget. And we do anticipate that in the next year, there will be a renewed need for funding in order to support the rebuilding of Lahaina, particularly as it comes to infrastructure in the area.

But perhaps the biggest question is where is the state going to get the money to pay for the wildfire lawsuit settlement?

Right now, what the governor has said is that the state is going to pay about $873 million toward the wildfire settlement. And this is out of a settlement that I think right now is about $4 billion. So that’s all still being decided as to the particulars of how the settlement will work. So this is subject to change this week or in the coming months. It just depends on how long it takes for all of the parties to agree on what the numbers should be and who’s going to get paid.

So that’s the big question.

Now, as to how the state’s going to cover that, the governor has put forth a plan. His suggestion is perhaps let’s look at reducing some of the jobs in state government that have been vacant for a very long time.

He’s mentioned the state lawsuit related to one of the pharmaceutical companies, and the state expects to get a significant amount of money out of that. I don’t remember the company’s name.

And then finally, the state is expected to actually have a $700 million surplus by the end of the year. So if there’s a need, some of the money to pay for the settlement could probably come out of that surplus. So all in all, there’s a couple of different strategies that are on the table for this.

Miro: A surplus? Any idea why that would come about? That amount of money for the state or for surplus?

Helton: Yeah. So the surplus has actually been around for a couple of years. You might remember when Gov. Ige was leaving office, they were talking about a surplus of $2 billion. And this was because the spending during especially 2022 — general excise tax revenues went up partially because of inflation. So there were two things: It was inflation, and then it was the federal government and some of their COVID-related relief going to the state.

When inflation goes up, prices go up as well. And when prices go up, so do excise tax revenues because they’re based on the price of the good being sold. So when inflation was high, the state actually got a lot more money than it expected. And then of course during COVID, the state also received a significant amount of money from the federal government.

So it was really those two primary factors that created a surplus in the state budget.

And now we still have a smaller surplus because we spent a lot of that money. But yes, we have one. It’s expected to be about $700 million by the end of the year, but of course, we’ll have to see what plays out in terms of the settlement.

Miro: OK. Getting back to the state government. Now how many vacancies are we talking about with the state government? How many job vacancies?

Helton: It’s actually pretty eye-popping. Right now — or I should say at the end of last year, which is when one of the state departments puts together their vacancy report — the state had a 27% vacancy rate. So there were about 4,700 unfilled jobs. That’s a lot.

And to add to that, about 30% of the state workforce is either eligible to retire now or will be by the middle of 2028.

So in terms of hiring, the state, there’s definitely a conversation that needs to be had about how to replace the people who are retiring.

But when it comes to all of those vacancies, the governor has suggested, let’s take a look at which positions aren’t really needed in order to provide the core government services and let’s simply not appropriate funding for those. Let’s abolish those positions, put the funding to better use elsewhere, and you will have freed up funding while not reducing services. So I think that’s a pretty solid strategy.

The report from last year, for example, identified that there were 115 vacant positions that had been vacant for four years or more, and that the departments weren’t even looking to fill. So when you have positions that are on the books for a long time, no one’s even trying to fill them, it makes sense to cut those positions.

Miro: Is that, in your opinion, going to take an audit? I mean, they brought in audits, someone to audit it before and they weren’t happy with his results of the audit. Is that going to take an audit or are they just going to — is the governor just going to assign some people to go over that?

Helton: It might take an audit. The Legislature knows which positions those are because that’s information provided by the department. And the Legislature has in its power, and if it includes abolishing those positions in either the budget or another bill, it can do that.

Miro: OK.

Helton: So I think we know what the positions are, and I think that we have the power to get rid of them. It’s just a matter of will. And unfortunately, the Legislature hasn’t always abolished all of the positions that have been recommended to be abolished. So we’ll hopefully be working on that in the upcoming session.

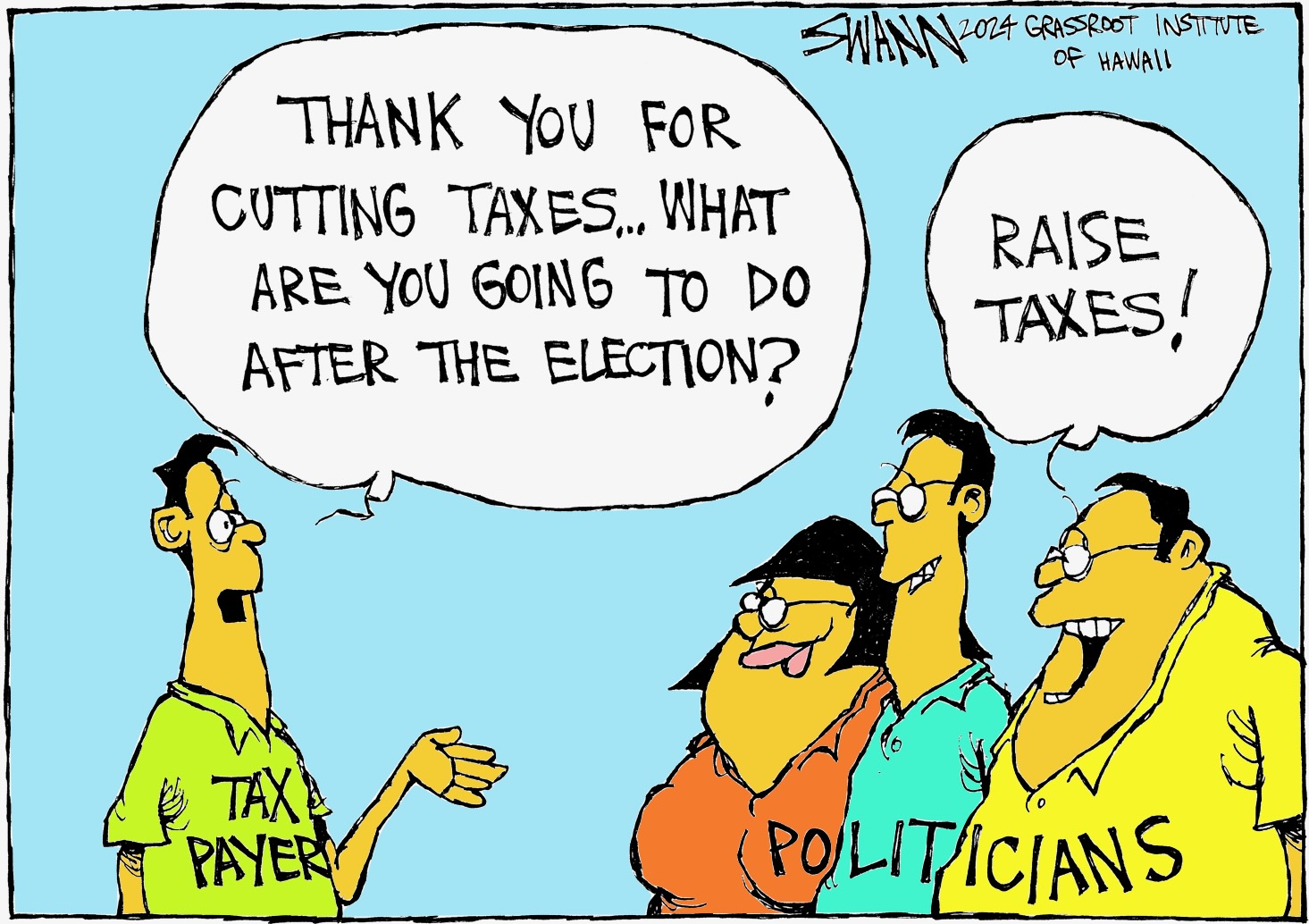

Miro: Couple more questions for policy researcher at Grassroot Institute of Hawaii, Jonathan Helton. Let’s see. Do you expect the lawmakers, Jonathan, to try to increase taxes or fees to cover these costs?

Helton: We expect there will be a push to increase either fees or taxes, but I know the governor has also suggested bringing back his idea of the “green fee.” It would be a fee charged to tourists either when they get off the airplane or when they check in at a hotel or an Airbnb.

And that proposal does have several logistical issues such as how you might enforce that and who that would apply to.

But some members of the Legislature have also talked about raising things like the capital gains tax. We saw an attempt to do that last year.

So we expect that there will be a push to increase taxes, but we’re not sure if that’s going to be successful. At the Grassroot Institute, of course, we are skeptical of the need to raise taxes. In fact, Hawaii is one of the most highly taxed states in the country, which is of course why we supported the tax cut this past year.

Miro: Hey, you’re skeptical of that, but you also no doubt have some suggestions of how to cover these costs at Grassroot Institute. Right?

Helton: Yes. One of the simplest steps that the state government could take to reduce some of its costs — either identifying unnecessary spending or spending that is downright wasteful — would be to set up a cost of-government commission.

Three of the counties already have these commissions. And they’re typically filled by volunteers who are tasked with looking at how to improve the efficiency of county agencies or to reduce county spending. But the state doesn’t have one of these commissions. And simply adopting one of these commissions and asking the people who serve on it to look for duplicative spending or places where the state could consolidate — that would be a good first step toward identifying things in the long run to reduce costs.

And this was actually — this is not my idea. This is a recommendation by the Tax Review Commission, which is a state commission that is set up every so often in order to review the state tax structure.

And so the Tax Review Commission said, “Hey, in addition to having a commission that would look at the tax structure and where we get our revenues, we should have a commission that looks at spending and how we need to plan to reduce our debt and our pension liabilities and perhaps improve efficiency.” I think this is a great step.

And of course, there are other things the state could probably do, and we hope at the Grassroot Institute, we’re going to be talking about those in the next several months. But just doing a cost-of-government commission would be a good step in the right direction.

Miro: Sounds like it. Now once again remind the listeners about what you have on the website as far as finding out what their tax savings would be with the calculator.

Helton: If you’d like to figure out how much the tax cut is going to save you, you can go to grassrootinstitute.org/taxcalculator. And again, that tax calculator, it’s got a couple of cool graphs. It’ll tell you how much that you’re going to save each year, and we hope that it will really educate people about what the Legislature has done.

Miro: All right. To wrap up this conversation, anything else you’d like to add, Jonathan?

Helton: I’d like to go back and emphasize something I mentioned earlier. People are living on a tight budget, and a lot of people are leaving Hawaii because they can’t afford to stay.

So when we ask the question, “Can the government afford the tax cut?” I think that we could also ask, “Can the people of Hawaii afford the high taxes?” And I the answer to that I think is no.

So our encouragement is that if people are going to live on a high budget, perhaps the government should also look to restrain some of its spending as well.

It should live on a tight budget. And we hope by doing that, the lawmakers will prioritize spending more efficiently and eliminating something that is not necessary. So the end result is lower taxes and a government that does the same job or it’s perhaps even a better job than before.

Miro: Once again, great information coming from Jonathan Helton at Grassroot Institute of Hawaii, and he’s a policy researcher over there. You can get him on that website that’s so easy to go to and easily obtained at grassrootinstitute.org, grassrootinstitute.org, and get all that great information from the group over there.

Jonathan, fantastic. Once again, look forward to another conversation down the road. In the meantime, enjoy the rest of your Sunday.

Helton: As always, I appreciate being on and hope you have a good rest of the day too.