Average Per Capita Property Taxes: How Does Your State Compare?

by Katherine Loughead, Tax Foundation, May 11, 2018

Property tax collection is a critical source of revenue for local governments, accounting for 72 percent of local tax collections nationwide in 2015 (most recent data available). Local property taxes are largely used to fund police departments, emergency services, road maintenance, and other services mainly associated with property ownership or residency.

While states used to rely heavily on property taxes as a source of revenue, this reliance has declined over time. In 2015, state-levied property taxes accounted for only 1.7 percent of state tax collections nationwide, down from 52.6 percent in 1902.

Even with decreasing dependence among states, the extent to which localities rely on property taxes resulted in property taxes comprising 31.1 percent of all U.S. state and local tax collections in fiscal year (FY) 2015. As such, property taxes are the largest source of combined state and local tax collections, trailed by general sales taxes (23.5 percent), individual income taxes (23.5 percent), corporate income taxes (3.7 percent), and other sources (18.2 percent).

Property tax rates are set by a variety of taxing authorities, including states, counties, cities, school boards, fire departments, and utility commissions. Some tax jurisdictions levy property taxes by imposing a rate or a millage (the amount of tax per thousand dollars of property value) on the fair market value (FMV) of the property. Other jurisdictions impose property taxes on the assessed value of the property, which is typically calculated as a percentage of FMV. In some states, assessment limits, different base years, or other property tax limitations can introduce variations in the ratio of assessed to fair market value.

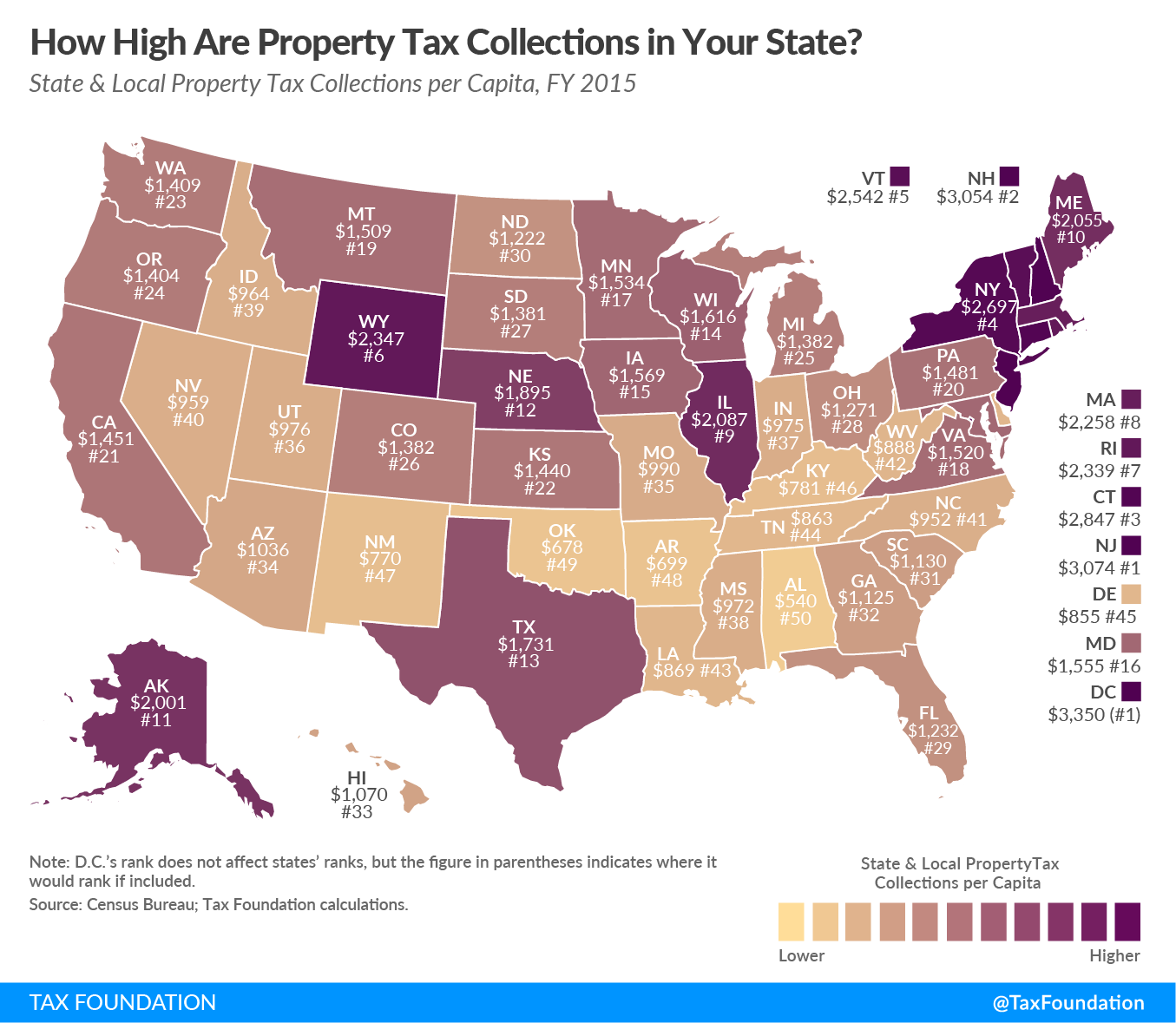

On average, state and local governments collect $1,518 per capita in property taxes, but collections vary widely by state, and several regional trends exist.

Property taxes are highest in the Northeast, and each of the New England states is among the 10 states with the highest per capita property taxes. Overall, the District of Columbia comes in first ($3,350), followed by New Jersey ($3,074), New Hampshire ($3,054), and Connecticut ($2,847). Property taxes tend to be highest in urban areas with heavy concentrations of high-income earners.

Among the 10 states with the lowest per capita property taxes, a majority are in the South, where sales taxes are a more prominent source of state revenue. Texas is a notable outlier, relying heavily on property taxes while not levying state individual or corporate income taxes. The nation’s lowest per capita property tax collections are in Arkansas ($699), Oklahoma ($678), and Alabama ($540).

While property taxes inevitably draw the ire of some residents living in high-tax jurisdictions, they are largely rooted in the “benefit principle,” meaning property taxes can be viewed as a payment for public services received. At the same time, good local public services can make municipalities more desirable, thereby increasing residential property value.