Hawaii income tax burden second highest in nation

One reason is higher rates apply early on the income spectrum, so nearly all taxpayers pay higher rates, says a new analysis

from Grassroot Institute, July 5, 2023

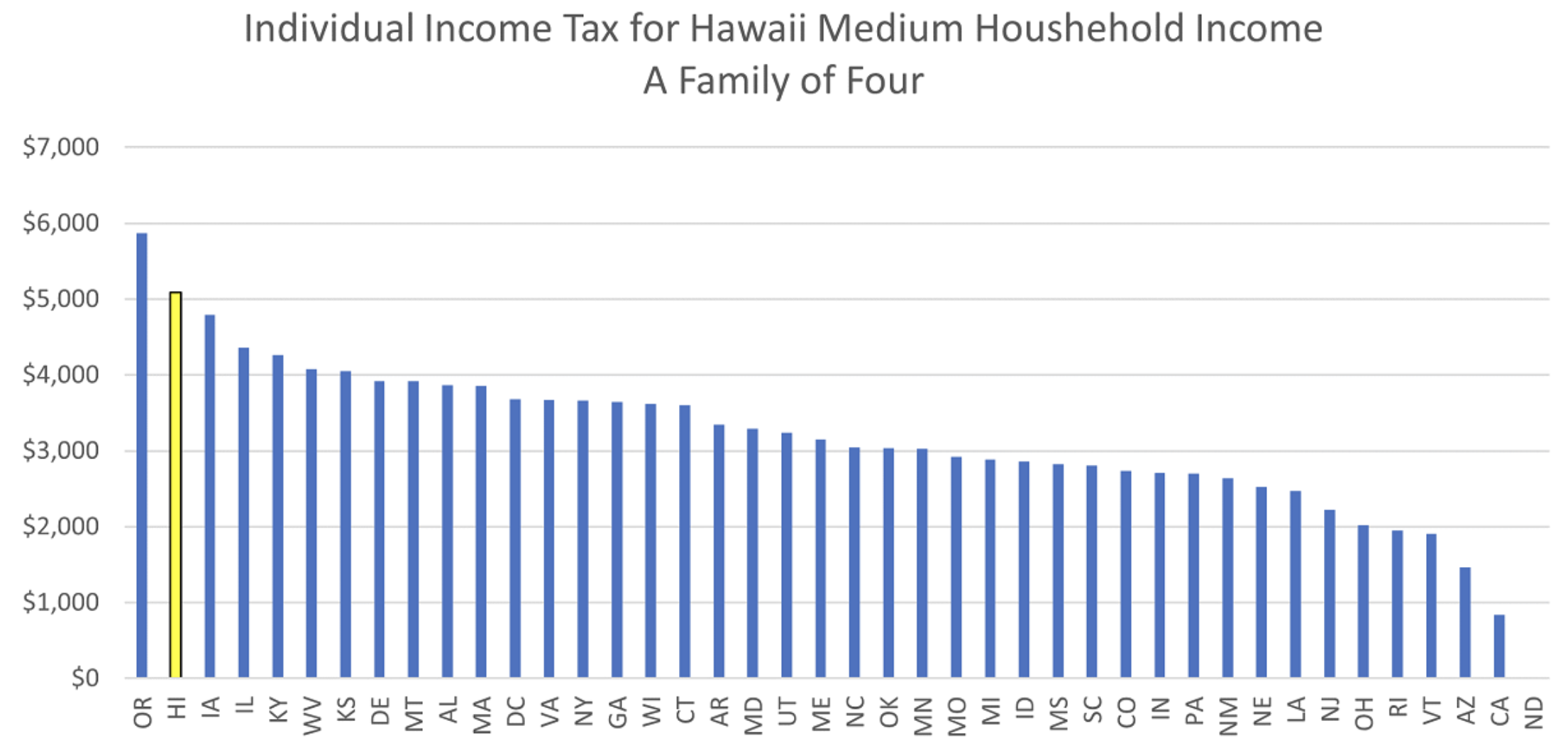

HONOLULU, July 5, 2023 >> Hawaii has the second-highest income tax burden of any state for all income levels, according to a new analysis from the state Department of Taxation.

Seth Colby, a tax research planning officer at the department and author of the analysis, found that a Hawaii family of four earning $88,005 a year — the median income in Hawaii — faces an income tax bill of about $5,086.

He said that of the 41 states that have an income tax, Oregon ranks first, Iowa third, Illinois fourth and Kentucky fifth. Ranking last is California, preceded by Arizona, Vermont, Rhode Island and Ohio.

Courtesy Hawaii Department of Taxation

Keli‘i Akina, Grassroot Institute of Hawaii president and CEO, said: “High income taxes are one of the major contributors to Hawaii’s high cost of living, in addition to what residents pay in excise, fuel, property and other taxes and fees. This new information underscores how poorly Hawaii’s tax system stacks up against those of other states, and helps explain why our economy is performing so poorly relative to the nation.”

As noted in today’s Honolulu Star-Advertiser, local economist Paul Brewbaker has estimatedthat “Hawaii’s economy has been shrinking 1% per annum, after inflation, for five years, since 2017, before the pandemic as well as after.”

Brewbaker said that while Hawaii and the nation are both growing real gross domestic producet at about 1.8% per annum, the earlier shrinkage in Hawaii’s real GDP has contributed to a 15-percentage-point gap between the nation’s current real GDP and Hawaii’s real GDP.

Colby, in his analysis, titled "Comparing Hawaii’s Income Tax Burden to Other States," noted that “Hawaii has a progressive income tax schedule, meaning that it starts low and increases with income, [but] the rates increase quickly and at low income levels.

“Nearly all taxpayers are subjected to a relatively high rate," he continued. "Prior to 2017, the highest marginal tax rate was 8.25% for all income over $48,000. Most other states do not apply such high rates until higher up the income spectrum.”

In addition, he said, “Hawaii offers one of the lowest standard deduction amounts … of any state. This means that taxes are levied on a greater portion of the taxpayer’s income.”

And, of the states that have personal exemptions, he said, Hawaii’s is at the lower end, “meaning more income is subject to taxation.”

Akina said the good news is that the Legislature and Gov. Josh Green did provide some tax relief to some Hawaii residents this year.

HB954, which the governor signed into law last Thursday, June 29, doubles the value of the earned income tax credit, increases the eligibility for and value of the food/excise tax credit and increases the value of the child and dependent care tax credit.

These higher tax credits will reduce the income tax burden on lower- and middle-income families by about $125 million per year.

Colby’s analysis found that as result, Hawaii's national rank for lower-income tax brackets would fall from second to fourth or third to 12th,depending on filing status.

The tax-relief bill comprised about one-third of the governor’s “Green Affordability Plan,” which, if approved in its entirety, would have saved taxpayers of all income brackets more than $300 million a year.

“I am glad our lawmakers saw fit to give some tax relief this year,” Akina said, “but I hope they will pass the remainder of the governor’s tax plan next year — as well as exempt medical services from the general excise tax. For the sake of future generations, Hawaii’s tax burden needs to be lightened.”

---30---

CS: Analysis: Hawaii has the second highest income-tax burden in the U.S.