How High are Champagne Taxes in Your State?

by Janelle Cammenga, Tax Foundation, December 27, 2019

Next week brings one decade to a close and opens the next: the 2020s. The equivalent decade a hundred years prior saw the prohibition of alcohol and the birth of speakeasies. While it’s hard to say whether these new ’20s will be roaring with a comeback of bobbed haircuts, art deco, and the Charleston, two things are for sure: wine, beer, and other spirits are legal in the United States, and the champagne you toast with on New Year’s Eve will be taxed.

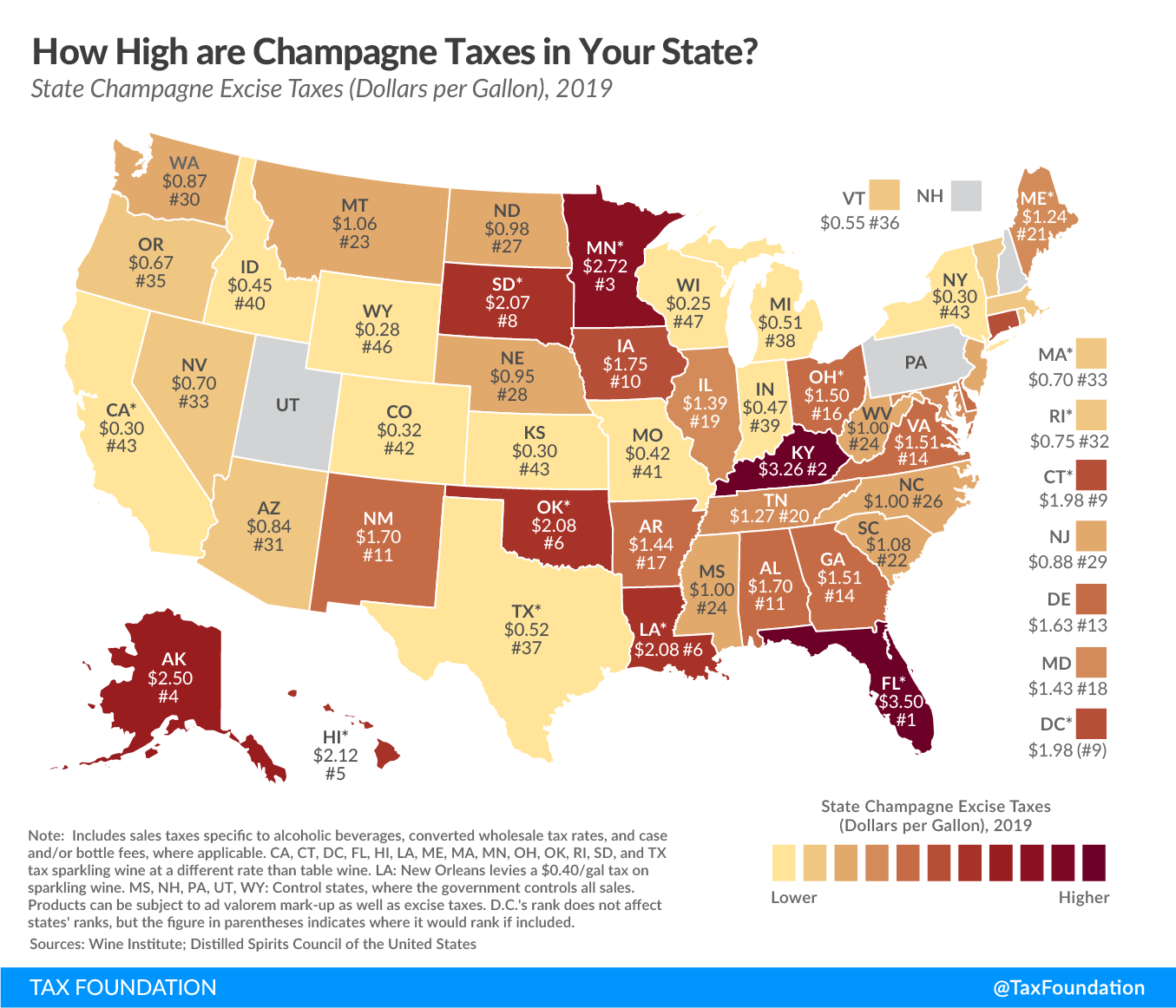

According to data compiled from both the Wine Institute and the Distilled Spirits Council of the United States, Florida comes in with the highest state champagne tax rate at $3.50 per gallon. Next come Kentucky ($3.26 a gallon) and Minnesota ($2.72 a gallon). Wisconsin ($0.25) and Wyoming ($0.28) are at the other end of the spectrum, with New York close behind at $0.30 a gallon.

Most states use the same excise tax rates for champagne and table wine, but 14 have higher, alternate rates for sparkling wine.

Even though states can levy taxes at the production, wholesale, or retail level, vendors ultimately pass along those taxes to consumers in the form of higher prices. On the other hand, four states (Arkansas, Maryland, Minnesota, and South Dakota) and the District of Columbia levy sales taxes specific to alcoholic beverages that consumers pay directly.

As you pop open your bottle of bubbly on New Year’s Eve before the ball drops in New York City, take a look at how your state compares on champagne excise taxes.

|