3 Ways to Make April 15 Less Painful

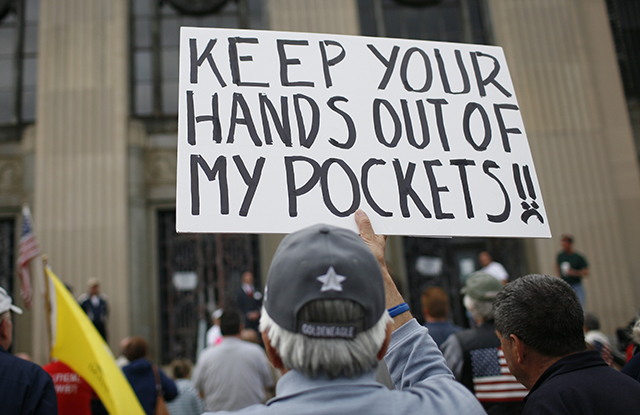

REUTERS/Mike Segar

REUTERS/Mike Segar

by Amy Payne, Heritage Foundation, February 27, 2014

Yesterday you told us what you think Washington should be doing—and more than a few of you said dealing with our horrendous taxes.

Representative Dave Camp (R-MI) rolled out a plan for tax reform yesterday that we hope will shift the conversation to something that would benefit all Americans. As Heritage chief economist Stephen Moore said, “The tax code stables in Washington haven’t been cleaned out since 1986.” And it shows.

Here are three things Congress should be including in tax reform—so that we can all dread April 15 a little less.

1. Lower tax rates.

The most obvious way to improve everyone’s year: Lower tax rates for individuals and businesses. President Obama often talks about closing tax “loopholes”—but he really means raising taxes. Camp asserts that “If loopholes are closed, Americans should get the benefit by way of lower rates.”

And for those interested in squeezing the rich—don’t worry, they’ll always be paying more taxes. As Moore notes, “the evidence from history shows that lower tax rates are usually associated with higher overall tax receipts and more taxes paid by the rich.”

2. Simplify, simplify, simplify.

How much paperwork are you dealing with this tax season? Sure, the infamous Form 1040 is only two pages, but the general instructions for it total 104 pages.

One of our readers submitted this idea yesterday: “Simplify taxes. NO ONE understands them (including my CPA).”

What if you could just mail in a postcard to the IRS?

That’s the idea behind the New Flat Tax that The Heritage Foundation has suggested. Heritage experts have explained that if this were in place, “American taxpayers will pay a single, simple tax rate—roughly 28 percent.” It would replace all federal income taxes, as well as the death tax and payroll taxes.

How could anyone be against a simpler system? Well, if you’ve ever used software like TurboTax or had to call an accountant or lawyer for tax preparation…you’ve glimpsed how many people make their living off of the labyrinth of tax rules.

Camp says the tax code should be simpler “so every family can do its own taxes confidently, without fearing an audit, or wondering if someone else who can afford an expensive accountant is getting a better deal.”

3. Let us be clear.

Economist and author Walter Williams once said that it would radically change Americans’ view of taxes if each person had to take his entire family down to a government office and pay his taxes in cash while his kids watched.

“Because of income and payroll tax withholding and the hidden costs of corporate and excise taxes, most Americans have little idea how much they are paying to fund the massive federal government,” says Heritage expert Curtis Dubay.

Tax reform should make the system more transparent (and simplifying payments would go a long way toward that). People should be able to tell how many times they are being taxed, and why.

Dubay reminds lawmakers that “Tax reform is not a way for Congress to extract more of the taxpayers’ hard-earned income.” The goal is to boost the economy—and that means jobs, wages, and retirement savings. This should be a movement all Americans can get behind.

LEARN MORE: The Dos and Don’ts of Tax Reform

Read the Morning Bell and more en español every day at Heritage Libertad.

Quick Hits: