The Best States to Flip Your Home Are in the East, Study Finds

Learn which states are profitable for house flippers.

by Lauren Monitz, GoBankingRates.com, April 18, 2018

Flipping houses often sounds like easy money: Buy an older home, do a little fixing up, make it look pretty and sell it shortly thereafter. However, it’s not that easy — especially if you live in a state where house flipping just isn’t that profitable.

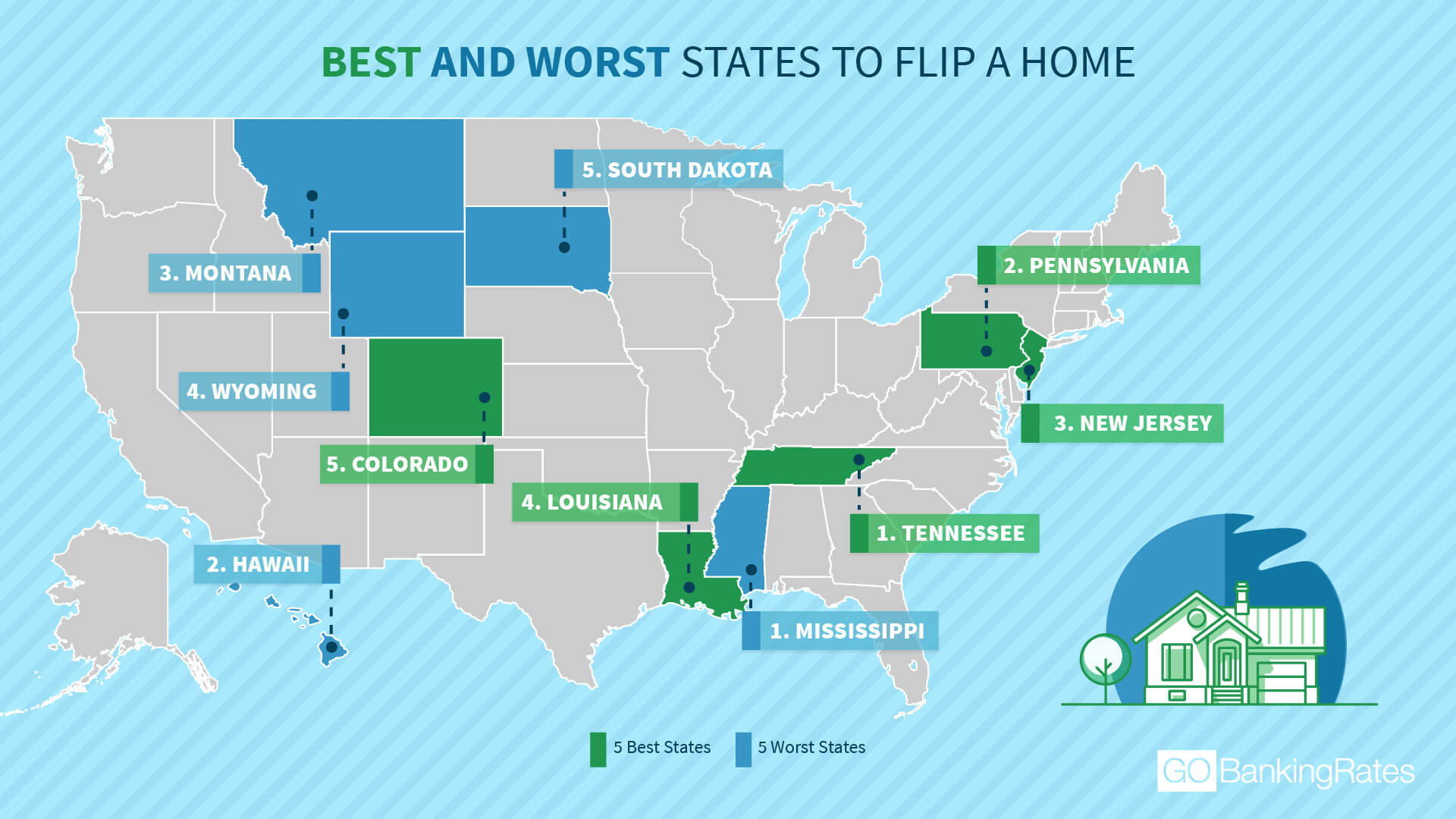

If you want to start flipping homes, give yourself the best chance of success by doing your research. The five best states for house flipping are Tennessee, Pennsylvania, New Jersey, Louisiana and Colorado, according to a recent GOBankingRates study.

The study looked at the median list price, how long it took to flip a house, the average gross profit and the average return on investment of each flip. Lower prices boosted a state’s ranking because you don’t have to tie up as much capital. States with faster average flip times also ranked higher because the sooner you can get your money out of one flip, the sooner you can reinvest it in another home. Of course, the higher the returns, the better the states fared in the rankings.

The best states for flipping houses are primarily in the East, with Colorado being the only state completely west of the Mississippi River to make the top 10 best states.

The worst states for flipping are predominantly landlocked states west of the Mississippi, with Mississippi the only state in the bottom 10 located east of the Mississippi River. Hawaii found its way into the bottom 10 due to its high housing costs to even buy a house, and it’s the only state in the study west of the Mississippi that isn’t landlocked.

©GOBankingRates

The best states also have much faster turnover times for their flips. Among the top 10 states, the average days to flip is 180. Among the bottom 10, flips take an average of 203 days. While 203 days might not sound like a lot of time, that’s over three weeks more per flip. Plus, if you’re borrowing the money to buy each home you flip, that’s 23 more days of interest you have to pay on potentially a few hundred thousand dollars.

In Tennessee, which took the top spot in the study, the average flip time is only 147 days. In Wyoming, which has the slowest turnover time, it’s 231 days — an 84-day difference. Mississippi, the worst state in the study, averages 220 days but fared the worst in the study because it had the smallest average gross profit and average gross ROI of any state.

Here are the 10 best states for house flipping:

| Rank |

State |

Average Listing Price |

Days to Flip |

Average Profit |

Average ROI |

| 1 |

Tennessee |

$268,692 |

147 |

$57,600 |

132.7% |

| 2 |

Pennsylvania |

$224,090 |

199 |

$105,190 |

162.4% |

| 3 |

New Jersey |

$372,916 |

207 |

$102,300 |

141.6% |

| 4 |

Louisiana |

$232,610 |

166 |

$71,866 |

104.2% |

| 5 |

Colorado |

$538,477 |

176 |

$74,300 |

155.6% |

| 6 |

Maryland |

$369,454 |

198 |

$109,617 |

109.6% |

| 7 |

Virginia |

$341,015 |

184 |

$91,783 |

99.3% |

| 8 |

Florida |

$406,803 |

151 |

$59,917 |

83.0% |

| 9 |

Illinois |

$277,163 |

196 |

$77,317 |

110.0% |

| 10 |

Kentucky |

$213,848 |

172 |

$55,241 |

107.8% |

And here are the 10 worst states for house flipping:

| Rank |

State |

Average Listing Price |

Days to Flip |

Average Profit |

Average ROI |

| 1 |

Mississippi |

$195,390 |

220 |

$9,875 |

4.3% |

| 2 |

Hawaii |

$905,687 |

198 |

$76,266 |

27.7% |

| 3 |

Montana |

$314,959 |

223 |

$30,326 |

12.9% |

| 4 |

Wyoming |

$291,855 |

231 |

$33,475 |

18.0% |

| 5 |

South Dakota |

$238,163 |

188 |

$17,750 |

26.1% |

| 6 |

Idaho |

$349,000 |

182 |

$26,606 |

14.6% |

| 7 |

Utah |

$440,946 |

194 |

$49,295 |

27.9% |

| 8 |

New Mexico |

$254,798 |

203 |

$43,863 |

26.6% |

| 9 |

North Dakota |

$226,863 |

208 |

$54,934 |

39.6% |

| 10 |

Missouri |

$204,506 |

179 |

$36,475 |

47.3% |

2. Hawaii

- Median home list price: $905,687

- Average number of days to flip a home: 198

- Average gross profit: $76,266

- Average gross ROI: 27.7 percent

Hawaii has the seventh-smallest average gross ROI in flips at less than 30 percent. Plus, its median home list price of over $900,000, the highest nationwide, ties up a lot of your capital at a time, making it really hard for anyone — especially millennials — to buy a home there.

read … Full Report