|

|

Tuesday, September 19, 2017 |

|

Hawaii 6th Most Indebted State

By News Release @ 9:49 PM :: 7959 Views :: Hawaii State Government, Hawaii Statistics, Labor, Taxes

|

|

45th PLACE -- HAWAII FINANCES STILL IN PERIL

From Truth in Accounting

FAST FACTS --

- Hawaii has $6.3 billion available in assets to pay $19.5 billion worth of bills.

- The outcome: A $13.1 billion shortfall and a $27,100 taxpayer burden.

- Despite reporting most of its pension debt, the state continues to hide much of its retiree health care debt.

- The state's total hidden debt amounts to $4.8 billion.

THE STATE'S BILLS EXCEED ITS ASSETS

- $26,039,844,000 Assets

- -$15,707,113,000 Minus: Capital assets

- -$3,982,773,000 Restricted assets

- $6,349,958,000 Assets available to pay bills

- -$19,483,225,000 Minus: Bills

- -$13,133,267,000 Money needed to pay bills

- -$27,100 Each taxpayer's share of this debt

BILLS THE STATE HAS ACCUMULATED

- $9,875,637,000 -- Bonds

- $2,487,658,000 -- Other liabilities

- -$8,754,014,000 -- Minus: Debt related to capital assets

- $6,808,018,000 -- Unfunded pension benefits

- $9,065,926,000 -- Unfunded retiree health care Bills

- $19,483,225,000 – Bills

GRADE: F

Bottom line: Hawaii would need more than $20,000 from each of its taxpayers to pay all of its bills, so it has received an "F" for its finances from Truth in Accounting.

* * * * *

Financial State of the States

From Truth in Accounting, September 19, 2017

You can view a PDF of the report HERE.

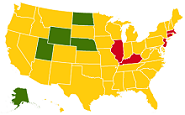

On September 19, Truth in Accounting released its annual Financial State of the States, a nationwide analysis of the most recent state government financial information. This is our eighth comprehensive analysis of the 50 state governments’ finances and includes background on new accounting standards coming into play, trends across the states, and key findings. This year, the study found that 41 states do not have enough money to pay all of their bills and in total the states have racked up over 1.5 trillion dollars in unfunded state debt. The study ranks the states according to their unique metric called the taxpayer burden or surplus. Check out the data for your state at the State Data Lab.

Report Findings

- TIA grades the states -- F grade: Taxpayer burden greater than $20,000 -- 9 states (New York, California, Delaware, Hawaii, Massachusetts, Kentucky, Connecticut, Illinois, and New Jersey)

- The Sunshine States

- The Sinkhole States

- Does your state balance its budget?

- Timeliness of state financial reports -- Here are the states that did not publish their financial reports within the 180-day deadline. (Hawaii 183 days)

- New pension standard brings greater transparency

- Retiree health care debt reporting rule will take effect in two years

- Why is truthful, transparent, and timely information important?

- Bring Full Accrual Calculations and Techniques (FACT) to budgeting

- Recommendations

- Methodology

- 50 state ranking (Hawaii Ranks 45th with debt of $27,100 per taxpayer see pg 118 for report)

|

|

|

|

|

|