Does Your State Have a Throwback or Throwout Rule?

by Janelle Cammenga, Tax Foundation, September 4, 2019.

This week’s state tax map looks at throwback and throwout rules in states’ corporate tax codes. These rules may not be widely understood, but they have a notable impact on business location and investment decisions, and reduce economic efficiency for the states which impose such rules. Over the long run, these rules reduce competitiveness while yielding very little—or no—increase in state collections.

For purposes of corporate taxation, states must apportion the income of multistate businesses. All apportionment formulas use some combination of three factors: property, payroll, and sales. Many states use single sales factor, considering sales into the state to the exclusion of any other factor. Other states use all three factors, sometimes (but not always) weighted equally. The goal of apportionment is to prevent double taxation of corporate income, but there is wide variation among states in how apportionment formulas are designed.

States can only tax corporations that have economic nexus with the state, which means that the corporation must have sufficient connection to the state to justify taxation. However, federal law constrains states in defining economic nexus. More specifically, Public Law 86-272 prohibits states from taxing income that arises from the sale of tangible property into the state by a company that has no other activity in that state other than soliciting sales.

When companies sell into a state where they do not have nexus, that destination state lacks jurisdiction to tax the company’s income. This results in what is known as “nowhere income”—income that cannot legally be taxed by the state where the income-producing sale occurs.

Under throwback rules, sales of tangible property which are not taxable in the destination state are “thrown back” into the state where the sale originated, even though that’s not where the income was earned. This means that if a company located in State A sells into State B, where the company lacks economic nexus, State A can require the company to “throw back” this income into its sales factor.

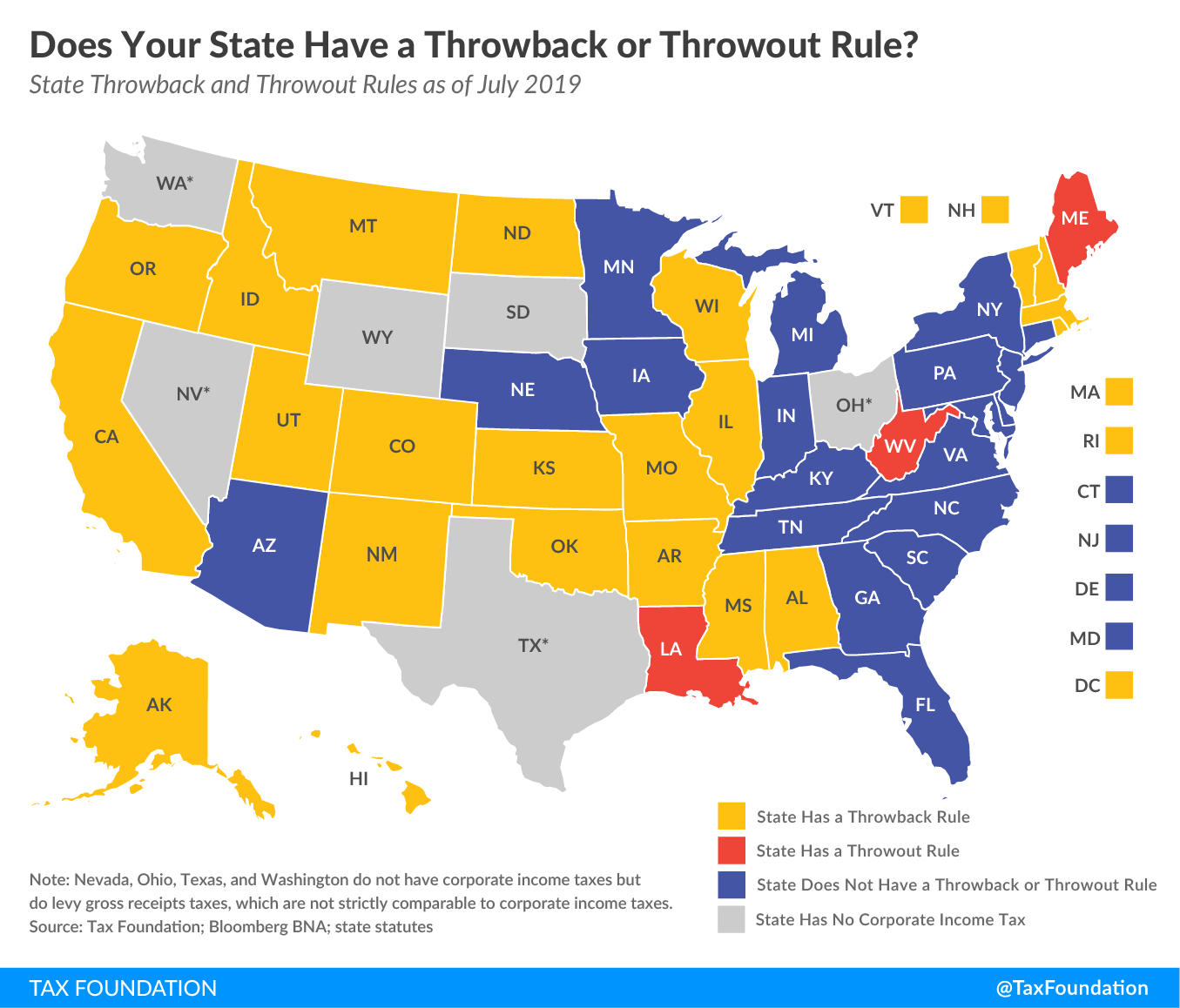

Twenty-two states (including Hawaii) and the District of Columbia impose throwback rules.

Although throwback rules are more common, three states adopt what are known as throwout rules. The difference between the two rules is in how the “nowhere income” is treated. In both cases, the state using the throwout or throwback rule is working with a fraction to calculate what portion of corporate income is taxable in that state. In the case of the sales factor (whether that’s the only factor or one of three), the fraction is the amount of sales associated with the state divided by the company’s total sales. Both throwback and throwout rules adjust this fraction to increase corporate tax liability. With a throwback rule, “nowhere income” is placed in the numerator (the amount apportioned to the state). With a throwout rule, the “nowhere income” is subtracted from the denominator (the amount of total sales). Both of these changes increase the value of the fraction, thus increasing a corporation’s in-state tax liability, though throwback rules do so more aggressively than throwout rules.

Throwback rules can yield exceedingly high and often uncompetitive levels of taxation for some businesses, to the point that the outmigration they generate can more than offset any revenue gains from taxing “nowhere income.”

These rules discourage investment and are inconsistent with the purpose of apportionment, which is to tax the share of a company’s income reasonably associated with that state—not to tax revenue clearly associated with other states just because those states are unable to tax that income. The rules are nonneutral, since any income thrown back is taxed at the originating state’s rate. This means companies without the ability to design their corporate structure around the tax code can face uncommonly high burdens, while other businesses can avoid such taxation by locating their sales activities in non-throwback states.

In short, these tax rules are economically inefficient and fail to raise the anticipated revenue. Whatever their aims, throwback and throwout rules are nonneutral, often inequitable, and ultimately counterproductive, and states which forgo them place themselves at an economic advantage.