New: Financial State of the States 2018

From Truth in Accounting, September 24, 2018

You can view a PDF of the report HERE. (Hawaii pg 116-117)

Truth in Accounting released its ninth annual Financial State of the States report, a nationwide analysis of the most recent state government financial information. This comprehensive analysis of the 50 states’ finances includes the most up-to-date state finance and pension data, trends across the states, and key findings.

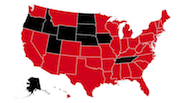

This year, the study found that 40 states do not have enough money to pay all of their bills and in total the states have racked up over $1.5 trillion dollars in unfunded state debt. The study ranks the states according to their Taxpayer Burden or Surplus™, which is each taxpayer's share of state bills after available assets have been tapped. Check out the data for your state at the State Data Lab.

* * * * *

HAWAII RANKS NO. 45 FOR ITS FISCAL HEALTH

FAST FACTS

Hawaii has $6.9 billion available in assets to pay $22.5 billion worth of bills.

The outcome is a $15.6 billion shortfall and a $31,600 Taxpayer Burden.

Despite reporting all of its pension debt, the state continues to hide $4.2 billion of its retiree health care debt.

Hawaii's reported net position is inflated by $3.1 billion, largely because the state defers recognizing losses incurred ·when the net pension liability increases.

Grade F:

Bottom line: Hawaii would need more than $20,000 from each of its taxpayers to pay all of its bills, so it has received an "F" for its finances from Truth in Accounting.

You can view a PDF of the report HERE. (Hawaii pg 116-117)

|