Click image to download a five-page PDF of this policy brief.

America’s Rising Housing Prices

by Randall O’Toole, The Antiplanner, February 1, 2022

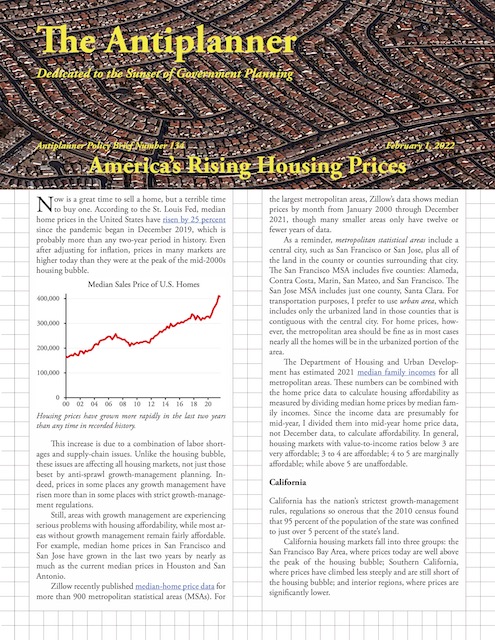

Now is a great time to sell a home, but a terrible time to buy one. According to the St. Louis Fed, median home prices in the United States have risen by 25 percent since the pandemic began in December 2019, which is probably more than any two-year period in history. Even after adjusting for inflation, prices in many markets are higher today than they were at the peak of the mid-2000s housing bubble.

This increase is due to a combination of labor shortages and supply-chain issues. Unlike the housing bubble, these issues are affecting all housing markets, not just those beset by anti-sprawl growth-management planning. Indeed, prices in some places without any growth management have risen more than in some places with strict growth-management regulations.

Housing prices have grown more rapidly in the last two years than any time in recorded history.

Still, areas with growth management are experiencing serious problems with housing affordability, while most areas without growth management remain fairly affordable. For example, median home prices in San Francisco and San Jose have grown in the last two years by nearly as much as the current median prices in Houston and San Antonio.

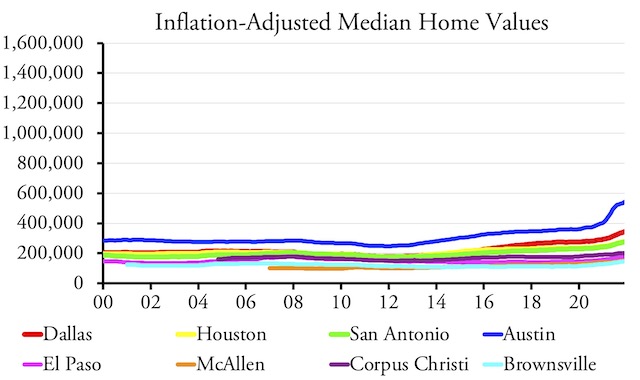

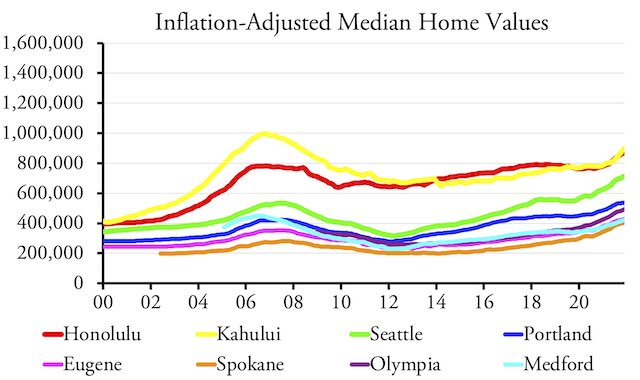

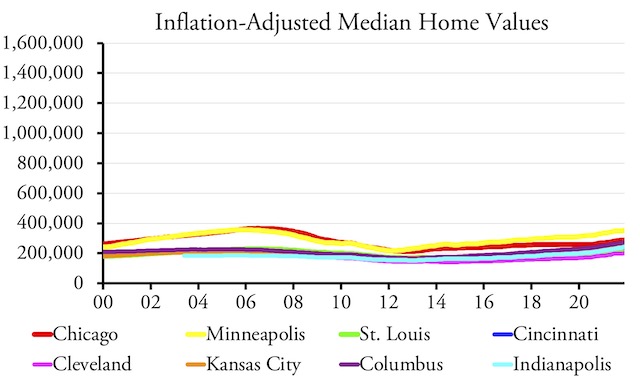

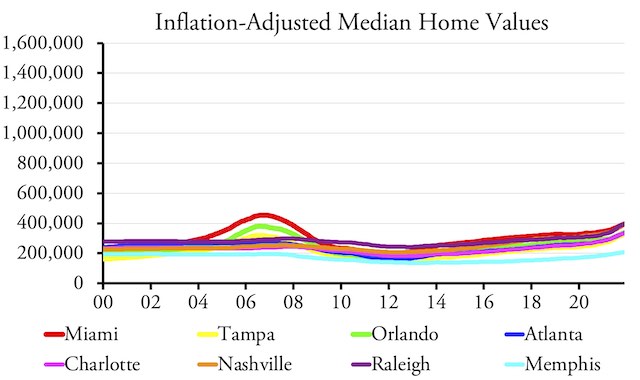

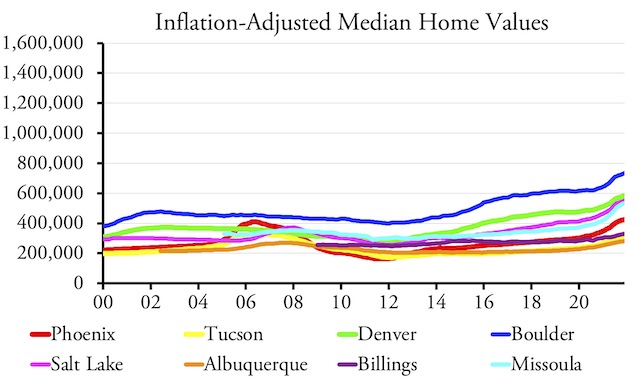

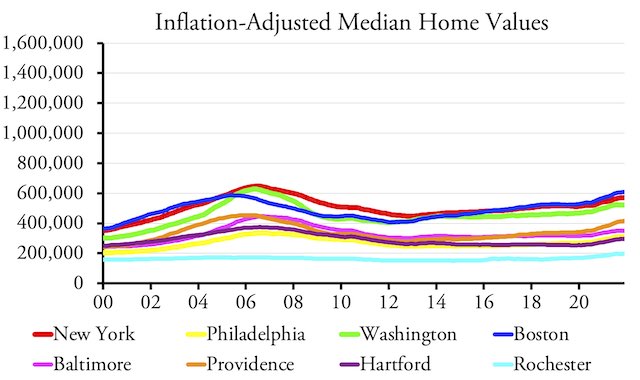

Zillow recently published median-home price data for more than 900 metropolitan statistical areas (MSAs). For the largest metropolitan areas, Zillow’s data shows median prices by month from January 2000 through December 2021, though many smaller areas only have twelve or fewer years of data.

As a reminder, metropolitan statistical areas include a central city, such as San Francisco or San Jose, plus all of the land in the county or counties surrounding that city. The San Francisco MSA includes five counties: Alameda, Contra Costa, Marin, San Mateo, and San Francisco. The San Jose MSA includes just one county, Santa Clara. For transportation purposes, I prefer to use urban area, which includes only the urbanized land in those counties that is contiguous with the central city. For home prices, however, the metropolitan area should be fine as in most cases nearly all the homes will be in the urbanized portion of the area.

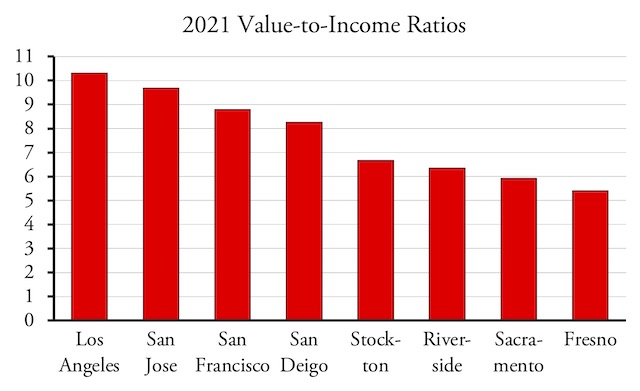

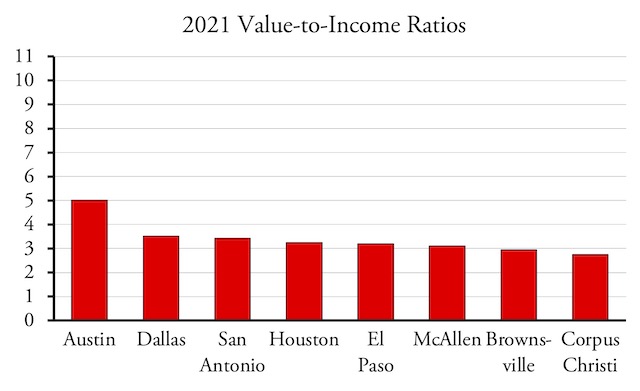

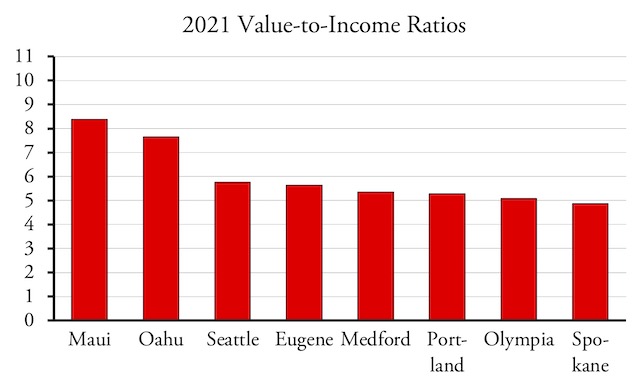

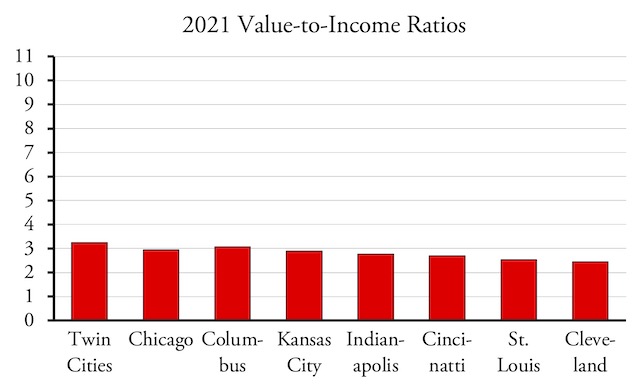

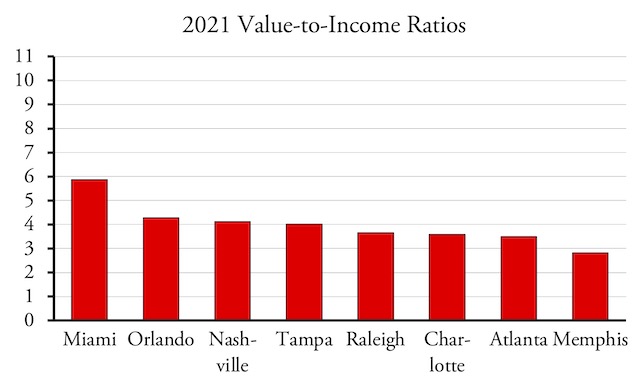

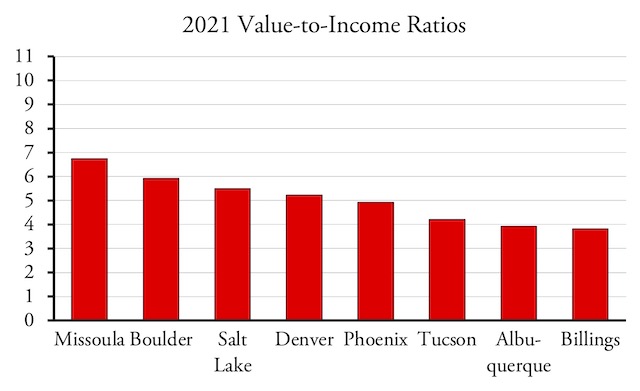

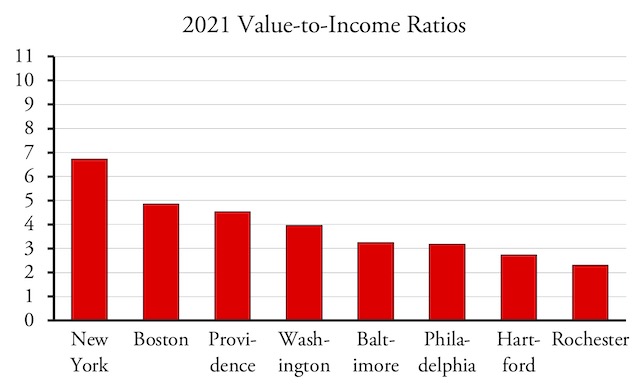

The Department of Housing and Urban Development has estimated 2021 median family incomes for all metropolitan areas. These numbers can be combined with the home price data to calculate housing affordability as measured by dividing median home prices by median family incomes. Since the income data are presumably for mid-year, I divided them into mid-year home price data, not December data, to calculate affordability. In general, housing markets with value-to-income ratios below 3 are very affordable; 3 to 4 are affordable; 4 to 5 are marginally affordable; while above 5 are unaffordable.

California

California has the nation’s strictest growth-management rules, regulations so onerous that the 2010 census found that 95 percent of the population of the state was confined to just over 5 percent of the state’s land.

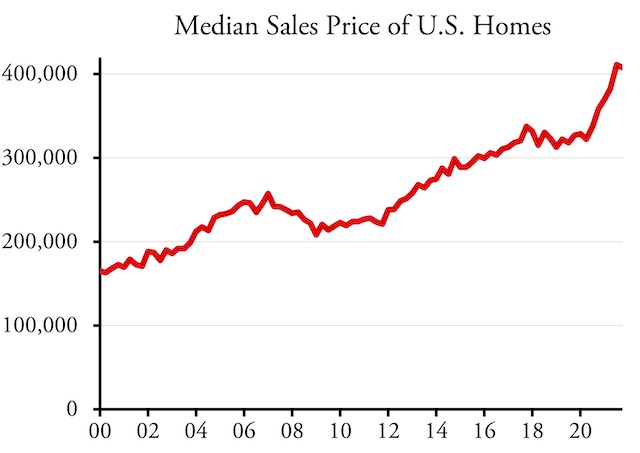

California housing markets fall into three groups: the San Francisco Bay Area, where prices today are well above the peak of the housing bubble; Southern California, where prices have climbed less steeply and are still short of the housing bubble; and interior regions, where prices are significantly lower.

Unfortunately, even housing markets in the interior are unaffordable, with value-to-income ratios above 5. On the coast, Los Angeles is the least affordable even though its prices are lower than the Bay Areas, as its median family incomes are also lower.

Texas

Texas has become known as the antithesis of California, and this is particularly true for housing. Cities may have single-family zoning and other zones, but counties aren’t allowed to zone outside of the cities. Houston famously has no zoning; in some areas it has setbacks and height limits but buildings can be used for housing, commercial, industrial, or any other purposes. Instead of zoning, Houston and developments in unincorporated areas use protective covenants or deed restrictions to limit uses, as developers know that potential homebuyers are more likely to buy if they know the neighborhoods they buy into will not be radically altered in the future.

This lack of regulation, especially in rural areas, has made Texas one of the most affordable housing markets in the world. Texas urban areas didn’t even go through a housing bubble in the mid-2000s. Despite pandemic-related prices increases, most markets remain affordable.

Austin is the exception. The city has strictly limited growth within its borders, making housing expensive. However, the city has little control over its suburbs, which are still relatively affordable.

Hawaii and the Northwest

In 1961, Hawaii became the first state in the nation to pass a growth-management law. As late as the early 1970s, housing was affordable almost everywhere in the country except Hawaii. Oregon followed in 1973 and Washington in 1992.

Oregon requires its cities to regularly evaluate their housing needs and expand their boundaries when necessary. Hawaii and Washington do not, so Seattle’s housing is less affordable than Portland’s. Washington’s law is stricter in the western part of the state, so Spokane housing is more affordable than most markets in the Northwest.

The Midwest

States in the middle of the United States present a sharp contrast to the Northwest. Many midwestern urban areas are growing quite fast, particularly Columbus and Indianapolis, yet remain affordable. Kansas City is one of the least congested major urban areas in the nation.

The only midwestern urban area that has attempted to manage its growth is the Twin Cities, and it shows in higher housing prices than other areas in the region—yet they are only a little higher and don’t come close to being unaffordable. This is because growth management in Pacific Coast states is regulated by the states, while in the Twin Cities it is regulated by the regional government, which has no say over counties outside of its region.

Despite the lack of growth management in other parts of the Midwest, urban sprawl hasn’t come close to paving over farms and rural areas. While “only” 89 percent of Ohio remains rural, in other midwestern states it ranges from 93 to 98 percent.

The South

Florida passed a growth-management law in 1985, becoming one of only two southern states to do so. The law required cities and counties to impose concurrency requirement on new development, meaning all infrastructure would have to be fully financed before new development could take place. This is a huge barrier to housing, especially for the large developments that keep housing affordable.

As a result of this law, Florida experienced a housing bubble in the mid-2000s. This persuaded the Florida legislature to repeal the growth-management mandate in 2011, but it still allowed cities keep concurrency requirements, and most do. However, some, including Tallahassee and Jacksonville, are quite affordable.

Tennessee is the other southern state to pass a growth-management law, and it mainly used the law to control annexations. Most parts of Tennessee remain affordable, but Nashville is only marginally affordable.

Other southern states, including Georgia and North Carolina, don’t try to control urban growth. After Dallas and Houston, Atlanta is the third-fastest growing urban area in the nation, yet remains quite affordable.

The Mountain States

The only state in the Rocky Mountain and intermountain regions to pass a growth-management law is Arizona, and its law is relatively weak. However, several urban areas, notably Boulder, Denver, Salt Lake City, Missoula, Kalispell, and Bozeman, have attempted to limit urban growth. This has made housing locally expensive, but in most cases people can escape high housing costs by moving to a nearby county.

In the 1970s, Boulder pioneered growth-management planning by limiting new housing within the city limits and buying land or development in a greenbelt around the city that eventually covered nearly ten times the land area of the city itself. This has made Boulder the most expensive housing market outside of California or Hawaii. It also pushed low-income workers out of the city, so the median family income of the remaining residents is more than $115,000 a year.

Denver’s regional government adopted an urban-growth boundary in 1997. This has made Denver and its suburbs expensive, though not as expensive as nearby Boulder. Salt Lake City’s regional government has encouraged cities in the area to preserve land from development, which has also made housing expensive.

Montana’s six largest cities are split. Bozeman, Kalispell, and Missoula have passed growth-management plans while Billings, Great Falls, and Helena have not, making the latter much more affordable than the former. When taking incomes into account, housing in these three communities is less affordable than Boulder’s. Recently, Lewis & Clark County (Helena) has been considering zoning all rural lands for 20-acre minimum lot sizes, which could make Helena housing as expensive as Missoula’s or Bozeman’s.

The Northeast

Most New England states have passed growth-management laws as have New Jersey and Maryland. However, the real decisions in these states are made at the county or city level. Many New England states have given up on the county level of government, giving cities and towns control over land-use regulation outside their borders. In most cases, the cities have imposed large-lot zoning on rural lands, preventing new housing developments that could keep housing affordable. This has made Boston particularly expensive.

New York City is hemmed in by Westchester County to the north, Connecticut to the east, and New Jersey to the west and south. All of these have growth restrictions, which has made New York City housing expensive. Other New York cities, such as Albany and Rochester, remain affordable.

Maryland’s Montgomery County, which is north of the District of Columbia, has used restrictive zoning to prohibit development of about two-thirds of its land area. Prince George’s County, to the west of DC, is not so restrictive and it remains the most affordable county in the DC area. In Virginia, 80 percent of Loudoun County, which is southwest of DC, is rural, but agricultural preservation rules limit development there. In short, regulations in the counties around DC have made its housing market expensive. Housing remains affordable in other Virginia urban areas that don’t try to restrict growth.

Where to Move?

The pandemic has led to a great upheaval, as people have quit their jobs or are insisting on working at home as the pandemic becomes endemic. These changes have given many people more control over where they live, and cost is an important factor when people choose where to move.

In general, the South (except most of Florida) and the Midwest are much more affordable than the Northeast or Pacific Coast states. The Rocky Mountain and Intermountain regions are mixed: Albuquerque is affordable while Santa Fe is not; Great Falls is affordable while Kalispell is not; Cedar City, Utah is affordable while St. George is not.

Within any given region, smaller urban areas tend to more affordable than bigger ones because smaller areas usually have less restrictive growth policies. Tucson is more affordable than Phoenix; Colorado Springs is more affordable than Denver. This isn’t a hard-and-fast rule, however: Billings is the biggest city in Montana yet is more affordable because it doesn’t have the restrict policies found in Bozeman, Kalispell, and Missoula.

Contrary to planners’ claims, there is little evidence that growth management makes cities more livable. Instead, by increasing housing prices, growth management forces low-income people out and creates communities that are less politically and socially diverse. Boulder and Colorado Springs, for example, are up against the Rocky Mountains and millions of acres of national forests, making both pretty livable. Upper-middle-class left-wingers who don’t want to rub shoulders with working-class conservatives find Boulder more congenial than Colorado Springs, but that doesn’t truly make Boulder more livable.

Eventually, the supply chain and labor problems that have recently driven up housing prices will be resolved, and the contrast between housing in areas with growth management and those without will be as stark as ever. In addition, it is possible that the nation is headed into a recession, which will bring all housing prices down.

If you wish to sell a house in an expensive and buy one in an affordable region, now may be a good time to do it. If you wish to move from an expensive to another expensive region, however, now would be a good time to sell your house in one but it might be best to rent in the other until housing prices come down. If you are concerned about housing issues in general, the best way to restore affordability is to repeal growth-management policies such as growth boundaries, agricultural reserves, and concurrency requirements.