State and Local Individual Income Tax Collections Per Capita

by Katherine Loughead, The Tax Foundation, February 21, 2019

The individual income tax is one of the most significant sources of revenue for state and local governments. In fiscal year (FY) 2016, the most recent year of data available, individual income taxes generated 23.5 percent of state and local tax collections, just less than general sales taxes (23.6 percent).

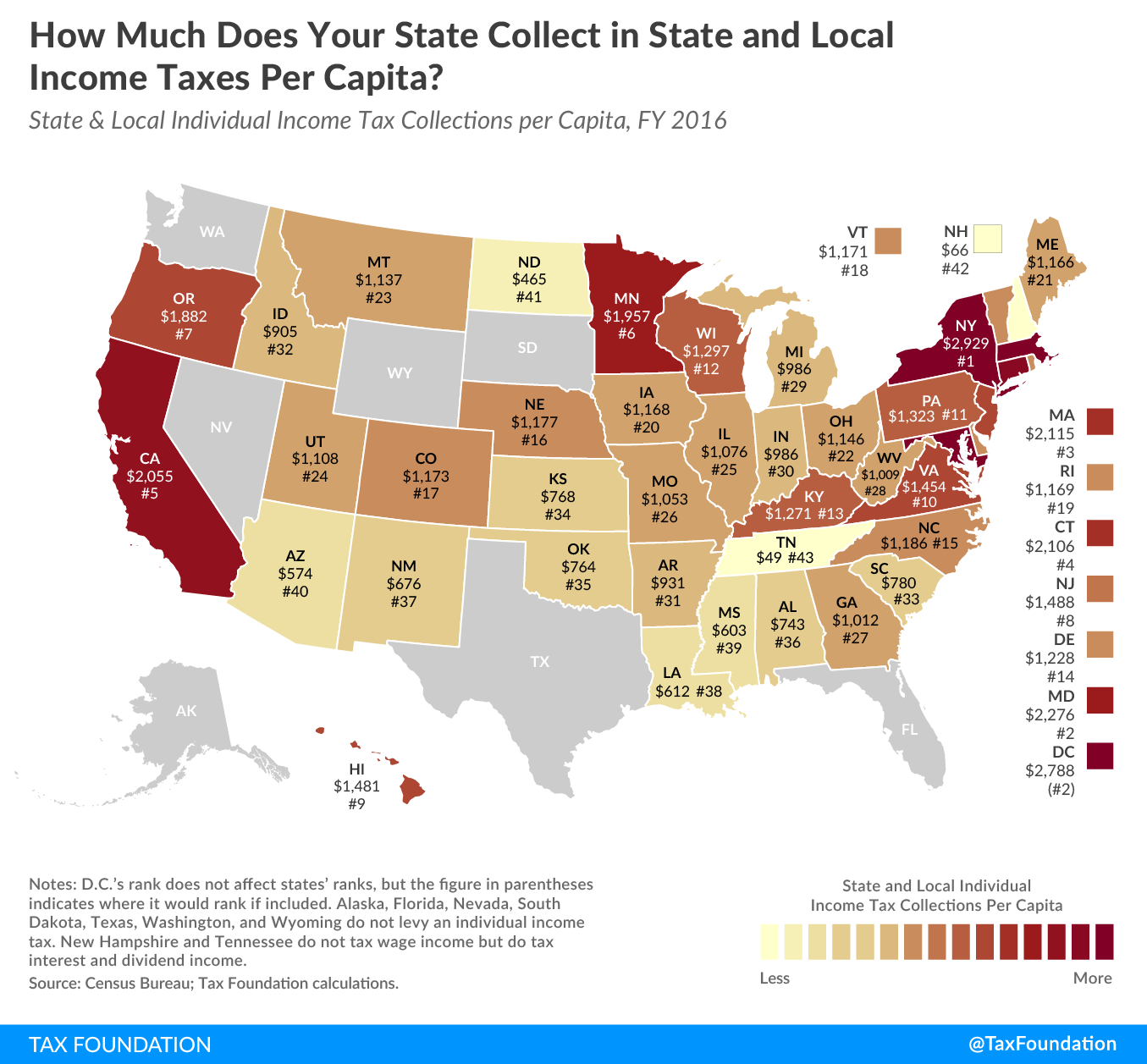

The map below shows combined state and local individual income tax collections per capita for each state in FY 2016. Forty-one states and the District of Columbia levy broad-based taxes on wage income and investment income, while two states—New Hampshire and Tennessee—tax investment income but not wage income. Tennessee’s tax on investment income—known as the “Hall tax”—is being phased out and will be fully repealed by tax year 2021. Seven states do not levy an individual income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

On average, state and local governments collected $1,164 per capita in individual income taxes, but collections varied widely from state to state. Collecting the most per capita were New York ($2,929), the District of Columbia ($2,788), Maryland ($2,276), Massachusetts ($2,115), Connecticut ($2,106), and California ($2,055). States collecting the lowest amount of individual income tax collections per capita tax investment income but not wage income: Tennessee ($49) and New Hampshire ($66). Of the states that tax wage income, lowest collections per capita were in North Dakota ($465), Arizona ($574), Mississippi ($603), Louisiana ($612), and New Mexico ($676).

|