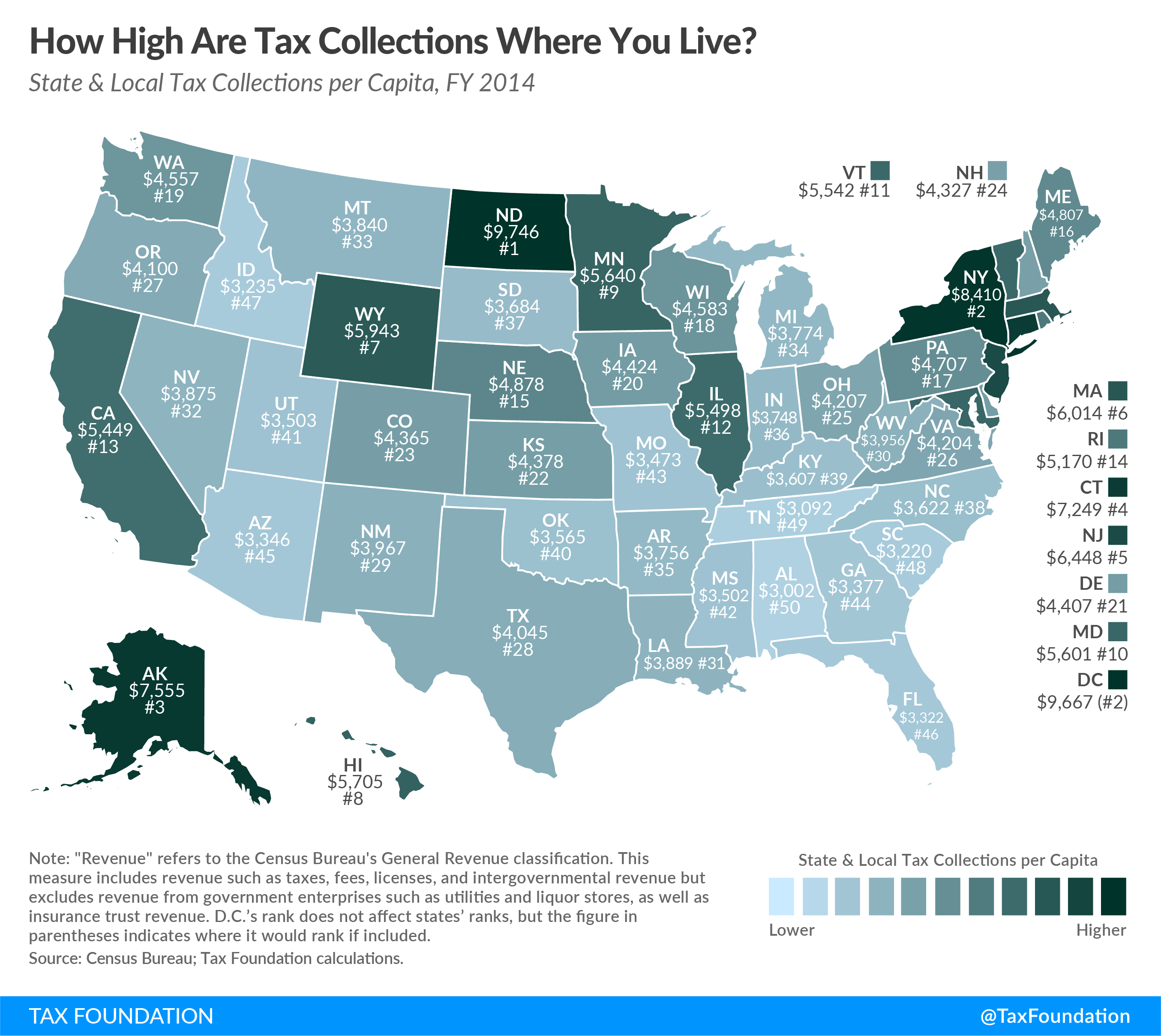

How High Are State and Local Tax Collections in Your State?

by Morgan Scarboro, Tax Foundation, October 12, 2017

Total state and local tax collections per capita vary drastically across the country, but the highest collections might surprise you. The three states with the highest state and local collections per capita are North Dakota ($9,746), New York ($8,410), and Alaska ($7,555). The three states with the lowest state and local collections per capita are South Carolina ($3,220), Tennessee ($3,092), and Alabama ($3,002). Most people wouldn’t expect to find North Dakota and Alaska on this list – but their presence points to a bigger story about tax incidence and ways to measure taxes.

There are many ways to measure taxes – marginal rates, effective rates, collections, tax burdens – and each measure tells a different side of the story. North Dakota and Alaska’s collections per capita are high, because both states collect a significant amount in severance tax revenue. Though the revenue is technically collected in their state, the tax is actually exported and paid by residents of other states who consume oil and gas.

This leads to a conversation about the difference between economic and legal incidence. Legally, the companies in the resource-extraction industries are writing the check for their severance taxes. However, the cost of the tax is largely passed on to consumers across the country in the form of higher prices, and those consumers feel the economic cost of paying the tax. The legal incidence of the tax falls on the company, but the economic incidence falls on the consumer.

Tax exporting can be a significant feature of certain states’ tax codes, meaning that collections can be high, but that doesn’t always mean that taxpayers in a state are paying more than neighboring states. Though it may be nuanced, these details are important to keep in mind when reviewing the many measures of taxation.

|