Best and worst states for driving

By Michelle Megna, CarInsurance.com, June 13, 2016

Drivers are hitting the road in record numbers after years of decline.

“Americans drove 3.1 trillion miles in 2015, which was an all-time record and 3.5 percent higher than in 2014,” says Julie Hall, a spokesperson for the AAA National Office. “The great American road trip is back, largely due to cheaper gas prices.”

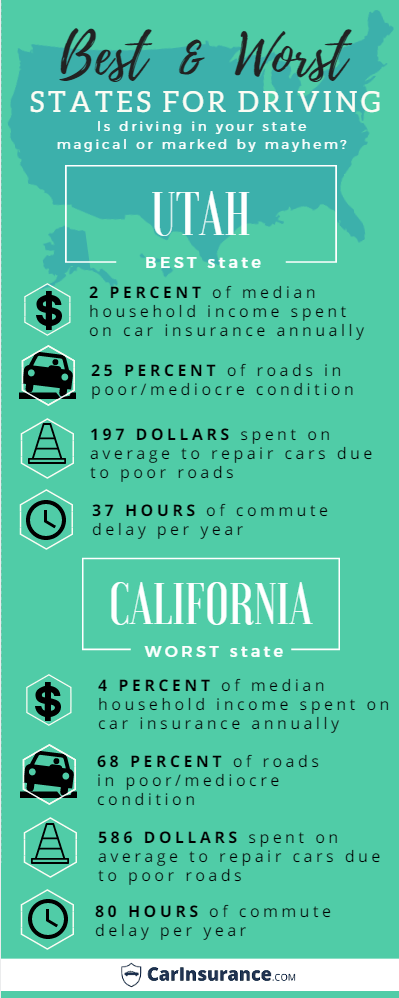

To kick off summer road trip season, CarInsurance.com ranked states on eight metrics to identify which ones are more favorable for motorists. Utah and Minnesota lead the nation, ranked at No. 1 and No. 2 respectively. California scored the worst at No. 50, with Oklahoma at No. 49.

Each state was scored on the following factors:

- Insurance -- Percent car insurance is of median household income

- Uninsured drivers -- Estimated percent of uninsured drivers

- Traffic fatalities -- Annual traffic deaths per 100,000 population

- Roads -- Percent of roads in poor/mediocre condition

- Bridges -- Percent of bridges deemed structurally deficient

- Repair costs -- Estimated extra cost of car repair due to driving on bad roads

- Gas -- Average price of a gallon of gasoline

- Commute delay -- Yearly delay, in hours, per auto commuter in state’s most congested city

- Byways -- Number of federally designated byways (the umbrella term for the collection of 150 distinct and diverse roads designated by the U.S. Secretary of Transportation that includes National Scenic Byways and All-American Roads) used as a tie-breaker

Best and worst states for driving:

|

|

Overall Rank |

Insurance |

Uninsured Drivers |

Traffic fatalities |

Roads |

Bridges |

Repairs |

Gas |

Commute delay

|

| Hawaii |

15 |

1.54% |

8.90% |

6.7 |

49% |

44% |

$515 |

$2.60 |

50 hours |

How best and worst states scored for driving

States that fared well had high scores for favorable road conditions, as well as cheap car insurance, gas and repair costs, and fewer traffic fatalities and hours of commuter delays. In Utah, for example, 2 percent of the median household income goes to car insurance, compared to 4 percent in California. A quarter of Utah’s roads are in bad shape, but the majority -- 68 percent -- of California’s are defined as poor/mediocre. California ($586) was second only to New Jersey for the cost per motorist for road repairs. Utah ($187) was among the least expensive states. California also took the top spot for most expensive gas and for having the longest commuter delays.

Percent of roads in poor/mediocre condition

States with the highest and lowest percentage of roads in poor/mediocre condition are, literally, all over the map. That’s to say there is no one region of the country that has the majority of roads in either great or poor shape. Connecticut and Illinois have the highest percentage of roads in bad shape, both with 73 percent, followed by Wisconsin with 71 percent. Indiana (17%) and Georgia (19%) have the least, according to the U.S. Department of Transportation (DOT).

Car repair costs due to poor road conditions

Both coasts are represented in the top spots for how much drivers pay each year to fix their cars due to damage from bad road conditions, according to DOT data. New Jersey has the highest price, $601, followed by California with $586. Georgia’s cost is just a fraction of those, at $60, the least expensive in the nation, followed by Florida at $128.

Hourly commuter delay per year

Commuters plagued by long delays live on both coasts, while those with the shortest commuter delays are clustered in the Midwest. The Urban Mobility Scorecard research report by the Texas A&M Transportation Institute and INRIX calculated how many hours per year a commuter is delayed by traffic in the state's most congested city. California (Los Angeles; 80 hours) ranked No. 1, followed by New Jersey (Newark; 74 hours) and New York (New York City; 74 hours) for longest commuter delays. North Dakota drivers have the shortest delay in the country, 10 hours, followed by Wyoming, with 11.

Percent of annual median income spent on car insurance

To put car insurance costs in context, we calculated the percent of each state’s annual median household income that’s spent on car insurance, using average car insurance rates by state.

Michigan and Louisiana checked in at the first and second spots, respectively, for highest percentage, both at nearly 7 percent. Michigan’s average annual car insurance rate is $3,535; annual median household income is $52,005. In Louisiana, the average rate per year is $2,819; median income is $42, 406.

Hawaii (average rate, $1,095; median income, $71,223) was the lowest at 1.54 percent, followed by New Hampshire (average rate, $1,514; median income, $73,397) at 2 percent.

Driver survey: 24% of motorists ‘dread’ driving

CarInsurance.com commissioned a survey of 1,000 drivers asking them about what they find most pleasurable and most bothersome when behind the wheel.

Here is how motorists described their driving experience when running errands and commuting:

- I find it very enjoyable: 32%

- I find it stressful but don't dread it: 25%

- I find it super stressful and I dread it: 24%

- I don’t think too much about it either way: 19%

Traffic and fellow drivers are tops among the most irritating factors contributing to a negative vibe behind the wheel:

- Traffic: 50%

- Other drivers’ bad behavior behind the wheel: 48%

- Poor physical road conditions, such as potholes: 39%

- Poor infrastructure, such as poorly planned intersections: 31%

- Road or bridge construction: 30%

- Expensive car insurance rates: 25%

- Inclement weather: 21%

On the upside, here is what motorists said contribute to a more Zen experience when driving:

- Majority of roads maintained: 48%

- Lots of scenic routes: 45%

- Good weather: 34%

- Cheap car insurance rates: 32%

Methodology:

Weighted rankings were calculated based on the following:

Annual traffic deaths per 100,000 – 20%

Average annual insurance cost as percent of median household income – 20%

Percent of roads in poor/mediocre condition – 20%

Estimated cost per motorist in state to repair roads and bridges – 10%

Average price of gallon of gas – 10%

Yearly delay per auto commuter – 10%

Percent of bridges deemed structurally deficient – 5%

Estimated percent of uninsured drivers – 5%

Sources:

Average annual cost of insurance:

CarInsurance.com commissioned Quadrant Information Services to field rates from six major insurers in 10 ZIP codes of each state.

Median annual household income:

U.S. Census Bureau

Estimated percentage of uninsured motorists:

Insurance Information Institute

Annual traffic deaths per 100,000 population (2014):

Insurance Institute for Highway Safety Highway Loss Data Institute

Percent of roads in poor/mediocre condition:

Percent of bridges deemed structurally deficient:

Estimated cost per motorist in state to repair roads and bridges:

U.S. Department of Transportation

Average price of regular gasoline (4/8/2016)

AAA Fuel Gauge Report

Yearly delay per auto conmuter:

Most congested city in state:

Texas A&M Transportation Institute, 2015 Urban Mobility Scorecard

Number of byways:

U.S. Department of Transportation Federal Highway Administration

Driver survey:

CarInsurance.com commissioned Op4g to conduct a survey of 1000 drivers. The online survey was fielded in March 2016.

LINK: Hawaii Car Insurance Info