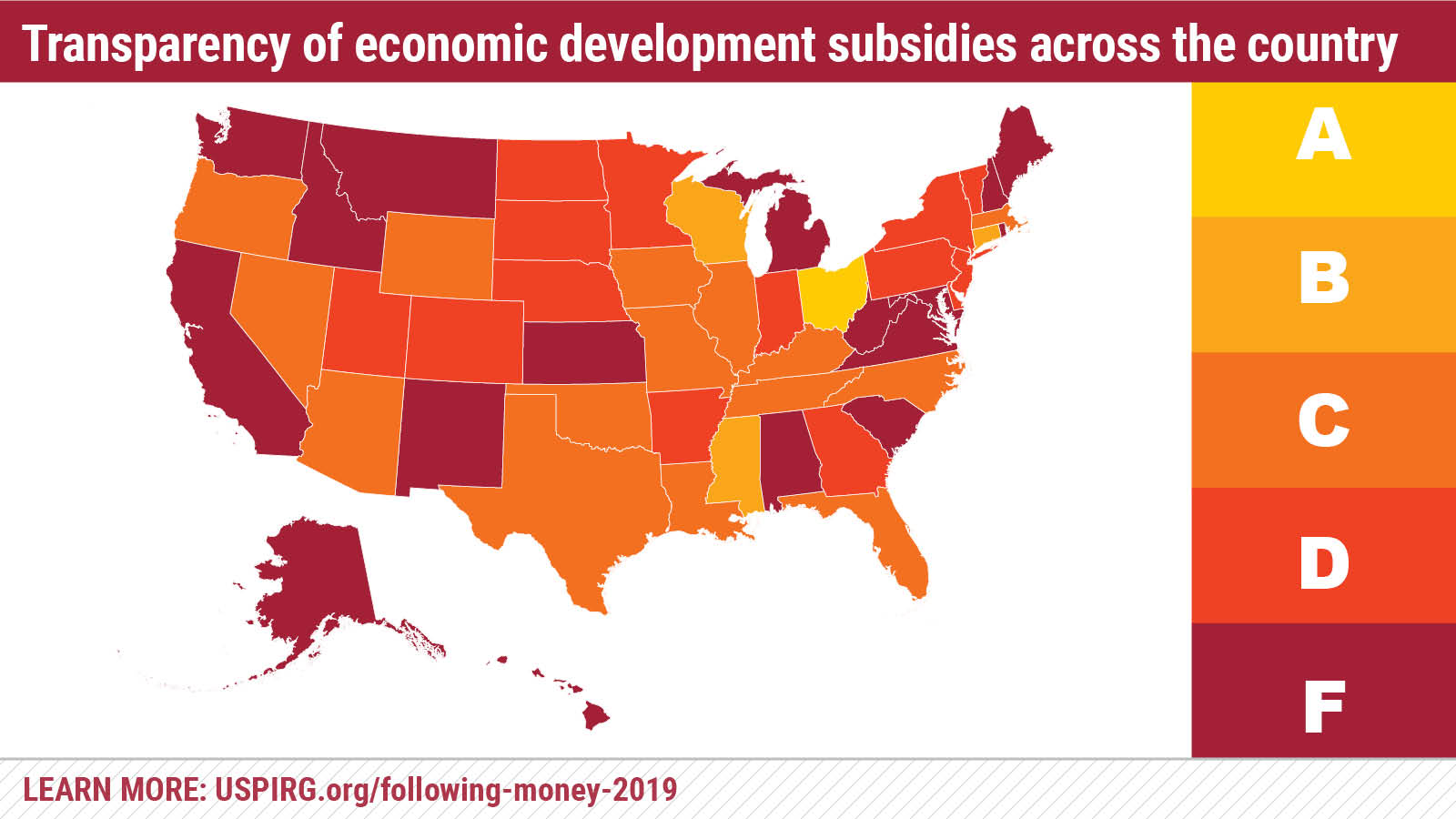

MORE THAN A THIRD OF U.S. STATES GET AN “F” FOR ECONOMIC DEVELOPMENT TRANSPARENCY

News Release from US PIRG, December 11, 2019

WASHINGTON -- More than one-third of U.S. states are failing to make critical information about how governments are subsidizing business projects with taxpayer dollars readily available to the public online, according to a new report from U.S. PIRG Education Fund and Frontier Group. Following the Money 2019, the organization’s tenth evaluation of online government spending transparency, gives 17 states (including Hawai’i) a failing grade, while only four states received a grade of “B” or higher.

(Hawai'i scores 27--2nd worst in the USA.)

State and local governments give more than $70 billion in economic development subsidies each year to private entities, hoping to stoke investment and job creation. These subsidies come in many forms, from tax credits for filming movies on location to direct cash grant payments to subsidize construction -- such as building a new sports stadium. All 50 states have economic development programs. But while these subsidies are a form of public spending, they are rarely held to the same transparency standards as other government expenditures.

"As taxpayers, we should be able to see how government spends our money down to the dime," said Andre Delattre, U.S. PIRG Education Fund executive director. "That includes the billions of dollars that state and local governments give away each year to lure businesses into their backyards."

U.S. PIRG Education Fund and Frontier Group’s Following the Money reports have evaluated states on online spending transparency since 2010. While many states have made progress toward providing citizens access to government spending information online, this year’s report finds economic development reporting is still lagging behind.

"It's often easier for citizens to see when a state hands a company $50 for printer ink than when it hands a company a million dollars to relocate its headquarters," said R.J. Cross, the report’s lead author and a policy analyst at Frontier Group. "States have moved light years ahead in the last decade when it comes to providing information on basic government spending online. But when it comes to economic development subsidies, most are still in the dark ages."

The report graded each state’s transparency efforts from “A” to “F” based on the availability of online reports detailing how much the state spends on tax breaks and direct grant programs; the availability of information on individual payments to companies on the state’s transparency site; and the existence of state laws that require ongoing reporting of information on economic development subsidies to the public.

Ohio received the report’s only “A” grade, while Wisconsin, Connecticut and Mississippi were the only states to receive “B” grades. The other 46 states do not provide consistent, comprehensive and accessible information online.

“Transparency checks corruption and enables citizens to hold their elected officials accountable,” finished Cross. “Without access to information, it’s impossible to know how fully these corporate subsidies are serving the public’s interest.”

Over a third of the states (17—including Hawai’i) are "Failing States" ("F" range) and do not meet even basic standards of online spending transparency for economic development subsidies. Only 10 of these states publish any kind of annual grants report, while only two include grant payments made by the primary economic development agency in the state’s online checkbook.

Hawaii Grants report: No points were awarded for Hawaii’s grants report, as the report did not include topline expenditure amounts for the programs being administered.

Grants report law: No points were awarded for a grants report law as no such legislation could be located.

Online portal: Hawaii’s online portal received no points because it does not allow users to view individual payments to companies, instead offering only a lump sum by expenditure category.

Online portal law: No credit was awarded for online portal legislation as no law requiring economic development payments in the online portal could be located.

How can your state improve transparency for economic development subsidies?

How can your state improve transparency for economic development subsidies?

All 50 states can take steps toward improving the transparency of their economic development subsidy programs. To ensure transparency and accountability of economic development spending, states should prioritize the following actions:

• States should publish an annual tax expenditure report detailing the impact of tax credits, exemptions and deductions on the state budget and make it available online.

• Every state should publish a comprehensive annual report that details economic development spending across all agencies, programs and funds to provide a statewide view of how much these expenditures cost and the benefits they have delivered.

• States should include economic development subsidy payments in the online checkbook portals they use to report other state spending. Each payment should specify the name of the recipient company and be identifiable as a payment for economic development. Excellent portals will additionally allow users to search and sort the data by program and fund.

• States should publish information on both projected and actual benefits associated with specific economic development subsidies received by specific companies.

• Provisions for online reporting of economic development subsidies should be included in state statutes, and state public records laws should guarantee public access to information about economic development subsidy programs.

Read the full report and see the full list of rankings.

PDF: FULL REPORT