Hawaii Ranks #45 in Nationwide Survey of State Fiscal Condition

Grassroot Institute stresses need for policies that reduce debt, tax burden

News Release from Grassroot Institute

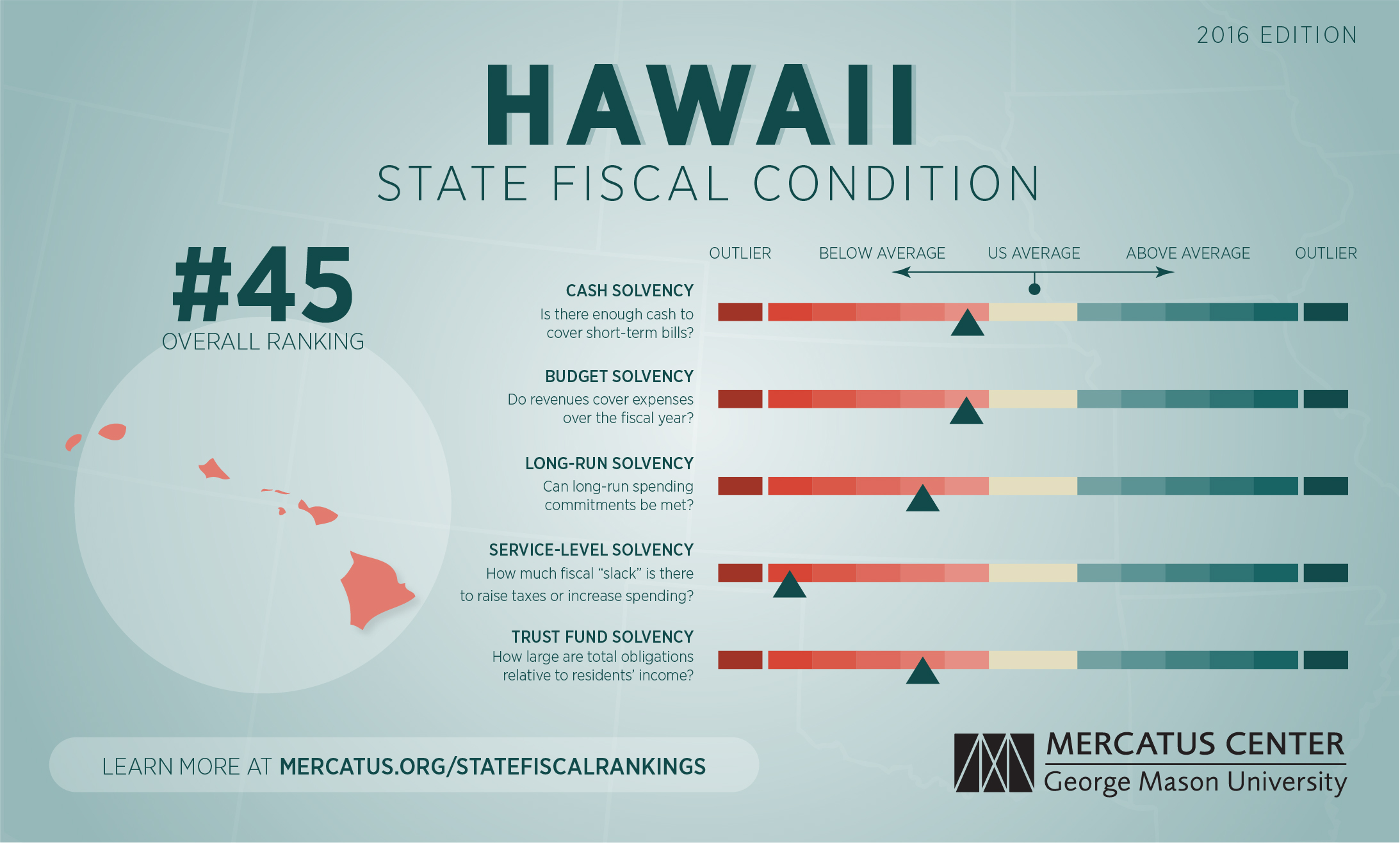

HONOLULU, HAWAII--June 1, 2016--According to a new study from the Mercatus Center, Hawaii ranks 45th nationwide in state fiscal condition, with only five states (and Puerto Rico) presenting a bleaker economic picture.The 2016 Ranking the States by Fiscal Condition presents a snapshot of every state's financial health, based on that state's own financial reporting. The goal of the report is to give citizens the ability to look at complicated financial reports in a larger context, giving them a clear picture of where their state stands financially.

Hawaii's best ranking (23rd) was in cash solvency, as the state is able to cover short-term obligations. In metrics that consider long-term debt and the state's unfunded liabilities, the state's rankings fell dramatically. Hawaii ranked 43rd in budget solvency, long-term solvency, service-level solvency (which considers taxes, revenues, and spending compared to state personal income), and trust fund solvency (which measures state debt).

"[Hawaii's] net assets are 1 percent of total assets, and total liabilities account for 64 percent of total assets, resulting in a long-term liability per capita of $8,180," states the report. "Total debt is $7.78 billion. Unfunded pension liabilities are $28.74 billion on a guaranteed-to-be-paid basis, and other postemployment benefits (OPEB) add $11.18 billion in unfunded liabilities. These three liabilities are equal to 73 percent of total state personal income."

"Once again, Hawaii has performed badly on a national survey of fiscal health, and for the same reason--our state debt," stated Keli'i Akina, Ph.D., President of the Grassroot Institute of Hawaii. "Every economic study that is done of our state in comparison to the rest of the nation focuses on the long-term damage caused by Hawaii's unfunded liabilities."

Dr. Akina continued: "What more do we need to show us that a new way of thinking about our state finances is sorely needed? Between our high tax burden and considerable state liabilities, we are handicapping our economy for at least a generation. It may not be pleasant, but we must consider stronger policies that reduce state liabilities and spur economic growth."

* * * * *

Hawaii Summary

by Eileen Norcross, Olivia Gonzalez, Mercatus Center, June 1, 2016

On the basis of its fiscal solvency in five separate categories, Hawaii ranks 45th among the US states and Puerto Rico for its fiscal health.

Hawaii has between 1.93 and 2.73 times the cash needed to cover short-term liabilities.

Revenues cover 99 percent of expenses, producing a deficit of $83 per capita.

Net assets are 1 percent of total assets, and total liabilities account for 64 percent of total assets, resulting in a long-term liability per capita of $8,180.

Total debt is $7.78 billion. Unfunded pension liabilities are $28.74 billion on a guaranteed-to-be-paid basis, and other postemployment benefits (OPEB) add $11.18 billion in unfunded liabilities. These three liabilities are equal to 73 percent of total state personal income.

Key Terms

- Cash solvency measures whether a state has enough cash to cover its short-term bills, which include accounts payable, vouchers, warrants, and short-term debt. (Hawaii ranks 23rd.)

- Budget solvency measures whether a state can cover its fiscal year spending using current revenues. Did it run a shortfall during the year? (Hawaii ranks 43rd.)

- Long-run solvency measures whether a state has a hedge against large long-term liabilities. Are enough assets available to cushion the state from potential shocks or long-term fiscal risks? (Hawaii ranks 42nd.)

- Service-level solvency measures how high taxes, revenues, and spending are when compared to state personal income. Do states have enough “fiscal slack”? If spending commitments demand more revenues, are states in a good position to increase taxes without harming the economy? Is spending high or low relative to the tax base? (Hawaii ranks 43rd.)

- Trust fund solvency measures how much debt a state has. How large are unfunded pension liabilities, OPEB liabilities, and state debt compared to the state personal income? (Hawaii ranks 43rd.)

For a complete explanation of the methodology used to calculate Hawaii’s fiscal health rankings, see Eileen Norcross and Olivia Gonzalez, “Ranking the States by Fiscal Condition,” 2016 ed. (Mercatus Research, Mercatus Center at George Mason University, Arlington, VA, June 2016).

LINK: DOWNLOAD THE PDF

LINK: Ranking the States by Fiscal Condition