Hawaii Government Employees' Retirement System: No Accountability and Improper Incentives

by Kelsey Winther Grassroot Institute of Hawaii

Imagine this scenario: You live next-door to a man with a nice job promising nice retirement benefits. Yet when he decides to retire, you are the one who will pay the bill. This is the situation for the retirement benefits of almost 14 percent of workers in Hawaii. While it seems logical for taxpayers to cover the benefits of public employees, this arrangement has given the state government a moral hazard to invest retirement funds in unwise and risky investments. There is little incentive for the managers of the Hawaii Employees Retirement System to insure solvency. Decisions are made by individuals with no interest in the financial success of the fund and the taxpayers who cover the losses have no say in the way funds are invested.

The Employees' Retirement System (ERS) of the State of Hawaii provides pensions to state and county employees. In 2009, there were almost 68,000 active members in the plan[i]. The fund is managed by board of trustees who calculate payouts and invest the funds. The benefits depend only on the service and pay of the employee; all risks from investment are passed on to taxpayers. The ERS plans are the opposite of defined benefit, or individual account plans like 401K plans in which the employees bear all the investment risk.

At present the plan is woefully underfunded and the accrued liability has consistently grown each year. Though several factors could be blamed for this mismanagement, , the shortfall is fundamentally the result of a systemic flaw in the structure of incentives. This paper will analyze how Hawaii’s retirement system got into this situation and how to halt the growth in the funding shortfall.

Unfunded liabilities are not a problem unique to Hawaii; states around the nation are accruing significant deficits in their state pension plans. Throughout the nation, state pension funds are underfunded by a total $3.23 trillion[ii]. This burden is falling on states with ever increasing budget shortfalls that are scrambling to keep up.

ERS Accrued Liability

As with any deficit on the government’s accounting books, a retirement fund shortfall is the result of insufficient supply of and excessive demand for resources. Each year the state government allocates funds which are then invested in stocks, bonds, real estate, and other investments. Both the state contributions and the return on investments are inadequate to keep the system solvent.

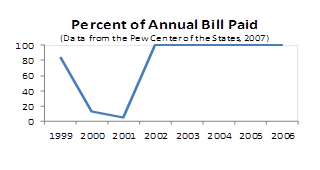

The insolvency of Hawaii’s pension system is in part due to failure in past years to provide the prescribed amount. At the start of the decade the state, facing significant budget pressures, scaled back the amount it allocated to the fund. In 2000 and 2001, contributions were $44.1 million and $155.8 million short of what was needed to maintain solvency[iii]. This deficit has not been made up, despite full funding in recent years. Funding for the state employees retirement system was in decline for three years, contributing to the current fund shortfall. In 1999, 83 percent of funding was provided, in 2000, 13 percent, and 2001, only 5 percent of necessary funds were paid into the system[iv].

Return on Investments

The money allocated to the system is invested according to the guidelines of the Government Accounting Standards Board and the judgment of the trustees who govern the fund. The GASB standards are not, however, consistent with typical accounting standards in the private sector. The Government Accounting Standards Board requires that public retirement systems calculate the liability for benefits derived from service to date using an expected rate of return, whereas Generally Accepted Accounting Principles require discounting based on the risk of the investment.[v] Such standards encourage the trustees to invest funds heavily in high risk assets that have a high expected yield. There is a twofold consequence to such accounting practices. First, the amount of money the state is supposed to allocate to the fund decreases as the discount rate goes up. The state could be paying 100 percent of the annual bill but at the same time paying less than is realistically needed. Second, risky investments can increase the likelihood of loss. Data indicates that this is the case as in 2008, the investment return was -3.51 percent[vi].

The Honolulu Star Bulletin showed the consequence of failed investments when it reported that the value of the pension fund fell 18.7 percent in fiscal year 2009. The losses equaling $2 billion dollars were in part due to the global recession[vii]. Clearly funds invested all over the market saw losses. But that story ignores that losses would have been far less if the fund had been invested in lower risk assets-- such as bonds--instead of assets with higher risk levels. At a time when Hawaii's economy was already so poor, a wise investor would have been more conservative in investments to prevent against losses.

Beyond the usual reasons for the funding shortfall are a host of structural inefficiencies in the government which add to the problem. The pension system acts as an entity separate from the state and considers itself a sort of union for state employees. The board of trustees is comprised of seven members, four of whom are union. These trustees operate only with concern for defending employees and not for the tax dollars being wasted. The same workers the board feels the need to defend have significant benefits guaranteed to them. Once a worker is hired, the retirement benefits are locked in and cannot be reduced. Thus, workers are attracted to state jobs by larger benefits than the state can afford. Politicians know taxpayers will not know how much the benefits cost until after the politicians expect to be retired – literally decades later.

Unfunded Liabilities

Unwise financial planning, flawed incentives, and failed investments have left the pension fund far short of the resources it will need for long term operation. The Hawaii ERS is woefully underfunded by any standard. The state government is obligated to pay its employees the benefits it has promised. But a report by the National Bureau of Economic Research predicts that Hawaii’s pension system will run out of funds in 2020[viii]. By the government’s own standard Hawaii has still failed. The Government Accountability Office suggests, at the recommendation of experts, that a funding ratio of 80 percent is sound. [ix] Yet, at present the funding ratio, when using the actuarial value, falls around 65 percent[x].

As bad as the reported percentages appear, they materially overstate current funding levels. The actuarial value of assets, which is assumed to be the official value, averages the real rates of annual return to create a figure that is more stable year to year. The official reports make this clear when they list the market value of the fund in addition to the actuarial value. Using the real value, the fund contains $8.8 million, meaning it is exactly 50 percent funded[xi].

The extent to which the pension plan is comprised of unfunded liabilities has steadily increased in recent years. At the start of the decade, HERS assets exceeded 100 percent of the accrued liability. In the subsequent years, assets steadily deteriorated to only 50 percent of the accrued liability.

In Comparison to Other States

The actuarial value represents the funding shortfall as less than it actually is. Yet for the purposes of comparison it is necessary to use the “official” rather than market figures. Thus, the comparison holds true but the unfunded liability is actually larger than the following numbers show.

Per Capita Unfunded Liability, in dollars[xii]

Hawaii's level of funding shortfall places it near the bottom of all the states. The above graph shows the percent of funding for the states with the greatest unfunded liability. The seriousness of the issue is even more evident when considering the per capita data. Because Hawaii has a relatively small population, the number is inherently less. But when comparing Hawaii’s liability per capita to other states, the significance of Hawaii’s deficit becomes clear. With a higher percentage of government employees than average, high benefits, and a great budget shortfall, Hawaii’s unfunded liability per capita is $7,652. The only state with a greater shortfall is New Jersey with an unfunded liability of $7,946 per person[xiii], or nearly $32,000 for a family of four.

Implications

By maintaining a $9 billion unfunded liability, the state of Hawaii is placing its citizens in financial danger. At present the government has accumulated a debt of $7,652 for each person in the state. There are several significant consequences to such a shortfall. The first impact is a decreased credit rating for the state. A significant deficit decreases the demand for state bonds. As the situation worsens with the pension plan shortfall the confidence in the state will fall, both for investors and for the average citizen.

The accrued liability presents a very real danger to the state’s ability to fund other programs. The shortfall in funding for benefits means the state might be forced to cut funds to education, social services, or other functions of government.

Perhaps more importantly is the burden on taxpayers. The law which created the ERS states that “all expenses in connection with the administration and operation of the system are made obligations of the State and of the respective counties.[xiv]” If the financial obligation belongs to the state than it necessarily falls to the taxpayers. Yet, at present, the money that has been collected from the taxpayers for benefits is melting away in risky investments. The trustees publicly and regularly declare they have an exclusive fiduciary duty to government employees, which prohibits them from considering the interests of taxpayers in setting investment policy.

Solutions

As states throughout the nation attempt to make up their pension deficits, government officials can learn lessons about what does and does not work. Even though small improvements can be made, it is important to note that no immediate legislative change is going to eliminate the multibillion dollar shortfall. The unfunded liability is currently 115 percent of the state budget.[xv] A shortfall of this magnitude cannot easily be made up; years of wise financial action are required. The solutions outlined here are just a step in the right direction but, nonetheless, an absolutely necessary one.

The goal of reform is twofold. The first is that the employer ensures that the earmarked assets equal to the accrued liability for that year. The second goal is that decisions about investment be made by those who bear the responsibility of gains or losses. Structural changes to the ERS can address both goals.

Short Term-

•Structural Changes

The ERS should be constructed so that the compensation paid by taxpayers to government employees for each year of service is a specified dollar amount that is put into an account in the name of each individual employee. In this case, the employees hold the investment risk, and therefore are entitled to exclusive authority to set the level of investment risk and to otherwise control the investment of assets. Each employee can direct his or her own investments. An individual account plan, like the private sector's 401k plans, eliminates the temptation for the state to assume an expected return based on imprudently high risk. All risk remains with the one making the investment decisions

•Unfunded liability Reduction

One potential mechanism for reducing the current shortfall is by implementing a tax which would reduce the amount of benefits owed and at the same time direct funds to make up the deficit. This would be done by placing a 100 percent tax on any benefits over market value (i.e. what a comparable worker in the private sector would receive). The money collected from the tax will be placed in a fund to pay for the current retirement benefits that are coming due. While no one likes the idea of cutting benefits, reducing them simply to levels in the private sector will go a long way toward solving the crisis.

Long Term-

Several actions will aid in slowing the growth of the shortfall and protecting the states that have more wisely managed their funds.

• Prevent a federal bailout.

The proposed federal bailout of state employee retirement systems would have a deleterious effect on the whole nation. (The Preserve Benefits and Jobs Act of 2009 and the Create Jobs and Save Benefits Act of 2010 are two examples of proposals for a nation-wide pension bailout.) If the federal government props up the states that have acted irresponsibly in the management of their funds, the burden would fall on the nation as a whole, including the states that have been wise to maintain their funds. Rewarding irresponsible fiscal behavior will provide a powerful inducement for all states to act irresponsibly. Aside from the basic injustice of spreading around the liability, a bailout would place another burden on the federal government when it is not equipped to handle its current debt.

In light of current economic conditions and budget deficits, permitting the federal government to borrow trillions more to bail out irresponsible states would spell disaster for the economy.

•Limit the growth of public employment and benefits

In recent years, employment in the private sector has fallen to compensate for the sluggish economy. Consistent with past trends, the government sector continued to hire more workers. This is especially true in Hawaii where 13.8 percent of workers are government employees[xvi]. This high percentage means there are fewer workers in the private sector paying for the growing number of workers in the public sector.

Additionally, across the nation, government workers receive a 45 percent premium in pay and benefits over workers in the private sector.[xvii] Forcing the state to lower wages and benefits to a level comparable to those in the private sector and reducing excessive government employment will begin the process of correcting the large and growing funding shortfall.

Without necessary changes, Hawaii taxpayers will continue to bear the burden of an ever increasing bill for their neighbor’s retirement. At the risk of breaking both state and federal budgets and continuing an injustice to Hawaii citizens, the state must change its imprudent policy. By restructuring to ensure proper incentives this systemic loss can be ended, benefiting the state, public employees, and most importantly, the taxpayers.

---30---

Kelsey Winther is a former Summer Policy Fellow at the Grassroot Institute.

Link to original: http://grassrootinstitute.org/research/hawaii-government-employees-retirement-system

GRIH: http://grassrootinstitute.org