A Visual Guide to Unemployment Benefit Claims

by Jared Walczak and Tom VanAntwerp, Tax Foundation, April 23, 2020

According to Thursday’s data release, another 4,267,395 people filed initial unemployment benefit claims during the week ending April 18, the second week of a decline in the rate of new claims, but still among the highest levels in U.S. history. Prior to the current crisis, the highest one-week unemployment claims as a percentage of everyone in the unemployment insurance system (those currently in “covered” employment plus those claiming benefits) was 1.36 percent, in January 1975. During the Great Recession, the one-week peak was 0.68 percent in January 2009. The peak during the current crisis, reached the week ending April 4, was 3.89 percent.

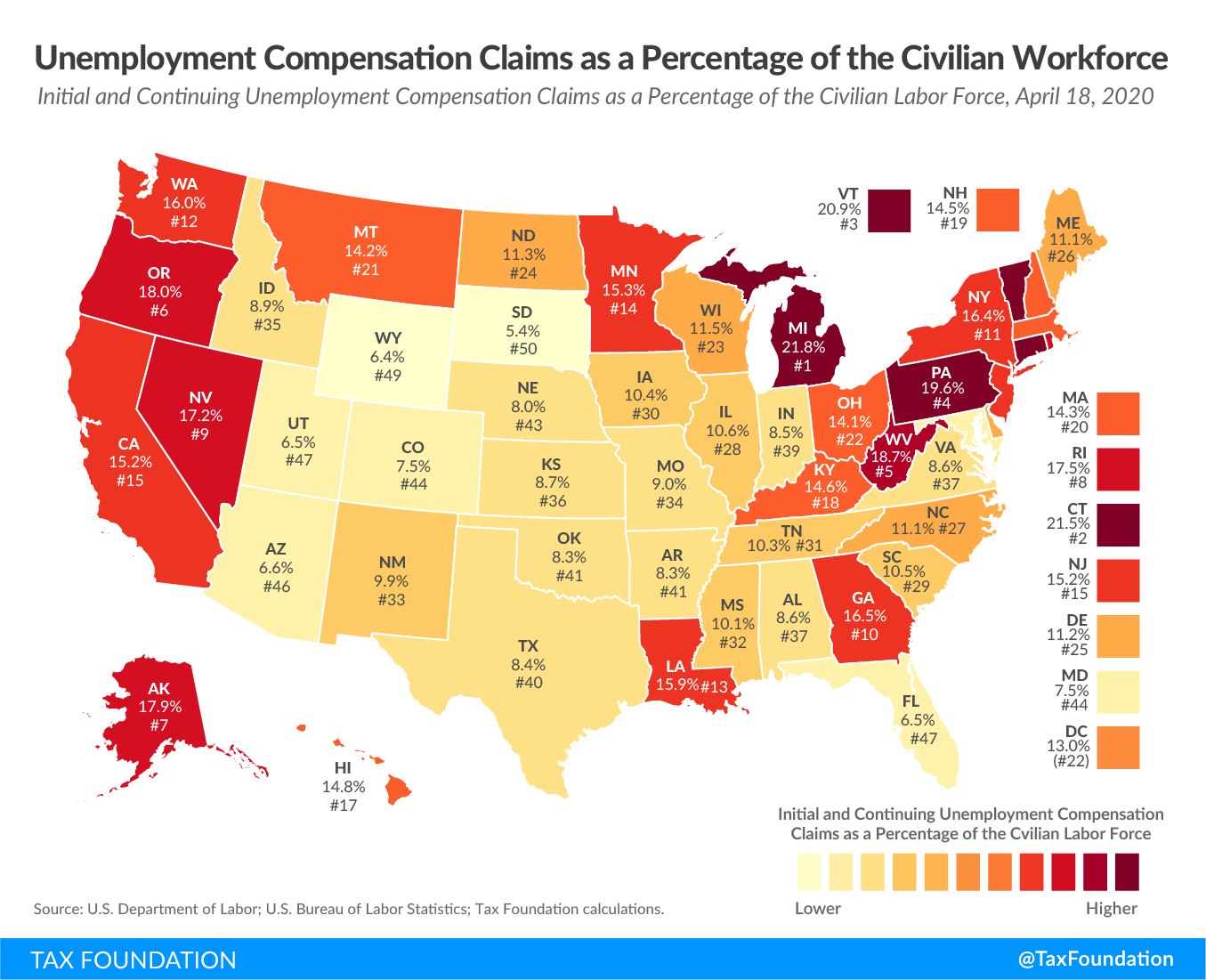

Approximately 12.5 percent of the U.S. civilian labor force has now applied for or is receiving unemployment compensation benefits (through April 18, the latest data). The previous high was 7.9 percent early in 1975 during a recession, with a Great Recession peak of 4.8 percent between February and April 2009. Entering March 2020, unemployment claims as a percentage of the civilian labor force stood at 1.4 percent.

More than 20 percent of the civilian labor force has applied for or is receiving benefits in three states: Michigan (21.8 percent), Connecticut (21.5 percent), and Vermont (20.9 percent). Another 13 states have rates of 15 percent or higher.

The latest week of claims data is the first in which any meaningful number of self-employed filers (normally ineligible for unemployment compensation) will be able to claim benefits. Ten states—Alabama, Iowa, Louisiana, Michigan, New Jersey, North Dakota, Rhode Island, Tennessee, Texas, and Utah—accepted claims under the Pandemic Unemployment Assistance (PUA) program last week, though few if any of these claims have begun to be paid out. The federal government will pick up the full cost of this expanded eligibility.

Mandatory business closures and shelter-in-place orders have radically accelerated job losses compared to the steadier pace of layoffs in prior recessions, meaning these claims likely represent a far greater share of the ultimate total than did any week’s claims during the Great Recession. But the numbers are still staggering, with every likelihood of sobering numbers in coming weeks as well.

Unfortunately, many states entered the crisis with woefully inadequate unemployment compensation trust funds, with the possibility that three states—California, New York, and Ohio—could run out of money to pay out claims filed to date by the end of April. If all the states’ funds were pooled together, they could cover about eight weeks of payments based on current claims levels, but wide disparities exist.

Our interactive tool allows you to see how the most recent week’s initial unemployment compensation claims in each state compare to average and peak weekly claims during the Great Recession. States vary in how quickly they process and report claims, so some states are “ahead” of their peers in reporting substantial increases, and differentials across states may be questions of timing rather than effects of the economic contraction.

Many states are woefully unprepared for the magnitude of the challenge ahead. Entering the crisis, 21 states’ unemployment compensation trust funds were below the minimum recommended solvency level to weather a recession. Six states had less than half the minimum recommended amount, representing 37 percent of the U.S. population.

Crucially, a solvency level of 1 indicates the ability to pay out claims for one year during a Great Recession-like event, and as of April 18, over 20.7 million people had filed for unemployment, 408 percent of the worst Great Recession level. A level of 1 now suggests the ability to pay out current claims for only a little under 13 weeks—and of course, states have already started paying out these new claims. Our map above draws from the most recent fund financial data and claims figures, taking into account payments already made, to project how many weeks each state’s fund has left.

As more firms lay off employees and unemployment increases, states’ unemployment insurance taxes will rise on businesses that can least afford to pay. As states receive federal assistance to aid with unemployment benefits, it may be appropriate to provide some measure of relief to businesses as well, particularly to the extent that their layoffs were precipitated by business closure orders.

Explore your state’s data on our interactive tool >>> LINK.