Moody's: US state debt medians remain steady

News Release from Moody’s Global Credit Research

New York, May 06, 2016 -- Total net tax-supported debt (NTSD) for US states was essentially unchanged following its first decline in nearly three decades last year , Moody's Investors Service says in its annual state debt medians report.

State net tax-supported debt marginally increased 0.6% to $512.5 billion. However, the amount remains below the 2013 peak of $516 billion.

"The recent slowdown in debt levels highlights states' reluctance to take on new long term obligations despite continued increases in tax revenue, including an estimated 6% rise in 2015," Genevieve Nolan, a Moody's Vice President--Senior Analyst says.

Thirty-five states experienced a decrease in absolute debt levels, Moody's says in "States -- US: Medians - Total Debt Remains Static in 2016." Only Kansas (Aa2 negative) and South Dakota (Aa1 stable) had double-digit increases in NTSD last year.

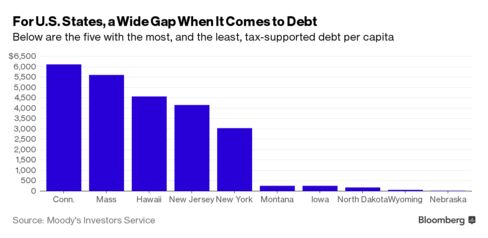

On a debt-per-capita basis, Connecticut (Aa3 negative) continues to top all states at $6,155. The order of the next highest four states is unchanged from last year, including Massachusetts (Aa1 stable), Hawaii (Aa2 positive), New Jersey (A2 negative), and New York (Aa1 stable).

The five states with the lowest NTSD per capita are also unchanged from last year, with Nebraska (Aa2 stable) the lowest, followed by Wyoming, North Dakota (Aa1 negative), Iowa (Aaa stable), and Montana (Aa1 stable).

"The 50-state median for net tax-supported debt per capita remained relatively stable at $1,025, following three years of decline. Thirty--six states experienced a decline in net tax-supported debt per capita," Nolan says.

General obligation debt continued to comprise the largest share of state debt at 52% of the total portfolio, although eight states either do not issue this debt or have none outstanding. Appropriation and lease revenue debt follows with a 21% share.

Moody's anticipates muted growth in state debt next year due to the continued declines in the energy sector and a number of states reaching debt issuance limitations.

Net tax-supported debt is defined as debt secured by state taxes or other operating resources which could otherwise be used for state operations, net of obligations that are self-supporting from pledged sources other than state taxes or operating resources.

Moody's 2016 state debt medians are based on the rating agency's analysis of calendar year 2015 debt issuance and fiscal year 2015 debt service.

The report is available to Moody's subscribers at https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBM_1024491.