THE FINANCIAL STATE OF HONOLULU -- HONOLULU FINANCES STRUGGLING

From Truth in Accounting, January 24, 2018

Truth in Accounting's (TIA) new city report ranks and grades the 75 most populous cities in the United States by their financial health. Honolulu ranks No. 65, earning it a "D" on TIA's grading scale.

Decisions by city officials have left the city with a debt burden of $2 billion, according to TIA's analysis of its 2016 financial filings. That burden equates to $16,300 for every Honolulu taxpayer.

Honolulu's financial problems are largely driven by runaway entitlement obligations in two categories: pensions and retiree healthcare benefits. The city has $1.6 billion in unfunded pension promises and $1.9 billion in unfunded retiree healthcare benefits. While Honolulu has promised these benefits, little money has been set aside to fund them.

These statistics are jarring, but what's also alarming is that city government officials continue to hide significant amounts of retirement debt from their balance sheets, despite new rules to increase financial transparency. This skewed financial data gives residents a false impression of their city's overall financial health.

Data included in this report is derived from the city of Honolulu's 2016 audited Comprehensive Annual Financial Report and retirement plans' actuarial reports. Visit State Data Lab for more information.

HONOLULU FINANCIAL BREAKDOWN -- FAST FACTS

Honolulu has $2.6 billion available in assets to pay $4.6 billion worth of bills.

The outcome is a $2 billion shortfall and a $16,300 Taxpayer Burden™.Despite reporting all of its pension debt, the city reports less than 25 percent of its retiree healthcare debt. The city's total hidden debt amounts to $1.4 billion.

GRADE D

Bottom line: Honolulu does not have enough money to pay its bills, so it has received a "D" for its finances from Truth in Accounting. A "D" grade is given to cities with a Taxpayer Burden™ between $5,000 and $20,000.

PDF: HONOLULU REPORT

Financial State of the Cities 2016

From Truth in Accounting, January 24, 2018

You can view a PDF of the report HERE.

On January 24, Truth in Accounting released its second Financial State of the Cities report, a comprehensive analysis of the fiscal health of the nation's most populous cities based on fiscal year 2016 comprehensive annual financial reports. This year, we have expanded our study to include the 75 most populated cities.

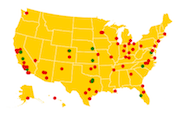

This year, the study found that 64 cities do not have enough money to pay all of their bills, and in total, the cities have racked up $335.4 billion in unfunded municipal debt. The study ranks the cities according to their Taxpayer Burden or Surplus™, which is each taxpayer's share of city bills after available assets have been tapped. Check out the data for your city at the State Data Lab.

Report findings

EXECUTIVE SUMMARY

Government reports are lengthy, cumbersome, and sometimes misleading documents. At Truth in Accounting (TIA), we believe that taxpayers and citizens deserve easy-to-understand, truthful, and transparent financial information from their governments.

This is our second Financial State of the Cities (FSOC) report, a comprehensive analysis of the fiscal health of the nation's most populous cities based on fiscal year 2016 comprehensive annual financial reports. This year, we have expanded our study to include the 75 most populated cities.

At the end of the FY 2016, 64 cities did not have enough money to pay all of their bills. This means that to balance the budget, elected officials have not included the true costs of the government in their budget calculations and have pushed costs onto future taxpayers. TIA divides the amount of money needed to pay bills by the number of city taxpayers to come up with the Taxpayer Burden. If there is a surplus, that number is likewise divided by the number of taxpayers to come up with the Taxpayer Surplus. We then rank the cities based on these measures.

We have also implemented a grading system for the cities to give greater context to each city’s Taxpayer Burden or Taxpayer Surplus. Based on our grading methodology, no cities received an A, 11 received B’s, 23 received C’s, 34 received D’s, and seven cities received an F.

However, TIA was unable to rank and grade two of the most populous cities—Newark and Jersey City in New Jersey—because they do not issue annual financial reports that follow generally accepted accounting principles, or GAAP. As a result, TIA included the next two most populated municipalities: Fort Wayne, Ind., and Irvine, Calif.

Cities in general do not have enough money to pay their bills. Based on our analysis, the total unfunded debt among the 75 most populous cities amounts to $335.4 billion. Most of this debt comes from unfunded retiree benefit promises, such as pension and retiree healthcare debt. This year, pension debt accounts for $210.7 billion, and other post-employment benefits—mainly retiree healthcare liabilities—totaled $119.5 billion.