Maui Short-Term Rentals, the Minatoya List, and Housing Supply

by Justin Tyndall and Emi Kim, UHERO, June 25, 2024

Recent state legislation has given counties new powers to regulate Transient Vacation Rental (TVR) properties. A proposal on Maui would significantly reduce the number of TVRs by withdrawing permission to operate for over 7,000 properties. Below, we briefly summarize the policy proposal and discuss the characteristics of the units that would be affected by the policy change. If the policy is enacted in full, it would increase Maui’s long-term residential housing stock by 13%, representing a dramatic increase in housing supply.

In 2001, amid questions regarding where TVRs could legally operate on Maui, a legal memo was issued by a Maui County employee providing clarification. Generally, condominium units already operating as vacation rentals as of 1989 were permitted to continue renting in the short-term market. The author of the memo was named Richard Minatoya, and the affected properties have been referred to as the “Minatoya List.” The rule was subsequently adopted into the Maui County Code. Many of the properties were in areas zoned for apartment buildings. The Mayor of Maui has announced plans to phase out the permissions granted by the Minatoya List, implying that these units will transition to other non-short term rental uses.

To assess the impacts of the policy on Maui’s housing supply, we examine property tax assessment records to understand the locations and characteristics of units that would be impacted by the policy.[1]

We examine the properties on the Minatoya List identified as “Apartment District Properties,” which cover 7,167 units. Some of these units are not currently operating as a vacation rental, as indicated in property tax filing information. We identified 6,172 units that are both operating as TVRs and appear on the list. It is these 6,172 properties that would be directly affected by the policy change, as they would be forced to cease operating as TVRs. We base the analysis below on this group of properties.

The locations of the affected units are mapped below. Minatoya List properties are concentrated in West Maui, Kīhei, and Wailea. Zooming in on the map (LINK) reveals the specific locations of affected units. The map can also be used to show the location of Maui’s current TVRs that do not appear on the Minatoya List. Non-Minatoya List properties are more widely distributed across Maui. 13,000 properties on Maui currently pay property taxes as a TVR, meaning Minatoya List TVRs represent 47% of all TVRs on Maui.

LINK: Locations of Short-term Rental Properties in Maui County

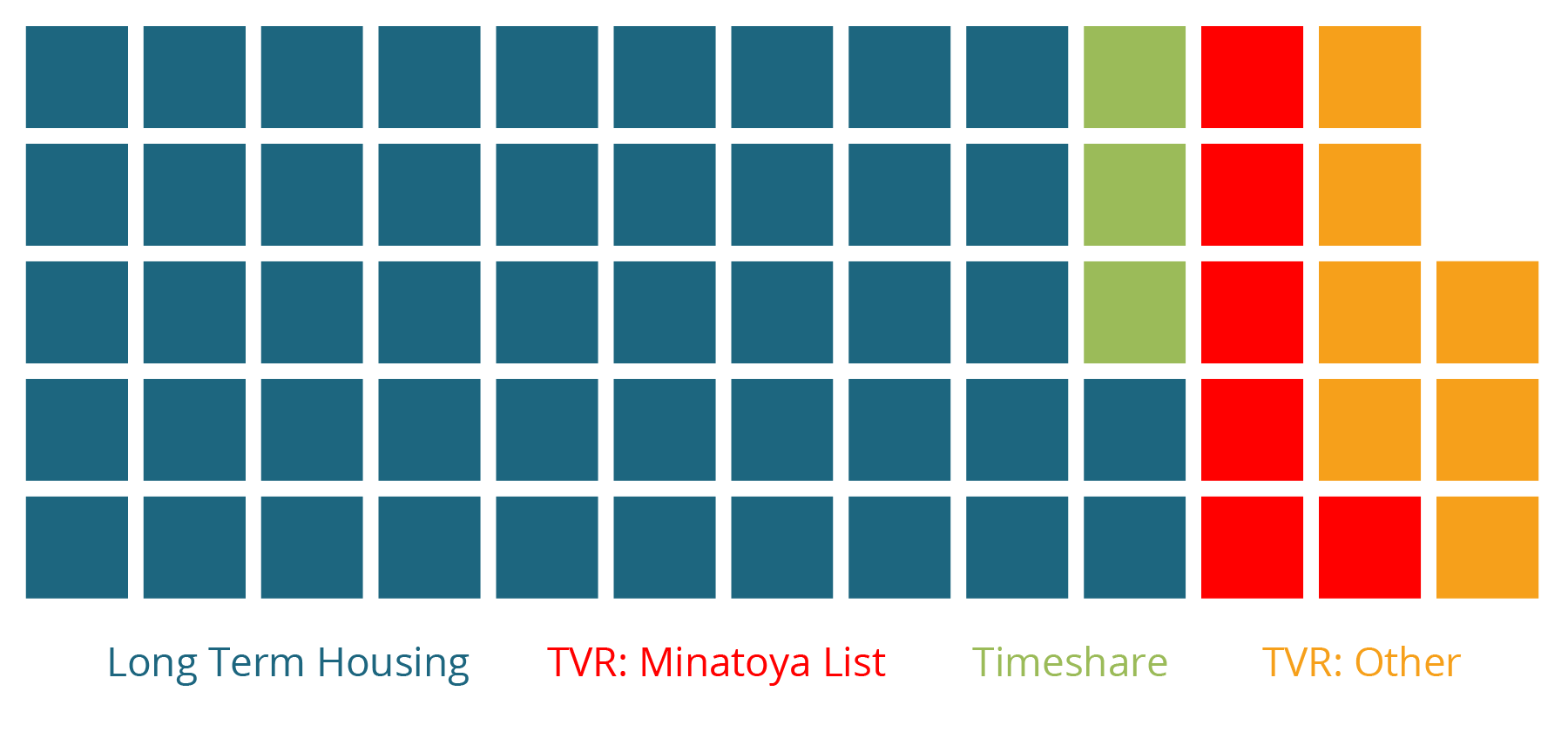

Maui County has a total stock of 63,000 housing units according to property tax records. Currently, 47,400 units are used for local housing, while 13,000 are used as TVRs, and an additional 2,500 operate as time-share units. Moving 6,172 units from TVRs to the long-term supply would therefore expand the supply of long-term housing on Maui by 13%. Such a large supply shock could have dramatic effects on the housing market. The magnitude is particularly large when compared to Maui’s extremely low production of new housing. According to US Census Bureau data, growth in residential housing supply on Maui from 2018-2022 was essentially zero, as the small amount of new construction was offset by vacation rental conversions.

Maui County’s Current Stock of 63,000 Housing Units, 1 square = 1,000 properties

The 6,172 units that would be added to the long-term supply of housing are a mix of small and mid-size condominium units. Studio apartments comprise 7% of the units, 51% are one-bedroom units, 39% are two-bedroom units, and the remainder have three or more bedrooms. The median unit is 838 square feet, with 72% of units under 1,000 square feet. Almost all of the units (99%) provide a single parking stall. The median date of construction is 1977.

The small units may be unsuitable for housing large families displaced by the fires in Lāhainā, many of whom would require more space. However, according to US Census Bureau data, half of the households in Lāhainā had a household size of two or fewer people and two-thirds had three or fewer people. These families could likely be accommodated by the Minatoya List properties. Generally increasing the supply of long-term housing may also have spillover effects across the housing market. The expansion of condominium units would present an opportunity to downsize for residents of single-family homes, potentially freeing up larger housing in other areas. As discussed in the recent UHERO Housing Factbook, adding new housing units tends to free up other housing units by inducing locals to move in a process known as “filtering”. The new units would generally help to alleviate housing pressure in an extremely tight market.

Characteristics of Impacted Properties

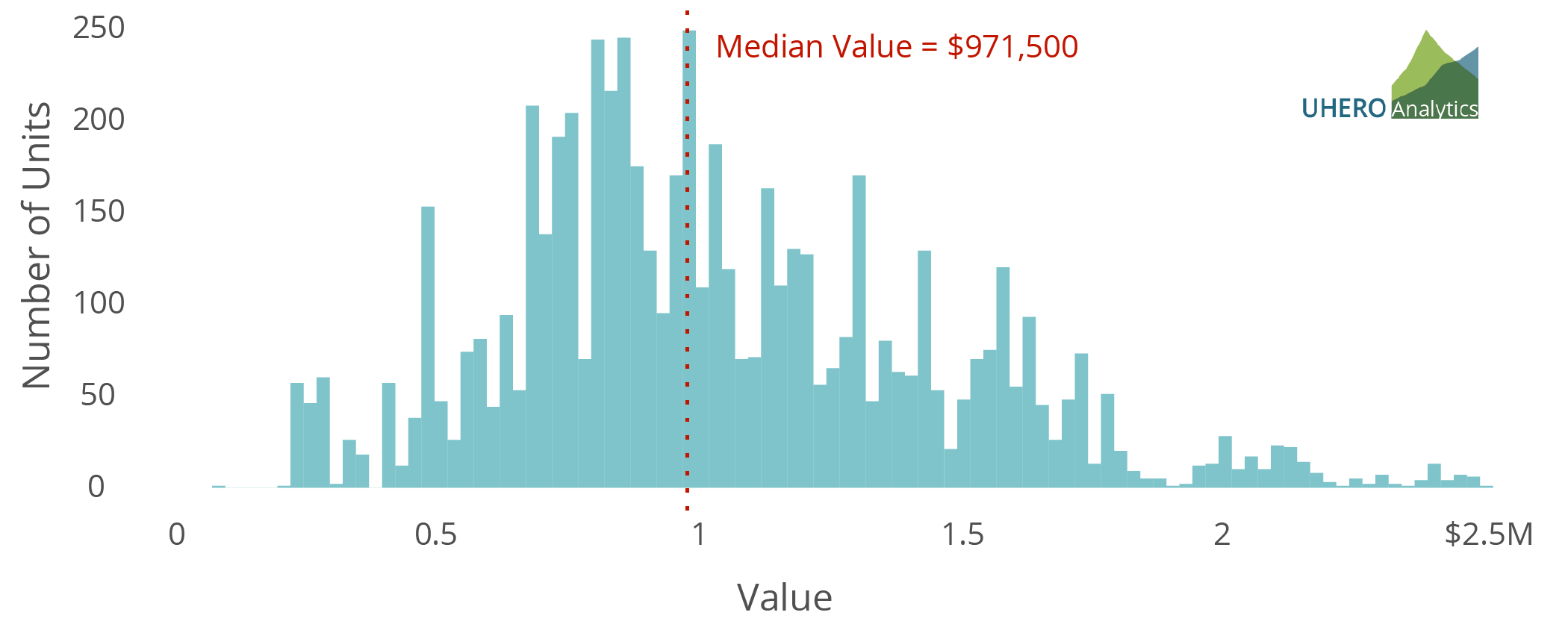

While the units are generally small, there is a significant range in appraised value. The median Minatoya List property is valued at $971,500, which is about 15% higher than the appraised value of the median condominium unit on Maui ($845,000). 26% of the properties are valued under $750,000 and 517 properties (8%) are valued under $500,000.

It is not clear what the market price of these units would be under a policy that bans TVR as a use. Currently, almost all of the demand for owning a Minatoya List property comes from operators of vacation rentals. Removing the ability to operate TVRs would dramatically reduce the demand for these units, potentially triggering significant price reductions, improving their affordability for residents. Furthermore, a large number of economic studies have found that a general expansion of housing supply lowers prices and rents throughout the market, meaning a flood of converted vacation rental properties onto the market would help push down housing costs across Maui.

There is clear evidence that condo prices on Maui are responsive to market supply. We looked at monthly condo price and inventory data going back to 2009 from the Maui Board of Realtors. In months when the inventory of available condo units was below 1,000, annual price appreciation averaged 10%. In months where inventory exceeded 1,000 units, average appreciation was -9%. In April 2024, there were only 500 available condos on Maui. If even a small share of the Minatoya List units end up on the for-sale market, we would expect to see significant–possibly double digit–declines in condominium prices on Maui.

Under a TVR ban on Minatoya List properties, TVR operators would need to decide how to repurpose their units. Owners could (1) sell their property, (2) rent out their property to a local household, or (3) leave the property vacant or for personal use. Pushing a significant number of housing units into the for-sale market could significantly lower housing prices on Maui. Similarly, the choice to shift the unit into the long-term rental market would put downward pressure on rents. Both of these would contribute to improved housing affordability for local families. An unfortunate outcome for housing supply would be if existing or new owners simply retain their properties for occasional personal use despite not being able to operate a vacation rental. Among active vacation rentals on Maui, 78% are operated by someone who runs multiple vacation properties. While some owners of individual units may elect to keep their unit vacant, owners of multiple units would face very strong financial incentives to sell or rent out their units in the long-term market, meaning many properties would likely be converted for long-term housing.

For the cases where owners decide to sell their units, there will be familiar concerns about who purchases these units and whether they end up housing local families. Despite high vacancy rates on Maui (24% according to the Census Bureau), the majority of residential housing is occupied by local residents. Combating high residential vacancies by raising property taxes on vacant units would be a complementary policy to expanding the stock of long-term housing.

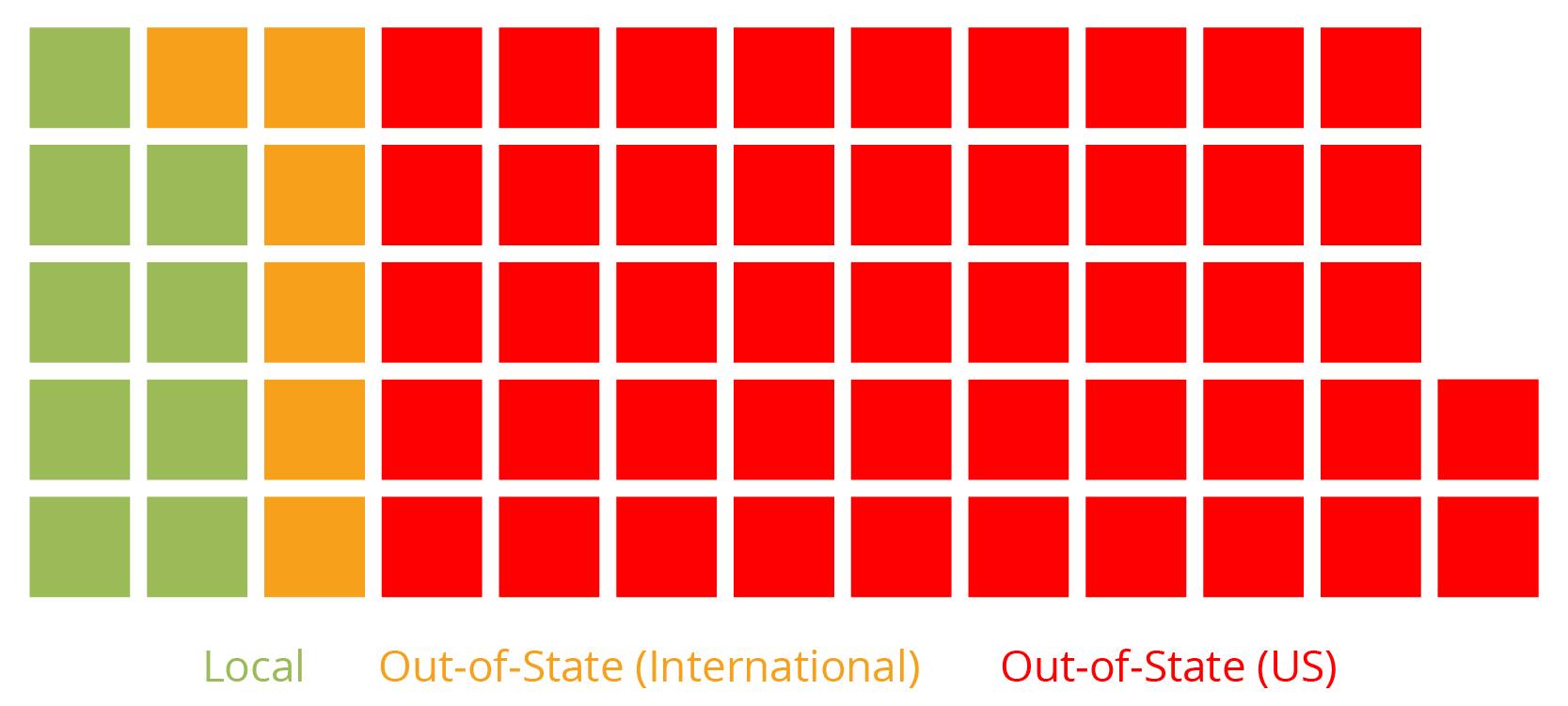

Direct financial losses from the policy would be borne by incumbent Minatoya List TVR owners, who would lose monthly income and potentially lose value in their investment. Using the mailing address on property tax assessment data, we identify the location of every Minatoya List property owner. Of the 6,172 units, 85% are owned by someone with an out-of-state mailing address. In the map and graphs below, we show the spatial distribution of Minatoya List TVR owners. 36% of owners list a mailing address in California, 12% live in Washington State, and 8% reside in Canada. The large majority of the policy’s direct costs would be borne by out-of-state property investors. Among the 15% of affected TVRs that are owned by a within-state resident, only half of those units are held by a Maui County resident.

Locations of Out-of-state TVR Owners

6,172 Minatoya List Properties, by Owner Location 1 square = 100 properties

Shifting 6,172 housing units from the short-term to the long-term market would have benefits for local housing affordability on Maui. However, the shift could trigger a substantial loss of property tax revenue for the county and could negatively impact the recovery of tourism on Maui by lowering accommodation capacity. These drawbacks could have significant consequences for Maui’s local population in terms of reduced county services, higher taxes, or a weakening labor market. While falling home prices are a benefit to those struggling to find housing, incumbent homeowners could lose equity if the price of homes fell county-wide, which could have broader economic impacts.

Rather than banning Minatoya TVRs, a more efficient policy might be to significantly increase the property tax rate for TVRs. A drastic increase in the rate could potentially increase, rather than decrease, county property tax receipts. Simultaneously, a significant enough increase in TVR property taxes would incentivize some owners to sell their units or convert them to long-term rentals. Using the existing property tax system rather than banning Minatoya units might also encounter fewer legal barriers to implementation. If an increase in the property tax rate failed to incentivize owners to shift properties into the long-term market, the county could simply raise the rate higher. A high enough property tax rate on TVRs could approximate the impacts of a ban, but a property rate approach would allow for the highest value TVRs to continue operating and generating tax revenue.

The impacts of phasing out the Minatoya List would be large for both the housing market and the economy of Maui. Maui faces an acute housing crisis, made worse by the Lāhainā fires. Reductions in tourism or property tax revenues would also present serious challenges to Maui County. This blog focused narrowly on the direct housing supply effects of the policy. Understanding the broad impacts of this policy will be key to understanding future economic conditions on Maui.

---30---

[1] Property data comes from the Maui County Document Center. Thank you to Matt Jachowski for data assistance. More analysis of Minatoya List properties is available here.