Getting Your Neighbor's Mortgage Off Your Lawn

by Amy Payne, Heritage Foundation, April 10, 2014

Did you know you are probably responsible for your neighbors’ mortgage payments?

What?

Heritage expert Norbert Michel explained:

Nearly all new residential mortgages are currently being guaranteed by Fannie [Mae] or Freddie [Mac] because these companies buy mortgages from banks and then sell investments backed by the mortgages. And because the Federal government guarantees these investments, taxpayers foot the bill when people default on their mortgages.

And what good have Fannie Mae and Freddie Mac—and all their taxpayer backing—done?

“The U.S. does more to promote homeownership than most countries, but we’ve barely increased ownership, and total costs of owning a home have spiked,” Michel said.

FACT: Fannie and Freddie have received billions in subsidies, but the homeownership rate is only 1 percentage point higher than it was in 1968. >>> Get more facts >>>

Meanwhile, we’ve written about how the Treasury is keeping Fannie and Freddie off the books—and hiding billions in taxpayer guarantees in the process.

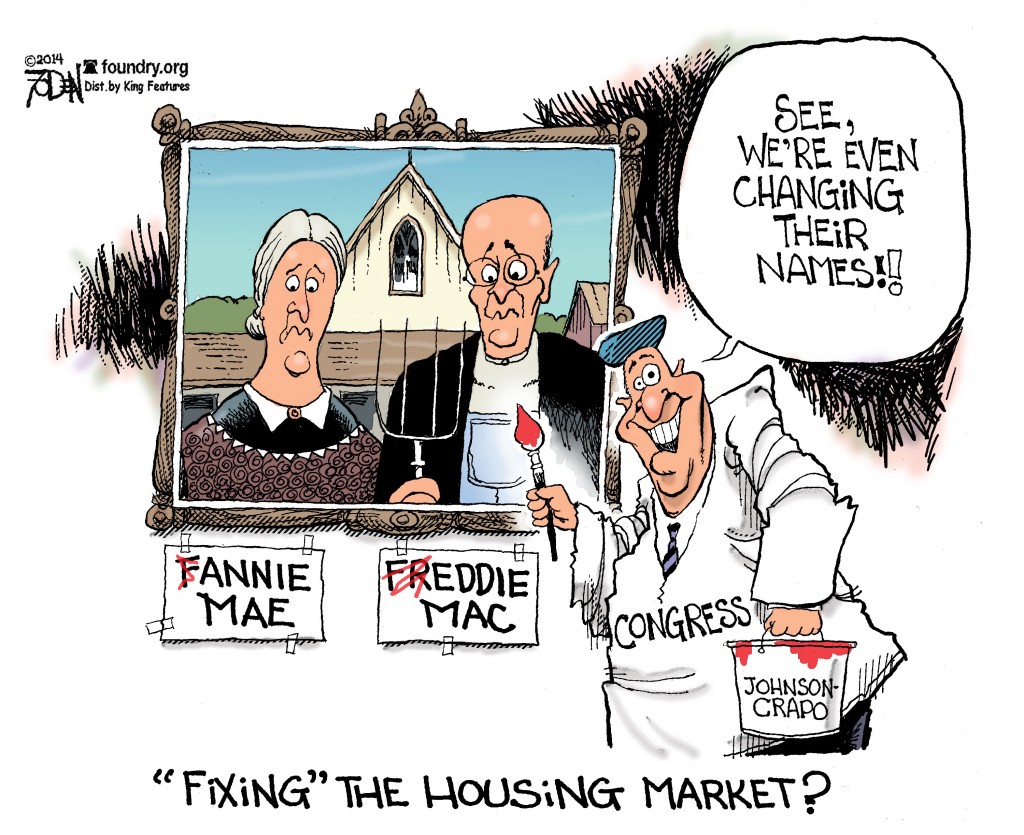

Heritage experts have warned that a bill sponsored by Sens. Tim Johnson (D-S.D.) and Mike Crapo (R-Idaho) would ultimately leave many of these problems intact.

The Johnson-Crapo bill adds to another attempt by Sens. Bob Corker (R–Tenn.) and Mark Warner (D–Va.) to create a new federal regulator.

“Between these Senate bills and the Dodd–Frank Act, the federal government is close to completely taking over the housing finance market,” said Heritage’s Michel and John Ligon. “Taxpayers—and consumers—deserve much better.”

Other lawmakers are intent on getting government out of the mortgage-backing business.

In an interview with Foundry Senior Contributor Genevieve Wood, Rep. Jeb Hensarling (R-Texas) talked about sponsoring legislation that would phase out Fannie and Freddie.

“They represent the single largest bailout in America’s history, almost $200 billion coming out of the pockets of working men and women in America,” Hensarling said. He added that the government’s “virtual monopoly on housing finance” means that “Washington elites now control who can receive a mortgage and who can’t.”

“You shouldn’t have a government-induced system that puts people into homes that, ultimately, they cannot afford to keep,” Hensarling said. “That’s not good for anybody.”

Heritage experts have projected that closing Fannie and Freddie “will relieve taxpayers of future bailouts and likely result in lower mortgage debt, higher personal income and savings, lower home prices, and lower monthly mortgage payments.” It’s time to get the government off our lawns.

Read the Morning Bell and more en español every day at Heritage Libertad.

Quick Hits: