To What Extent Does Your State Rely on Individual Income Taxes?

by Janelle Cammenga, Tax Foundation, May 13, 2020

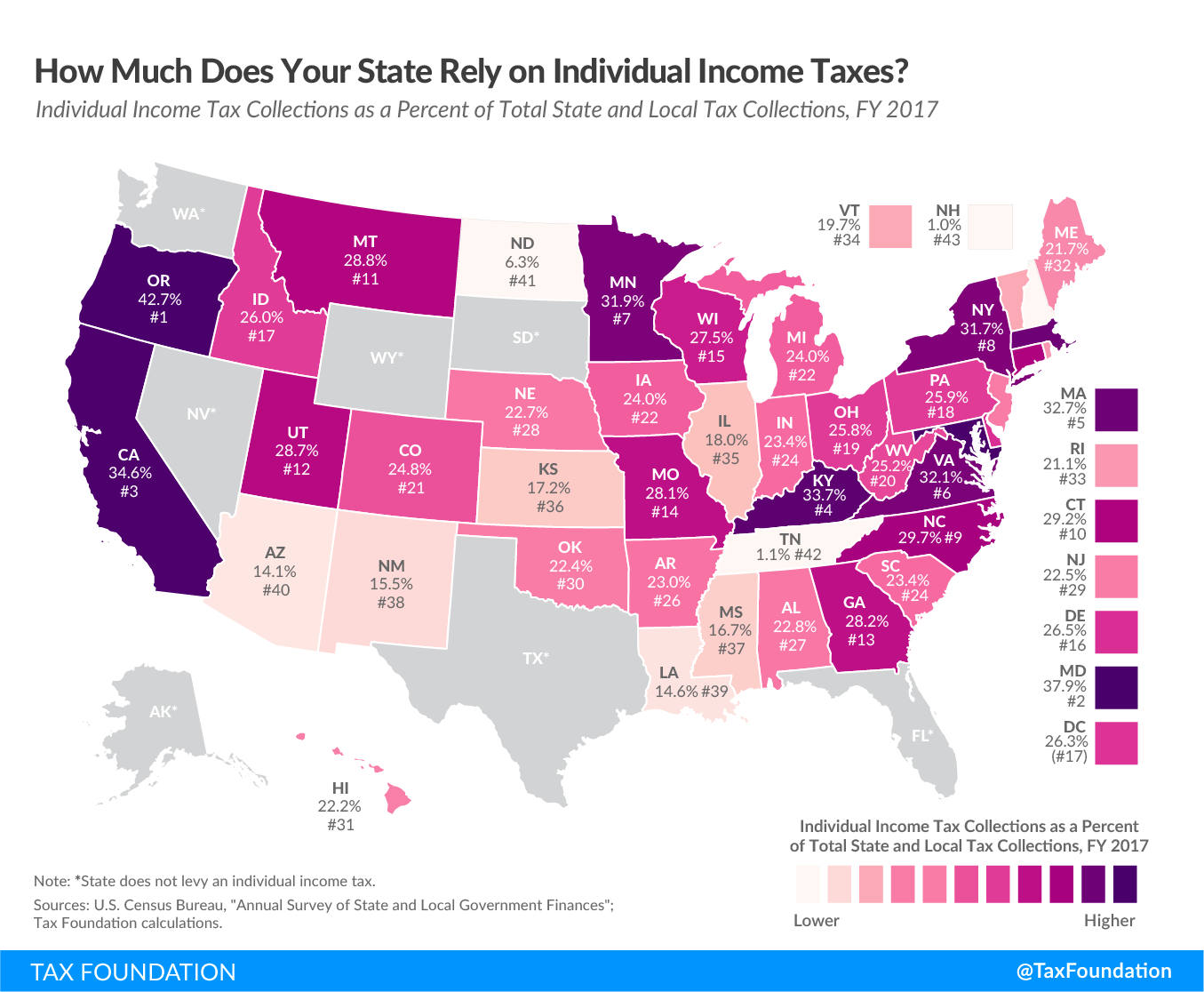

Sources of state revenue have come under closer scrutiny in light of the impact of the coronavirus outbreak, as different tax types have differing volatility and economic impact—although even beyond these unique circumstances, it is important for policymakers to understand the trade-offs associated with different sources of tax revenue. This week’s map looks at what percentage of each state’s state and local tax collections is attributable to the individual income tax.

State and localities rely heavily on the individual income tax, which comprised 23.3 percent of total U.S. state and local tax collections in fiscal year 2017, the latest year of data available. The individual income tax ranks just below the general sales tax (23.6 percent), both behind property taxes (31.9 percent) as the largest category of state and local revenue sources (See Facts & Figures Table 8).

Of all the states, Oregon and Maryland rely most heavily on individual income taxes, which account for 42.7 percent and 37.9 percent of their total state and local tax collections respectively. Both are among the 17 states where localities also levy income taxes. Oregon has chosen not to collect sales taxes, a decision which contributes to that state’s heavy reliance on the individual income tax.

While the individual income tax tends to be a major revenue source for state and local governments, some states rely on it very little, and some not at all. Seven states (Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming) do not collect individual income taxes, while two states (New Hampshire and Tennessee) collect taxes on dividend and interest income but not wage income. Tennessee’s tax on investment income—known as the “Hall tax”—is in the process of being phased out and will be fully repealed next year, which will leave the state with no individual income tax.

It comes as no surprise that New Hampshire and Tennessee raise the least amount of revenue from the individual income tax, 1.0 and 1.1 percent respectively. In North Dakota and Arizona, the next lowest states, the individual income tax generates 6.3 percent and 14.1 percent of their total tax collections respectively.

While the current outbreak differs from other economic crises in that social distancing restrictions and the nature of pandemics have caused consumption to drop dramatically, it is generally true that income taxes are more volatile than consumption taxes in an economic downturn, as income itself tends to fluctuate more than consumption. In addition, states’ mirroring of the federal government by delaying income tax deadlines means that income tax collections will temporarily be much lower than in years past.

Volatility is not the only factor to consider. As we’ve pointed out in the past, a state’s combination of tax sources has implications for its revenue stability and economic growth. Income taxes tend to be more harmful to economic growth than consumption taxes and property taxes. Income taxes fall on labor and savings, while consumption taxes, like the sales tax, fall on what people spend instead of what they earn. As a result, income taxes tend to be less neutral than sales taxes.