A Visual Guide to Unemployment Benefit Claims

by Jared Walczak and Tom VanAntwerp, Tax Foundation, April 2, 2020

On April 2, weekly initial unemployment benefit claims hit the highest level in U.S. history for the second week in a row, with 5,823,917 people filing for unemployment—twice the 2,898,450 who filed last week. Prior to the current crisis, the highest one-week unemployment claims as a percentage of everyone in the unemployment insurance system (those currently in “covered” employment plus those claiming benefits) was 1.36 percent, in January 1975. During the Great Recession, the one-week peak was 0.68 percent in January 2009. During the week ending March 28, it reached 3.77 percent.

Approximately 5.6 percent of the U.S. civilian labor force has now applied for or is receiving unemployment compensation benefits (through March 28, the latest data). The highest ever was 7.9 percent early in 1975 during a recession, with a Great Recession peak of 4.8 percent between February and April 2009. Entering March, unemployment claims as a percentage of the civilian labor force stood at 1.4 percent.

Mandatory business closures and shelter-in-place orders have radically accelerated job losses compared to the steadier pace of layoffs in prior recessions, meaning these claims likely represent a far greater share of the ultimate total than did any week’s claims during the Great Recession. But the numbers are still staggering, with every likelihood of sobering numbers in coming weeks as well.

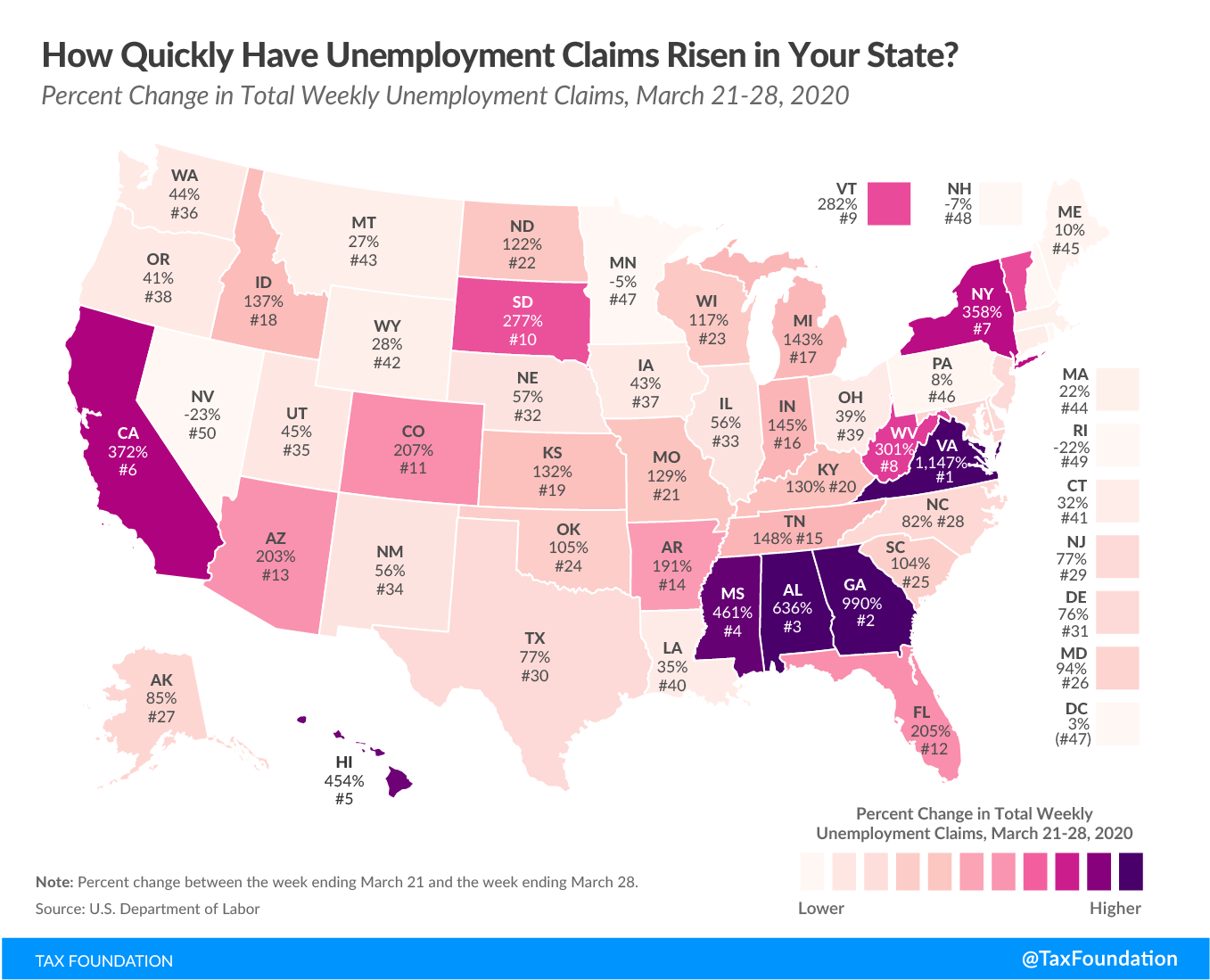

Our interactive tool allows you to see how the most recent week’s initial unemployment compensation claims in each state compare to average and peak weekly claims during the Great Recession. States vary in how quickly they process and report claims, so some states are “ahead” of their peers in reporting substantial increases, and differentials across states may be questions of timing rather than in the effects of the economic contraction.

Many states are woefully unprepared for the magnitude of the challenge ahead. Entering the crisis, 21 states’ unemployment compensation trust funds were below the minimum recommended solvency level to weather a recession. Six states had less than half the minimum recommended amount, representing 37 percent of the U.S. population.

As more firms lay off employees and unemployment increases, states’ unemployment insurance taxes will rise on businesses that can least afford to pay. As states receive federal assistance to aid with unemployment benefits, it may be appropriate to provide some measure of relief to businesses as well, particularly to the extent that their layoffs were precipitated by business closure orders.

Explore your state’s data on our interactive tool >>> LINK