Legacy Costs (excerpt)

From the Volcker Alliance, November, 2017

We found that at various points over the three years studied, about twenty states contributed less to pension systems than the amount the plans’ actuaries recommended. Among those not making the full contribution for all three years were Hawaii, Illinois, Massachusetts, and New Jersey (although New Jersey municipalities, unlike the state itself, are obliged to contribute the full amount). The impact on state budgets of pension underfunding is evident. Before passing a budget in July 2017, Illinois went without one for more than two years as the legislature and governor fought over taxes and a menu of spending priorities limited by $119 billion in pension debt (as of June 30, 2016) and past-due vendor bills. A casualty of the long stalemate was the state’s credit rating, which Moody’s Investors Service downgraded to Baa3—one level above junk in June 2017.

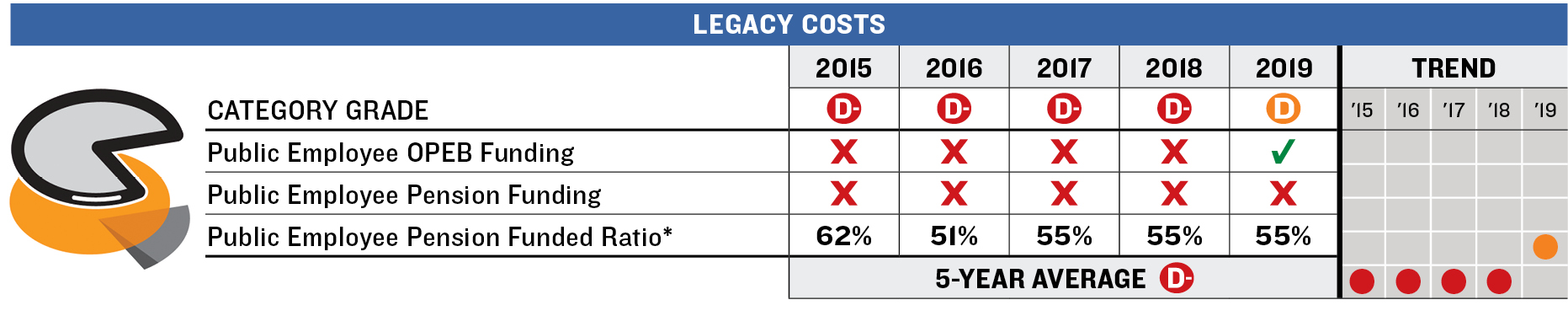

Three states earning an A in the Reserve Funds category received D-minus grades from the Volcker Alliance for their handling of legacy costs. Hawaii, Texas, and Virginia all failed to make their full actuarially determined pension and OPEB contributions in all three years of the study. Under legislation passed in 2012, however, Virginia is scheduled to start making full contributions to pensions by fiscal 2019. Hawaii, meanwhile, is scheduled to begin making its full annual required contribution for OPEB in the same year under a law passed in 2013.

read ... Legacy Costs

* * * * *

Hawaii -- State Budget Practice Report Cards and Budget Resource Guide

From the Volcker Alliance, November, 2017

As befits a federal system composed of sovereign members, each US state has a unique approach to the way it raises funds and allocates expenditures for daily operations and capital investments. That is why it is of paramount importance to assess the quality of states’ budgetary building blocks and define what makes up a balanced budget.

To emphasize the importance of clear and comprehensible budgets to inform citizens, promote responsible policymaking, and improve fiscal stability, the Volcker Alliance launched a study in 2016 of the budgetary and financial reporting practices of all fifty states, our largest project since our founding in 2013. The mission of the Volcker Alliance is to improve the effectiveness of the administration of government at all levels, and making processes such as state budgeting more transparent is important to that goal.

The report cards presented here are taken from the 2017 Volcker Alliance report, Truth and Integrity in State Budgeting: What Is the Reality? which also proposes a set of best budgeting practices for policymakers to follow. For public officials, policy advocates, journalists, academics, and concerned citizens who wish to gain greater of state fiscal issues, the accompanying annotated budget resource guide is derived from the Alliance publication State Budget Sources: An Annotated Guide to State Budgets, Financial Reports, and Fiscal Analyses (2016).

State Budget Report Cards

The report cards found here contain grades of the state's budgetary practices during the fiscal years of 2015 through 2017. Each state received marks in five critical categories, based on their adherence to best practices in several key budgeting indicators. The five categories covered methods used to achieve budgetary balance as well as how budgets and other financial information are disclosed to the public.

States received grades of A to D-minus (there are no “failed states”) for their procedures in estimating revenues and expenditures; their use of one-time actions to balance budgets; how they oversee and use rainy day funds and other fiscal reserves; the adequacy of their funding of public worker retirement and other postemployment benefits; and the quality of transparency of budget and related financial information. The grades are based on research conducted by public finance and budgeting professors and students at eleven US schools of public administration or policy. The universities’ research efforts were augmented by Volcker Alliance staff, data consultants at Municipal Market Analytics, and special project consultants Katherine Barrett and Richard Greene.

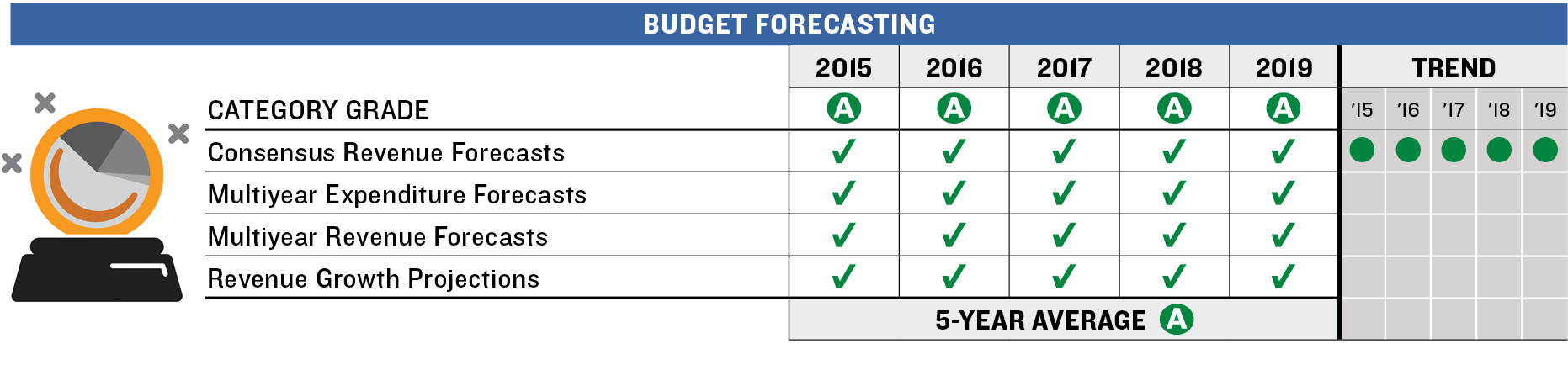

HideBudget Forecasting

Budget Forecasting evaluates whether and how states estimated long-term revenue and expenditure trends.

This table contains the Volcker Alliance’s assessments of the scope and quality of the state's budgetary forecasting during the fiscal years of 2015 through 2017. States are graded on a scale of A to D-minus, the lowest possible, on whether they used consensus revenue estimates for the coming year or biennium in budget documents; provided a reasonable, detailed rationale to support revenue growth projections at time of initial budget; successfully avoided having to make a material midyear negative budget adjustment; utilized multiyear revenue forecasts for at least three full fiscal years in budget and planning documents; and utilized multiyear expenditure forecasts for at least three full fiscal years in budget and planning documents.

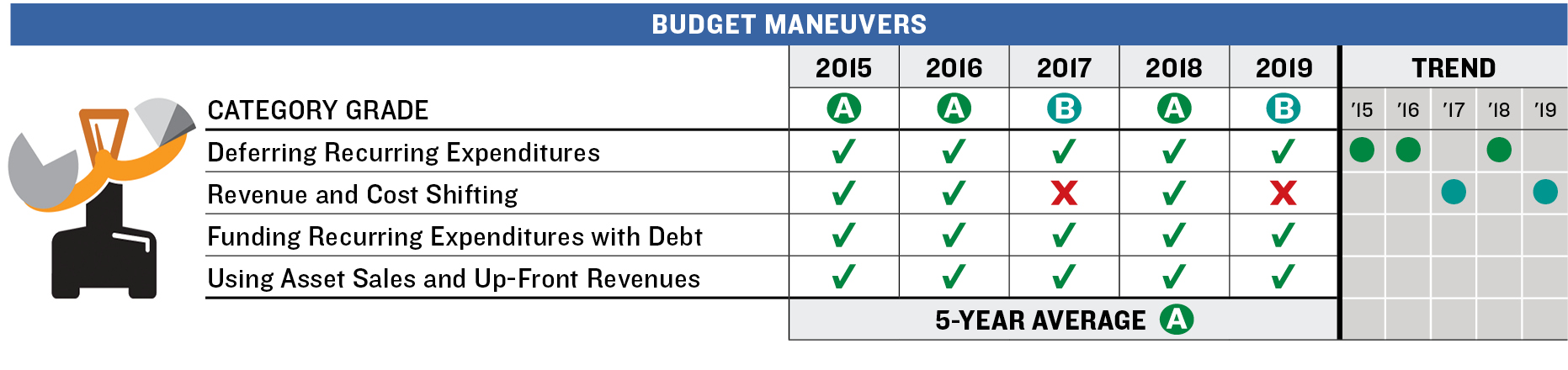

HideBudget Maneuvers

Budget Maneuvers evaluates whether states used one-time revenues, borrowings, asset sales, and other measures to achieve short-term budgetary balance.

This table contains the Volcker Alliance’s assessments of the state's use of one-time actions to cover recurring costs and balance budgets during the fiscal years of 2015 through 2017. States are graded on a scale of A to D-minus, the lowest possible, on whether they successfully avoided these one-time techniques: using proceeds of borrowing to pay for recurring expenditures; using “scoop and toss” refinancing to raise funds for any current expenditures, including debt service; diverting bond premiums (or other up-front cash flows generated during sales of bonds or other financial transactions) into the general fund or other general revenue account; using pension bond proceeds to make the annual required or actuarially determined contribution to any pension; using up-front proceeds or deferral of up-front costs on financial transactions to fund recurring expenditures; using proceeds from material, nonrecurring asset sales (excluding routine disposals of surplus or outdated property) to fund recurring expenditures; deferring recurring expenditures, excluding those for capital projects, into future fiscal years from the current year; using one-time transfers into the general fund from special funds to pay for recurring expenditures; and temporarily shifting costs to counties, municipalities, school districts, or other governments or agencies, or upstreaming cash from any such entity to the state, that is not part of a regular agreement or process.

HideLegacy Costs

Legacy Costs evaluates whether states provided adequate funding, as defined by retirement system actuaries, for pensions and other promised retirement benefits for public workers.

This table contains the Volcker Alliance’s assessments of the state's ability to meet promises made to public employees for pensions and other retirement costs, when applicable, during the fiscal years of 2015 through 2017. States are graded on a scale of A to D-minus, the lowest possible, on whether their contributions to public employee pension funds were effectively 100 percent of the actuarially required or determined amounts, adjusted for any unfunded liabilities; and whether their contributions to any public employee OPEB plans were effectively 100 percent of the ADC or ARC.

*Pension Funded Ratio Source: Pew Charitable Trusts, 2015

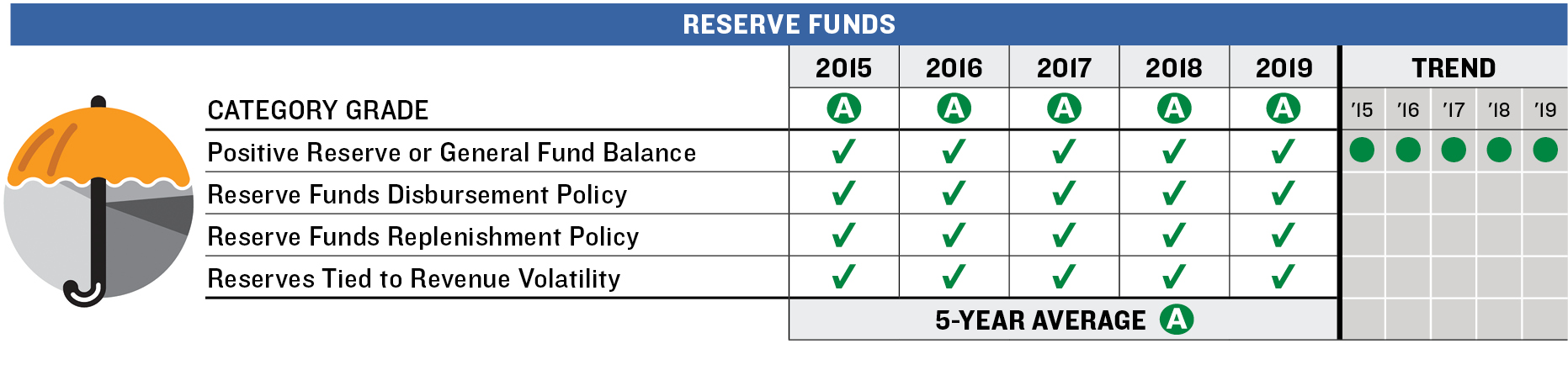

HideReserve Funds

Reserve Funds evaluates states’ rainy day funds and other fiscal reserves as well as any policies governing their use and replenishment.

This table contains the Volcker Alliance’s assessments of the state's balances and policies for financial reserve funds during the fiscal years of 2015 through 2017. States are graded on a scale of A to D-minus, the lowest possible, on the following: whether they had policies (set by constitution, referendum, statute, or other formal rule) for the use and replenishment of rainy day funds; whether the rainy day fund balance (or contribution) was specifically tied to the historical trend of revenue volatility; and whether the rainy day fund or general fund balances were greater than zero on the first day of the fiscal year.

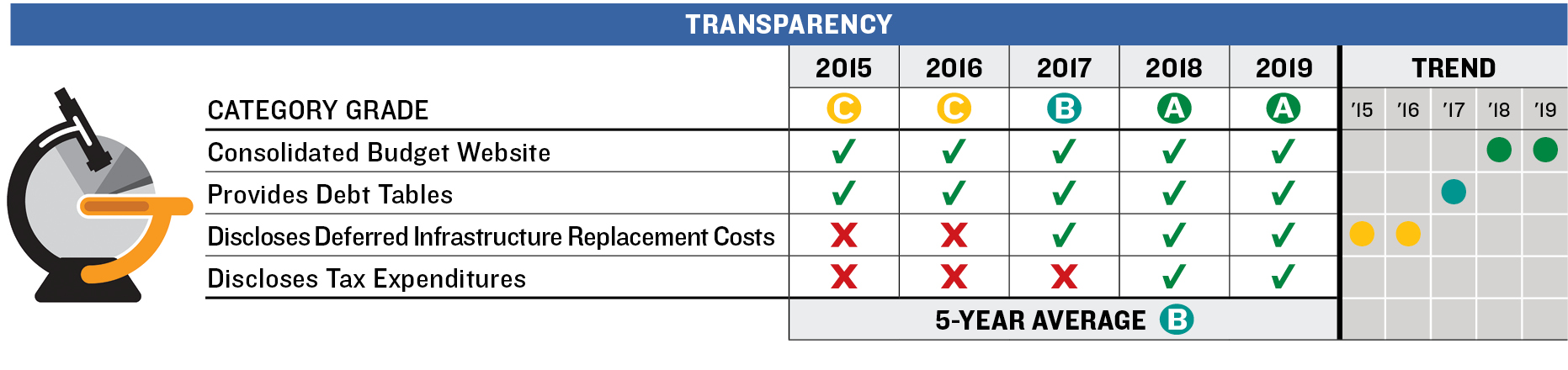

HideTransparency

Transparency evaluates the accessibility to the public of state's budget practices.

This table contains the Volcker Alliance’s assessments of the state's actions to promote greater transparency of their budget and related information during the fiscal years of 2015 through 2017. States are graded on a scale of A to D-minus, the lowest possible, on whether they had a consolidated website or set of related sites providing budget and supplemental data; provided tables listing outstanding debt, debt-service costs, and information on any legal debt limits; disclosed the estimated cost of the deferred infrastructure maintenance liability for all capital assets as part of budget and planning documents; and provided an annual or biennial tax expenditure report in budget documents or through other agencies.

State Budget Sources

State Budget Sources: An Annotated Guide to State Budgets, Financial Reports, and Fiscal Analyses is a resource published by the Volcker Alliance designed to help public officials, policy advocates, journalists, academics, and concerned citizens fully understand the critical fiscal decisions that governors and legislators must make. The guide includes the links below to budgets for this state as well as legislative analyses of budget bills and treasurers’ or comptrollers’ monthly state cash-flow statements; capital spending plans; reports on public-worker pension funding and returns; and reports by local and national fiscal research organizations, bond rating firms, and associations of state fiscal and finance officials.

Read … Full Hawaii Report

VA: Truth and Integrity in State Budgeting

G: States' Financial Practices Get Graded