What You Need to Know About the Debt Limit

by Amy Payne, Heritage Foundation, September 19, 2013

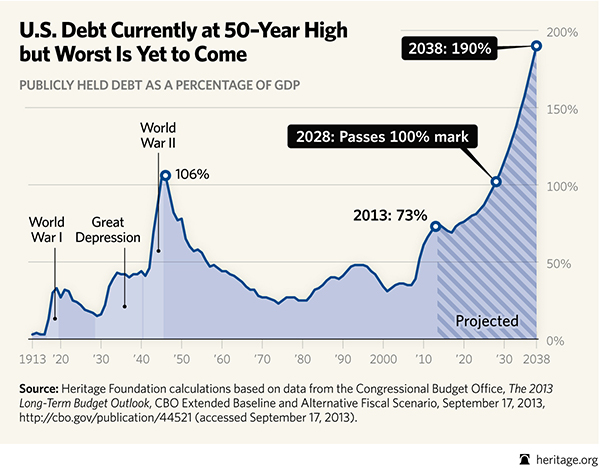

The Congressional Budget Office just dropped a budget update on Washington, and it’s not good. The U.S. government is spending recklessly—and Obamacare is adding fuel to the fire.

The new report comes at a crucial time, as negotiations over the debt limit are starting up again. Here are some basics to help you cut through all the political spin.

What is the debt limit?

Yes, it’s the legal limit on federal government borrowing—but the debt limit is a wake-up call. It’s a chance for Congress and the President to stop the spending insanity.

Share this graphic on Facebook to spread the word

Why does it matter?

Government spending is accelerating with no end in sight as long as entitlement programs keep expanding.

Entitlement spending is the biggest driver of skyrocketing debt. In only 10 years, Social Security, Medicare, and Medicaid will devour half of the federal budget.

Of course, Obamacare’s new entitlements only add to this mess. Think health care spending is out of control now? “Obamacare is the single biggest factor driving the growth in mandatory health care spending over the next decade,” warns Heritage expert Alyene Senger. The insurance exchanges, the Medicaid expansion… it’s all adding to our spending problem. (continues below chart)

What should Congress do?

In a new Rasmussen poll, 58 percent of Americans “favor a federal budget that cuts spending.” Right on. Congress should cut spending, reform these programs that are ballooning the debt, and put the budget on a path to balance within 10 years. Facing the debt ceiling gives them the opportunity to correct the catastrophic course we are on.

Read the Morning Bell and more en español every day at Heritage Libertad.

Quick Hits:

|