| State |

Hawaii |

| 2018 Rank |

11 |

| 2019 Rank |

12 |

| 2020 Rank |

16 |

| 2021 Rank |

18 |

| Change from 2020 to 2021 |

-2 |

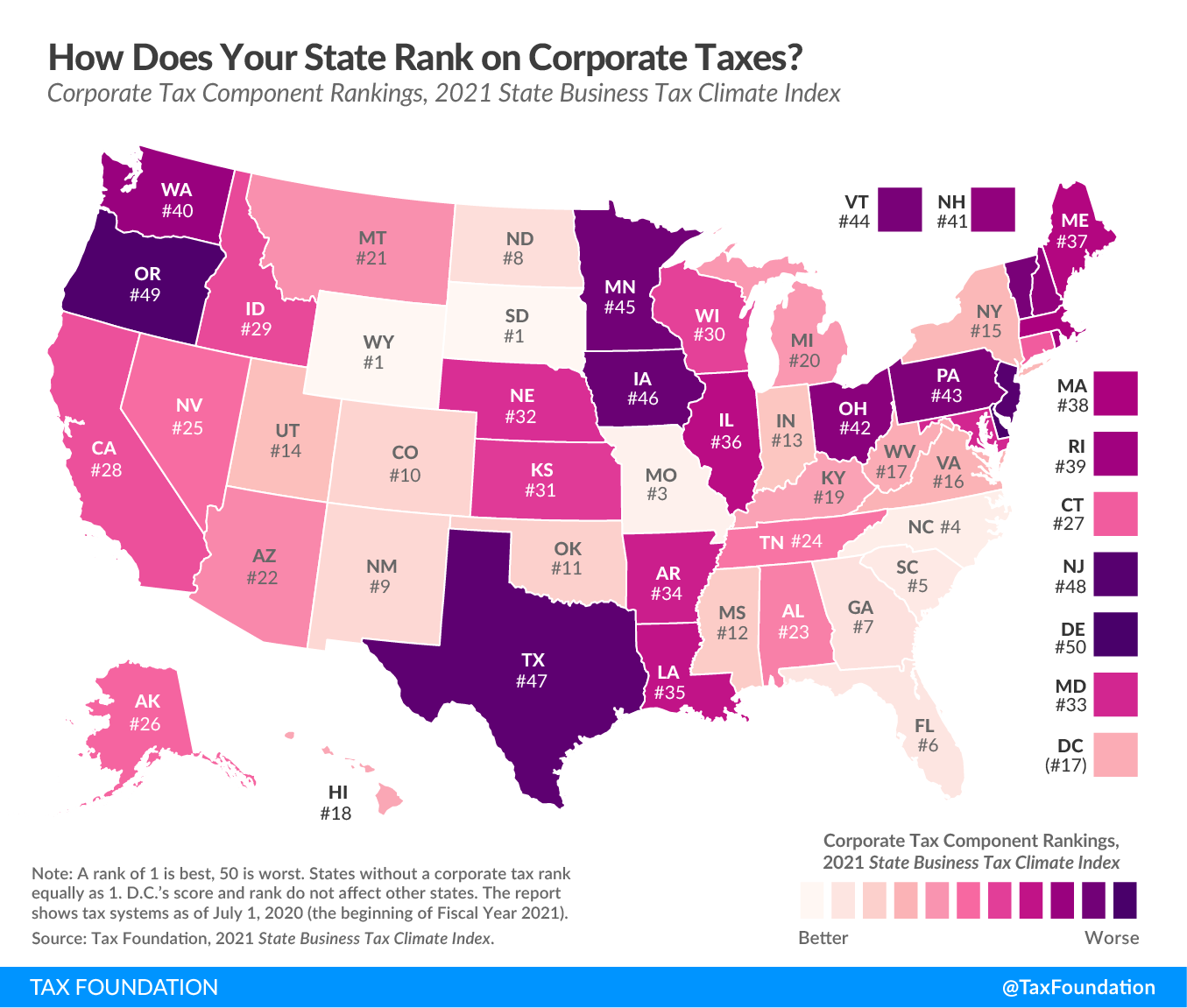

Corporate Tax Component of the State Business Tax Climate index (2018-2021)

Ranking Corporate Income Taxes on the 2021 State Business Tax Climate Index

by Janelle Cammenga, Tax Foundation, November 4, 2020

In the coming weeks, we will break down our recently released 2021 State Business Tax Climate Index with maps illustrating each of the five major components of the Index: corporate, individual, sales, property, and unemployment insurance taxes. Today we look at states’ rankings on the corporate tax component, which accounts for 20.8 percent of each state’s overall rank.

The corporate tax component of our Index measures each state’s principal tax on business activities. Most states levy a corporate income tax on a company’s profits (receipts minus most business expenses, including compensation and the cost of goods sold), while some states levy gross receipts taxes, which allow few or no deductions for a company’s expenses.

Unlike other studies that look solely at tax burdens, the Index measures how well or poorly each state structures its tax system. It is concerned with the how, not the how much, of state revenue, because there are better and worse ways to levy taxes. Our corporate tax component, for example, scores states not just on their corporate tax rates and brackets, but also on how they handle net operating losses, whether they levy gross receipts-style taxes (which are more economically harmful than corporate income taxes), whether businesses can fully expense purchases of machinery and equipment, and whether states index their brackets for inflation, among other factors.

Click here to see an interactive version of states’ corporate tax rankings, and then click on your state for more information about how its tax system compares both regionally and nationally.

|