How Much Income You Need to Afford the Average Home in Every State in 2018

From HowMuch.com

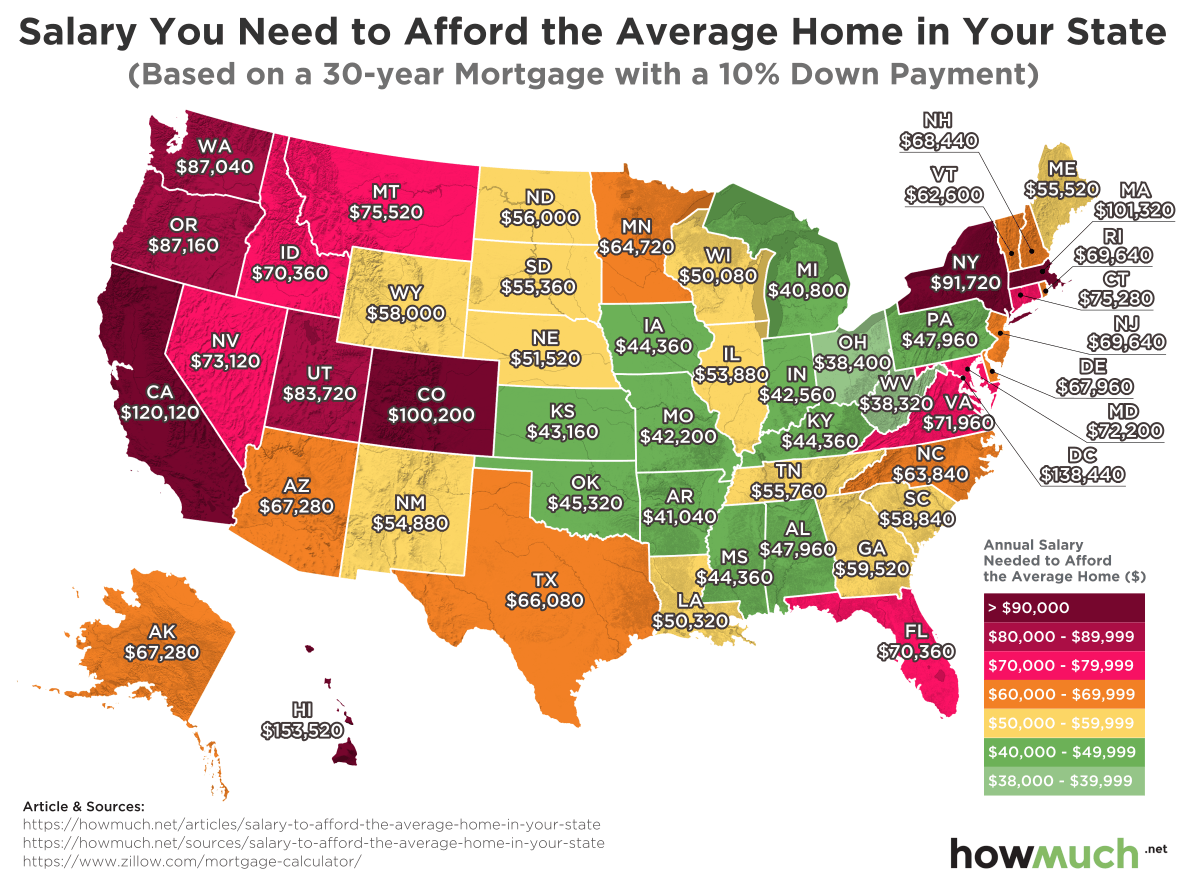

The housing market has not only recovered its pre-recession levels, but some observers are actually starting to worry about yet another housing bubble. Housing prices are on the rise, thanks in large part to extremely tight inventory, so it’s worth asking: are potential home buyers getting priced out of the market? The answer depends on where they live and how much money they make.

We collected average home prices for every state from Zillow which we then plugged into a mortgage calculator to figure out monthly payments. Remember, mortgage payments consist of both the principal and the interest for the loan. The interest rate we used varied from 4 to 5% in each state, depending on the market. The lower the interest rate, the lower the monthly payment. To keep things simple, we assumed buyers could contribute a 10% down payment. Another thing to keep in mind is that financial advisors commonly recommend the total cost of housing take up no more than 30% of gross income (the amount before taxes, retirement savings, etc.). Using this rule as our benchmark, we calculated the minimum salary required to afford the average home in each state.

Top Five Places Where You Need the Highest Salaries to Afford the Average Home

1. Hawaii: $153,520 for a house worth $610,000

2. Washington, DC: $138,440 for a house worth $549,000

3. California: $120,120 for a house worth $499,900

4. Massachusetts: $101,320 for a house worth $419,900

5. Colorado: $100,200 for a house worth $415,000

Top Five Places Where You Need the Lowest Salaries to Afford the Average Home

1. West Virginia: $38,320 for a house worth $149,500

2. Ohio: $38,400 for a house worth $149,900

3. Michigan: $40,800 for a house worth $160,000

4. Arkansas: $41,040 for a house worth $161,000

5. Missouri: $42,200 for a house worth $165,900

read … Full Report

HNN: Someone worked out how much income you need in every state to buy a home. Hawaii didn't do well

Bid for back taxes on online car rentals goes before state Supreme Court

HNN: The state and the nation's largest online travel companies squared off again before the Hawaii Supreme Court on Thursday.

The last time was three years ago, when the high court ordered Priceline, Expedia, Travelocity and others to pay $53 million in state back taxes for hotel room bookings dating back more than a decade.

Now, the state is arguing that the companies owe another $50 million in back taxes for car rental revenues it earned since 2004….

the ultimate decision on whether the state can tax online travel companies and Internet retailers like Amazon might not rest with Hawaii’s high court but with the U.S. Supreme Court.

The U.S. Supreme Court justices have agreed to hear North Dakota’s challenge to a 26-year-old case in which the high court barred states from collecting taxes from companies that don’t have a physical presence in their states.

Expecting a positive ruling, Hawaii lawmakers are now proposing to tax Internet companies that do more than $100,000 in annual sales and don't have a brick-and-mortar store here.

They said the measure could mean hundreds of millions more in taxes for Hawaii's treasury….

read … More Tax Hikes

Legislative News:

Cancer experts say don't block sale of sunscreen with oxybenzone

QUICK HITS:

Oahu tax preparer pleads guilty to filing phony returns