Pew: 34 states collect more in taxes than pre-Great Recession, when revenue plummeted

by Bethany Blankley, Watchdog.org, May 23, 2018

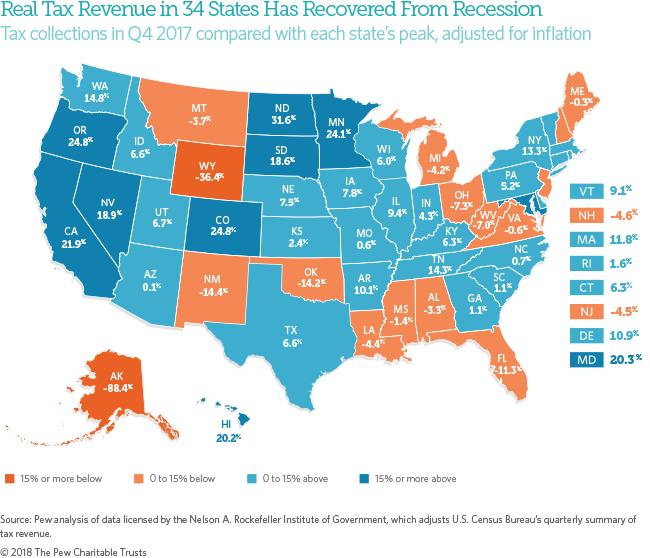

A decade after the start of the Great Recession, 34 states took in more tax revenue at the end of 2017 than 10 years ago just prior to the start of the global financial crisis, according to The Pew Charitable Trusts’ Fiscal 50 project.

But 16 states still collect less tax revenue than at their recession-era peaks, after adjusting for inflation, according to Pew. And most have less in reserves than they did before the last downturn.

Pew's analysis compares state tax receipts from when the Great Recession began in December 2007 to the fourth quarter of 2017. Accounting for each state’s peak quarter of revenue before the end of the recession and adjusting for inflation, nine states posted tax revenue rebounds of 15 percent or more: North Dakota (31.6 percent), Oregon and Colorado (24.8 percent), Minnesota (24.1 percent), California (21.9 percent), Maryland (20.3 percent), Hawaii (20.2 percent), Nevada (18.9), and South Dakota (18.6 percent).

In 2010, North Dakota was the first state to surpass its recession-era peak and has experienced the highest tax revenue growth since the recession. Oregon and Colorado (24.8 percent) tied for second-highest growth since their recession-era peaks. Both have a constitutional cap on tax revenue growth.

The state with the least was Alaska, which collected only about 12 percent as much in inflation-adjusted tax dollars as it did in 2008….

Collectively, state tax revenue swelled to a high of 9.1 percent above its 2008 peak (adjusting for inflation), representing an increase of 1.9 percent from the last quarter. Pew notes it was “among the largest jumps in quarterly tax revenue since the economic recovery began. The latest results mean that the 50 states combined had the equivalent of 9.1 cents more in purchasing power in the fourth quarter of 2017 for every $1 they collected at their peak in 2008.”

As of the fourth quarter of 2017, without adjusting for inflation, 50-state tax revenue was 25.2 percent above peak and tax collections had recovered in 47 states – all except Alaska, Oklahoma and Wyoming. Sixteen states’ tax collections were still below peak by the last quarter of 2017.

Increased revenue growth appears to have been affected by several factors, experts note. Many states reported robust gains at the end of 2017, as Congress prepared to pass the Tax Cuts and Jobs Act.

“An unusually large number of states,” 15, reported tax revenue spikes by at least 10 percent in the fourth quarter of 2017, compared to the same period the prior year, Pew reports.

Some growth was driven by taxpayer behavior, resulting in a one-time revenue increase derived from personal income taxes, hedge fund earnings, and robust stock market growth.

Some growth was driven by tax increases. State tax collections rose sharply in the fourth quarter of 2017. Louisiana, notably, raised sales, cigarette, and alcohol taxes in 2016. And Illinois raised its income tax once temporarilly in 2011 with rollbacks in 2015, and again in the summer of 2017, effective for the fiscal year that started July 1.

The National Association of State Budget Officers reports that “states in the past three fiscal years have enacted more tax increases than cuts overall, while doing the opposite in fiscal years 2014 and 2015."

Barb Rosewicz, director of the Fiscal 50 project, said that “state tax actions resulted in an expected net increase in 50-state revenue in the past three fiscal years, which reflect a combination of a state’s economic change and explicit policy actions“ such as tax increases and decreases.

While some may argue that a national trend of states increasing taxes is on the rise, Rosewicz told Watchdog.org, “the evidence doesn’t support this conclusion. Large changes in just a handful of states can result in a net tax revenue increase, despite more states lowering rather than raising taxes. Even though there was a net increase in revenue expected for fiscal 2017, 20 states enacted net revenue decreases compared with just 11 making net increases.”

Many states raised taxes to address shortfalls in fiscal years 2010 and 2011, she said. But since then, only in 2016 and 2018 did states enact a greater number of increases than cuts.

“The recent increases coincide with a period of exceptionally slow revenue growth and tight budgets for many states,” Rosewicz said.

J. Scott Moody, director of the Family Prosperity Initiative, cautioned about tax increases and offered solutions for states to deal with economic fluctuations.

“Higher taxes during economic downturns only serve to increase the severity of the downturn and put states in a deeper financial hole," Moody told Watchdog.org. "To prevent having to raise taxes during economic downturns, more states should enact tax and expenditure limitations (TELs) such as Colorado’s pioneering Taxpayer Bill of Rights. A well-designed TEL should limit the growth in spending during good economic times and set aside some of the budget surplus into a rainy day fund. The rainy day fund can be drawn down during economic downturns in order to avoid the whiplash of higher taxes.”

The Nelson A. Rockefeller Institute of Government warns that the growth states are experiencing may be short-lived. States face uncertainty from the effects of federal tax changes because many of their constitutional budget processes and state income tax rules are connected to the federal tax code and are directly affected by federal rule changes. In Louisiana’s Constitution, for example, the state tax rate automatically increases when federal taxes decrease.

“As states come out of a period of exceptionally slow revenue growth, the volatile revenue pattern ahead poses a new challenge,” the Pew report states. “Even a return to peak levels can leave states with little extra to make up for cuts in federal aid or to pay for costs associated with population increases, growth in Medicaid enrollment or deferred needs.

“Looking ahead, the federal tax cut passed in December incorporates a range of changes to federal tax exemptions, deductions, and credits that could carry over and trigger changes in state tax collections. Some states have altered their tax codes in response to federal action,” Pew adds.

“A harder question is where are tax revenues going to go in the future, in light of burgeoning debt and unfunded retirement benefits. That is definitely a matter of concern, and more alarming in some states than others,” Bill Bergman, director of Research at Truth in Accounting, told Watchdog.org after reviewing the data.

---30---

Link: Fiscal 50 Project

AP: Study: Some public pensions funds could run dry in downturn