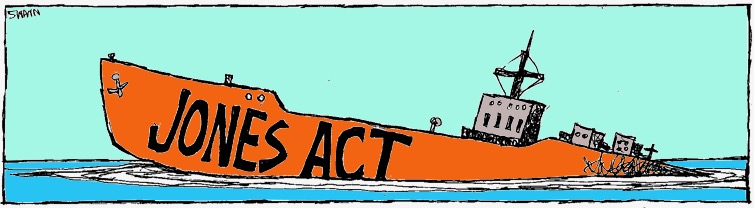

Recent headlines support idea that Jones Act makes no economic sense

from Grassroot Institute

Last week’s headlines confirm that the 1920 federal maritime law known as the Jones Act — a century-old problem for Hawaii — drives up shipping costs for aluminum cans, oil and gas, wind energy and just about everything else. Among recent articles selected for your reading pleasure:

>> In “Soda Cans Simply Hit Different In Hawaii,” Mashed, May 1, Jess Jezioroswki writes about one reason soda cans in Hawaii are so different from those manufactured on the mainland. “The cost of doing business across an ocean is very expensive. Everything needs to be shipped to the islands, and a 100-year-old law called the Jones Act increases shipping costs, according to Grassroot Institute of Hawaii.”

>> In “The Jones Act’s Role in Encouraging Puerto Rico’s Use of Russian Energy,” Cato Institute, May 1, Colin Grabow and Alfredo Carrillo Obregon write that until Russia invaded Ukraine, the U.S. territory of Puerto Rico imported liquified natural gas and oil from Russia on a regular basis. They asked: Why would the island import LNG from distant Russia rather than the much closer U.S. mainland — one of the world’s top exporters of LNG? They answered: “A large part of the answer almost certainly lies in U.S. maritime protectionism. Of the world’s more than 640 LNG tankers, zero comply with the [Jones Act].”

>> Speaking of LNG, in “Shell delivers first LNG cargo to US Navy in Guantanamo Bay on Avenir vessel,” TradeWinds, May 2, Lucy Hine writes that the U.S. Navy is using foreign-flagged tankers to move the fuel to its Guantanamo Bay base, partly because there are no available Jones Act LNG tankers and partly because Gitmo is leased from Cuba, a foreign destination, so shipments from the U.S. do not need to be carried on Jones Act ships.

>> In “Shipbuilding Contributes to Higher Costs in US Offshore Wind,” Offshore Engineer, May 1, Eric Haun writes that the Jones Act has posed a challenge to states exploring the possibility of building offshore wind farms, especially its requirement that many of the ships associated with turbine installation be built in the United States. “The price to build these vessels in the U.S. — where labor costs are only expected to increase — is considerably higher than it is for those being built in Asia and Europe,” Haun writes. “According to Intelatus, the price for a newly built Jones Act-compliant SOV [service operations vessel] comes with a 40% to 140% premium compare to SOVs being built for Europe.”

|