by Andrew Walden

December 31, 2010 might have been “lights out” for wind energy, but when President Obama, on December 17, signed the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010, the bill did more than extend the Bush Tax cuts and unemployment benefits. Among other things, the measure extends through December 31, 2011, payment of Section 1603 grants for “alternative energy” developers.

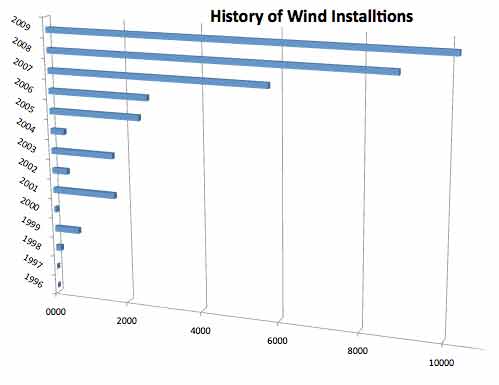

In a December 2 article, Taylor Johnson of Wind Power Engineering pointed out that section 1603 cash grant program had been set to expire at the end of 2010, leaving wind energy developers/owners little more than 3 weeks to begin “significant” work on their projects in order to receive the grant. The cash grant is a strong incentive for owners and developers of wind farms. It allows for up to a 30% cash incentive toward a project in lieu of slower-paying energy tax credits, which makes investing in renewable energy quite profitable. This generous incentive was responsible for much of the increased growth rate the wind industry experienced in 2009, and led to the highest year-to-year number of installations in U.S. history.

Annual installations of wind turbines in the United States by MW.

US wind energy installations peaked in 2009. In spite of the renewal, will installations continue to decline as they did in 2010?

The Manhattan Institute senior fellow Robert Bryce, writing in the Wall Street Journal explains: “…low natural gas prices have made wind energy uneconomic in the U.S., despite federal subsidies that amount to $6.44 for every 1 million British thermal units (BTUs) produced by wind turbines.”

---30---

AP: New tax law packed with obscure business tax cuts

RELATED:

|