Hawaii in Critical Fiscal Condition

Study of State Solvency Ranks Hawaii in Bottom 10 Nationwide

News Release from Grassroot Institute

HONOLULU, Hawaii—January 14, 2014—A nationwide study found Hawaii ranks number 43 nationwide as one of the states whose finances are reaching a critical point. The study, which was conducted by the Mercatus Center at George Mason University, considered and weighted a variety of financial indices, including cash solvency, budget solvency, long-run solvency, and service level solvency, in formulating their rankings.

Though the report specifies that the findings reveal a, “snapshot in time,” for the states, the rankings are reflective of general fiscal health and policy—a fact that underlines Hawaii’s spending and budget issues as well as the problem of unfunded liabilities that continue to damage the state economic outlook. Hawaii ranked 24th in cash solvency (whether the state has cash on hand to meet short-term obligations), but was 47th in budget solvency, 40th in long-run solvency (ability to cover long-term obligations), and 42nd in service-level solvency (whether the government has sufficient resources to provide adequate services for residents).

“Again, we see the effect of continual fiscal mismanagement,” states Keli’i Akina, Ph.D., President of Grassroot Institute of Hawaii, the state’s free market think-tank and advocate for greater fiscal responsibility. “Taxpayers and citizens must demand greater accountability from our political leaders or we will see our spending and budget shortfalls continue to damage Hawaii’s economic well-being.”

With the legislature primed to consider new bills related to taxes, spending, and unfunded liabilities, Dr. Akina called on legislators to heed the warnings contained in the Mercatus Center’s State Fiscal Condition Report: "As Hawaii's legislators begin a new session, we urge them to consider sound fiscal policies which will raise Hawaii out of the 'Bottom 10' grouping of states in terms of fiscal condition. Serious and workable measures are needed immediately not only to reduce the State's unfunded liabilities, but to reverse the trend of borrowing from the future to pay for the past."

The Mercatus report can be downloaded and read in full at http://mercatus.org/publication/state-fiscal-condition-ranking-50-states.

###

State Fiscal Condition: Ranking the 50 States

by Sarah Arnett, Mercatus Center, Jan 14, 2014

LINK: DOWNLOAD PUBLICATION PDF

New research from Sarah Arnett examines states’ abilities to meet their financial obligations in the face of state budget challenges that have far outlasted the Great Recession. Fiscal simulations by the Government Accountability Office suggest that despite recent gains in tax revenues and pension assets, the long-term outlook for states’ fiscal condition is negative (GAO 2013). These simulations predict that states will have yearly difficulties balancing revenues and expenditures due, in part, to rising health care costs and the cost of funding state and local pensions.

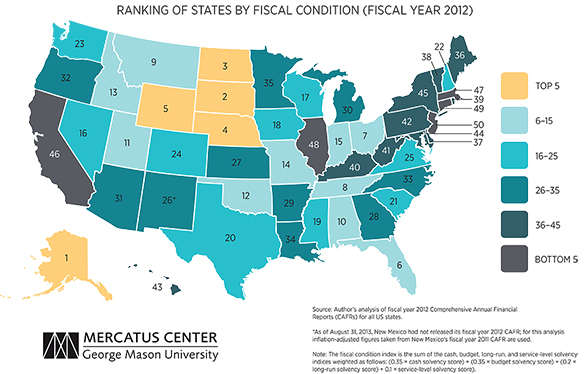

Arnett uses four different indices to analyze state solvency using each state’s fiscal year 2012 Comprehensive Annual Financial Report data. She then weights these four indices to create the State Fiscal Condition Index below.

Cash Solvency -- Hawaii 24th

A state’s cash solvency takes into account the cash the state can easily access to pay its bills in the near term, reflecting the state government’s liquidity. The map below indicates that most states have enough cash on hand to meet their short-term obligations.

Budget Solvency -- Hawaii 47th

A state’s budget solvency is its ability to create enough revenue to cover its expenditures over a fiscal year. Budget solvency varies greatly across states. As the map below shows, in fiscal year 2012-13 states had an operating ratio below 1, indicating a budget deficit.

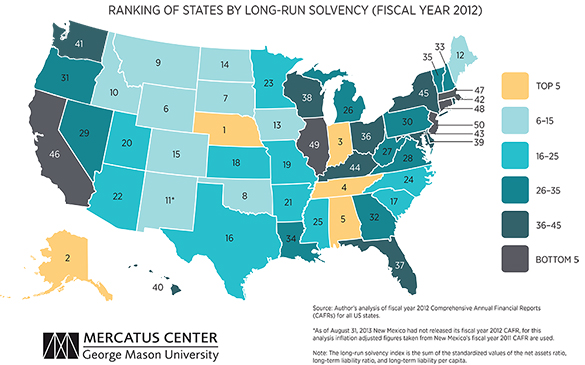

Long-Run Solvency -- Hawaii 40th

Long-run solvency measures a state’s ability to use incoming revenue to cover all its expenditures, including long-term obligations such as guaranteed pension benefits and infrastructure maintenance. Long-run solvency is less sensitive to economic trends than the other measures examined here.

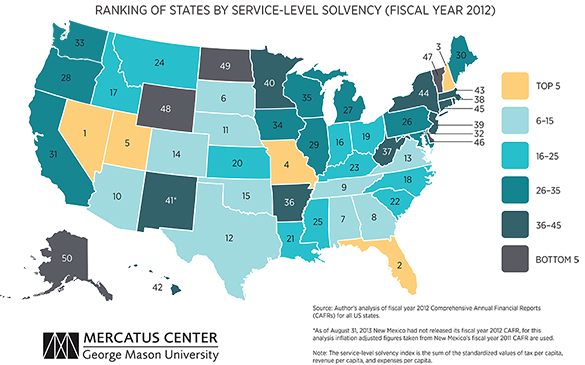

Service-Level Solvency -- Hawaii 42nd

Service-level solvency is the most difficult to measure because it reflects whether state governments have the resources to provide their residents with an adequate level of services. A state’s service-level solvency is measured using taxes and revenue per capita, along with expenditures per capita.

State Fiscal Condition Index -- Hawaii 43rd

Using the four solvency indices above, Arnett creates an overall State Fiscal Condition Index. She improves on past research about fiscal metrics by weighting each solvency indicator based on the timeframe in which it will affect state residents. Although the ranking is a snapshot in time, the states at the bottom are there due to years of poor financial management decisions, bad economic conditions, or a combination of the two. New Jersey and Connecticut face similar problems: tax revenues that have not kept up with expenditures, use of budget practices that only appeared to balance their annual budgets, and significant debt levels as a result of decades of using bonds without being able to pay for them (State Budget Crisis Task Force 2012). In addition, both states have underfunded their pension systems, resulting in billions in unfunded liabilities.

Click here to read the >>> entire paper.